Market

Will ETH See a Bitcoin-Like Rally?

As the launch of the spot Ethereum ETFs reaches the finish line, several predictions have emerged. While some have been bearish on ETH’s price, others are betting on a parabolic rally.

Out of the numerous forecasts, one caught BeInCrypto’s attention, and it has to do with ETH’s potential to replicate Bitcoin’s (BTC) performance.

200% Increase Likely as Ethereum Whales Change Positions?

On July 9, a pseudonymous analyst on X Follis posted that the Ethereum ETF could cause the altcoin price to move in a similar way to BTC’s performance between 2023 and 2024. During that period, BTC jumped from $26,000 before reaching an all-time high of $73,750.

“The Ethereum ETF is about to launch and the ETH chart looks identical to BTC before it pumped +200% last year.” Follis shared.

At press time, ETH trades at $3,108. Based on the trader’s opinion, the price of ETH will reach $9,324 in less than a year or thereabouts.

While this may not be impossible, a surge in demand will be required for the prediction to come true.

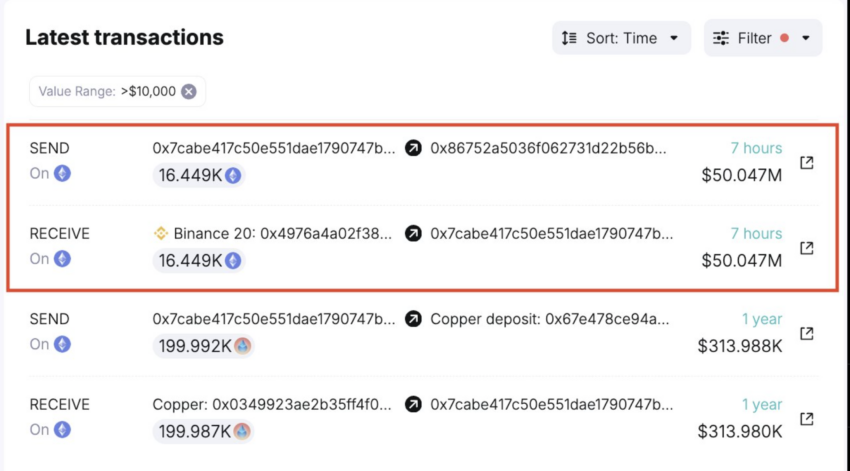

However, Spot On Chain disclosed in the early hours of July 10 that a whale had withdrawn $50.30 million worth of ETH. The on-chain data provider notes that this is the first significant accumulation since the speculation around the impact of the Ethereum ETH began.

Read More: How to Invest in Ethereum ETFs

This accumulation contrasts what happened a few days ago when a whale sold $12 million worth of the altcoin. Furthermore, data from Glassnode shows that Ethereum whales have left distribution and are now buying the crypto in large quantities.

The number of addresses holding ETH worth $1 million or more shows evidence of this action. On July 7, this metric was 14,217. However, as of this writing, the figure has increased to 14,823, reflecting higher demand for the crypto and optimism about the spot Ethereum ETF approval.

ETH Price Prediction: Almost like BTC, But Not the Same

Compared with BTC, ETH’s price has undergone a more significant correction. From May 28 to July 9, Ethereum’s price dropped by 24.65%.

Bitcoin, on the other hand, fell by 19.43%, indicating that the number one crypto in market value continues to outperform ETH despite its bullish cues.

However, historically, relatively deeper corrections provide an opportunity for higher prices. Interestingly, the daily ETH/USD chart shows a double bottom formation to that effect.

A double bottom pattern appears when two low points form near a similar rectangular price level. This signifies a potential bullish reversal.

Before the Ethereum ETF saga, the last time the cryptocurrency formed a similar pattern was in January 2024. Three months later, the price of ETH had increased by 81.94% and reached $4,067.

If a similar thing occurs, then ETH’s price will trade around $5,625 before the end of September. However, the short-term outlook for the token will remain bullish, provided bulls defend ETH at $2,934.

Read More: Ethereum ETF Explained: What It Is and How It Works

Should this be the case, ETH may enter the resistance zone at $3,555. In addition, if the Ethereum ETF launches within a week or two, the price of the altcoin can attempt to surpass $3,758.

But if ETH meets a pessimistic market with next-to-no positivity after the financial product launch, the price may decline

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.