Market

US Moves $33.6M, Raising Market Speculation

On Wednesday, the US government transferred $33.6 million worth of cryptocurrency seized from FTX and Alameda Research to undisclosed wallets.

The transactions raised speculation about the future of these assets, with concerns about market impact should they land on exchanges.

US Government Moves Funds Seized from FTX

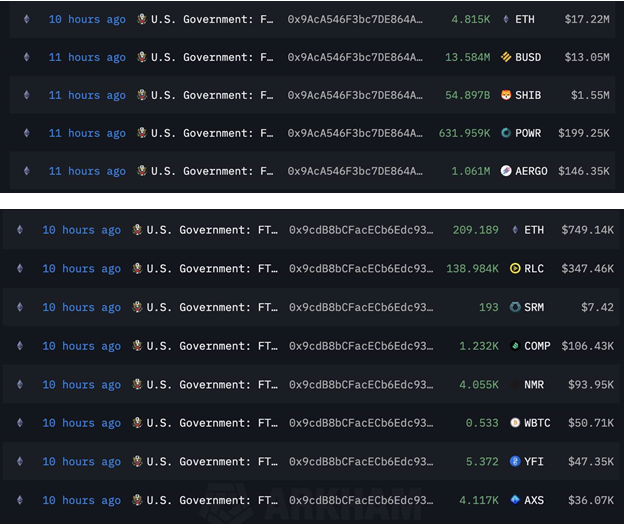

According to blockchain analytics firm Arkham, the assets moved early Wednesday included 5,024 ETH (approximately $18.17 million) and $13.58 million in Binance USD (BUSD). Similarly, the government also moved smaller amounts of tokens such as SHIB, AERGO, and WBTC. The transfers went to unknown wallets, but on-chain data shows these addresses start with 0x9ac and 0x9cd.

The largest share of the transferred value, Ethereum (ETH), is trading at its highest level since May 2024, at $3,704, as of this writing. This comes amid a strong crypto market recovery, but concerns linger that liquidating these assets could introduce significant selling pressure, which could destabilize token prices.

This development also occurs against a backdrop of heightened scrutiny of FTX’s role in political finance. Cameron Winklevoss recently called for an investigation into why US prosecutors dropped campaign finance charges against Sam Bankman-Fried (SBF). As BeInCrypto reported, he alleged that such decisions undermine public trust in the justice system.

SBF was accused of using customer funds to support political donations, leading to questions about regulatory gaps. Meanwhile, FTX has unveiled an ambitious reorganization plan aiming to compensate creditors and revitalize the brand. The proposal, set to take effect in January 2025, outlines a strategy to recover value for stakeholders, despite significant challenges stemming from the FTX collapse.

Meanwhile, the latest move by the US government aligns with a series of recent crypto transactions, including the transfer of nearly 19,780 BTC seized from Silk Road to Coinbase Prime just days earlier. The government’s current holdings include around 198,109 BTC, worth $19.15 billion, seized in crypto-related criminal cases over the last decade.

The US government’s recent activity highlights changing policies around managing seized crypto assets, emphasizing transparency concerns and market impact. As regulatory debates and corporate restructurings continue, the interplay between crypto markets and governance remains a critical area of focus.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.