Market

Solana ETF Is Next Post-Ethereum ETF Launch

Following the approval of Bitcoin and Ethereum exchange-traded funds (ETFs), attention has shifted towards the potential for Solana ETFs.

Indeed, the US Securities and Exchange Commission’s (SEC) progress in approving these financial products has fueled interest in other altcoins, with Solana now under the spotlight.

The Potential for a Solana ETF

The idea of a Solana ETF is generating considerable discussion among industry leaders and investors. Given the popularity of altcoin ETFs as a means to diversify crypto investments, an approved Solana ETF could provide substantial benefits and increased exposure to its ecosystem.

Over the past few years, Solana has gained significant traction. Despite initial setbacks like network outages and challenging market conditions, Solana has achieved remarkable milestones.

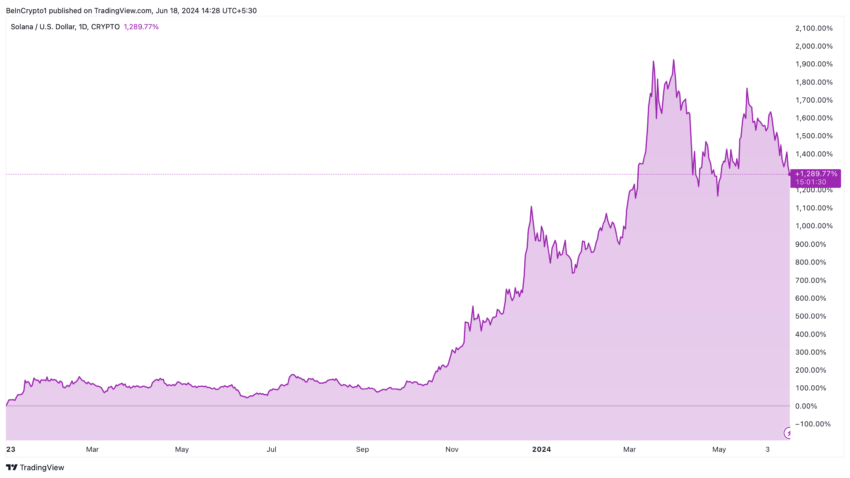

Since January 2023, the price of SOL has surged over 1,289%, demonstrating its resilience and increasing investor confidence.

Read more: Solana (SOL) Price Prediction 2024 / 2025 / 2030

Moreover, active addresses on the Solana network have increased from 660,000 to 1.56 million year-to-date, and search interest in Google Trends has reached new highs. These metrics reflect its rising prominence among retail and institutional investors, indicating an expanding user base and heightened network activity.

The Path to Solana ETF Approval

Experts have varied opinions on the feasibility and timeline of a Solana ETF. Crypto investor Brian Kelly initiated the discussion on X (formerly Twitter) by expressing his belief that one might be next.

Bloomberg ETF analyst James Seyffart agreed, suggesting that while it could take a few years, the process might be accelerated under certain conditions.

“[A Solana ETF] will happen within a few years of getting a CFTC regulated futures market. But Congress and the market structure bills like FIT21 could make it happen quicker. I think a Solana ETF would see most demand vs other digital asset,’” Seyffart noted.

Still, the approval process for any ETF, including a Solana ETF, is stringent and overseen by the SEC. Here is an overview of the process:

- Filing an Application: The sponsor submits a detailed proposal to the SEC, outlining the ETF’s structure and objectives.

- Regulatory Review: The SEC thoroughly reviews the proposal to ensure investor protection, market integrity, and regulatory compliance.

- Public Comments: Proposals are often opened for public comment, allowing stakeholders to express opinions or concerns, which the SEC considers before making a decision.

- Approval or Rejection: The SEC either approves or rejects the proposal, possibly with conditions to ensure compliance.

Legal and Regulatory Considerations

Andrew Rossow, an attorney with Minc Law and CEO of AR Media Consulting, highlighted the challenges in approving a crypto ETF.

“The question we should be asking is what hurdles the US needs to overcome to realistically and safely open the door to crypto ETF conversations? Even with the SEC’s approval of a spot Bitcoin ETF in January, this process was a major headache, stretching the SEC’s time and resources. Expecting a different outcome now, without substantial regulatory changes, is unrealistic,” Rossow highlighted.

Thus far, no official filings for a Solana ETF have been made in the US, and Anthony Pompliano, an investor at Pomp Investments, admitted to not having even heard about it. The stringent regulatory environment may explain the absence of filings. More importantly, the SEC has previously labeled SOL as a “security,” which could further complicate its approval process.

As the crypto market continues to develop with each ETF approval, optimism is growing. The impending approval of an Ethereum ETF this summer fuels hope for other altcoins, including Solana.

Ultimately, the potential for a Solana ETF will depend on regulatory approval, market maturity, and investor demand.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.