Market

Nasdaq Seeks SEC Approval to Offer Options Trading on BlackRock’s Spot Ethereum ETF

BlackRock recently filed a proposal for options trading and listing on its spot Ethereum (ETH) exchange-traded fund (ETF), iShares Ethereum Trust (ETHA).

The proposal was submitted to the US Securities Exchange and Commission (SEC) on August 6 via the Nasdaq International Securities Exchange.

Nasdaq and BlackRock Leverage Experience with Commodity ETFs for Crypto

According to the filing, the newly proposed iShares Ethereum Trust assets will consist solely of ETH, which Coinbase will hold. Meanwhile, the Bank of New York Mellon will hold the cash assets. Furthermore, the document affirmed that the trust will remain non-engaged in Ethereum staking to earn additional income.

Read more: An Introduction to Crypto Options Trading

Nasdaq outlined that this move aims to broaden the range of investment tools for Ethereum and make crypto investments more accessible within traditional financial markets. Although these shares do not equate to a direct investment in ETH, they enable investors to gain exposure to Ethereum. This is because the approach takes place through the public securities market, which might be more familiar to traditional investors.

The options market allows traders to buy or sell an asset, like a stock or an ETF, at a specified price before a certain date. They often use options to protect against potential losses or to speculate on an asset’s future price. Unlike futures, options provide flexibility since the trader can decide whether to execute the trade.

Both Nasdaq and BlackRock have notable experience in listing options on other commodity ETFs structured as trusts. These include iShares COMEX Gold Trust and iShares Silver Trust. Hence, this move to add options to the spot crypto ETF marks a significant development in this context.

James Seyffart, an ETF analyst at Bloomberg Intelligence, commented on Nasdaq and BlackRock’s filing to add options on Ethereum ETFs. He noted that the SEC’s final decision will likely be around April 9, 2025.

“SEC is not the only decision maker on adding options here. Also need signoff from Options Clearing Corporation (OCC) and Commodity Futures Trading Commission (CFTC),” Seyffart added.

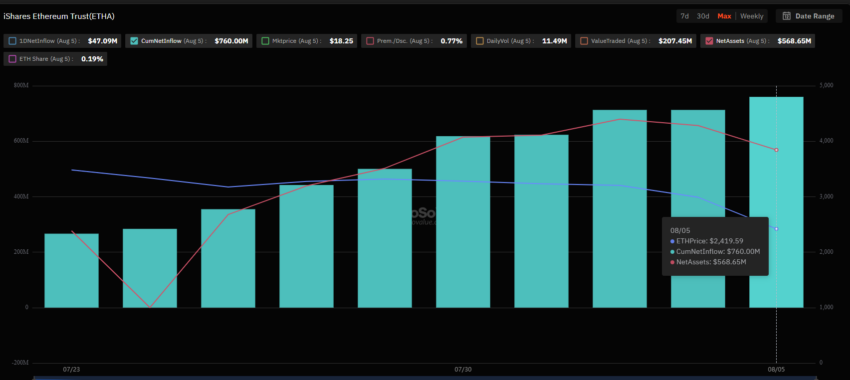

BlackRock is a prominent issuer of spot Bitcoin and Ethereum ETFs in the US. According to SoSo Value data, BlackRock’s iShares Bitcoin Trust (IBIT) had net assets of $18.28 billion as of August 5, making it the largest spot Bitcoin ETF.

Read more: Ethereum ETF Explained: What It Is and How It Works

The data also showed that BlackRock’s iShares Ethereum Trust (ETHA) had net assets of $568.65 million as of the same date, ranking it as the third largest spot Ethereum ETF in the US market after Grayscale’s ETHE and Ethereum Trust.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.