Market

Is Now the Time to Buy?

Leading meme coin Shiba Inu (SHIB) has seen a significant drop in value, falling by 20% over the past week. Due to this double-digit price fall, a key on-chain metric suggests that SHIB has become undervalued, indicating it might be a good time to buy.

However, while the MVRV ratio suggests a favorable buying opportunity, SHIB’s downtrend may not be over.

Shiba Inu Becomes Undervalued, But There Is a Catch

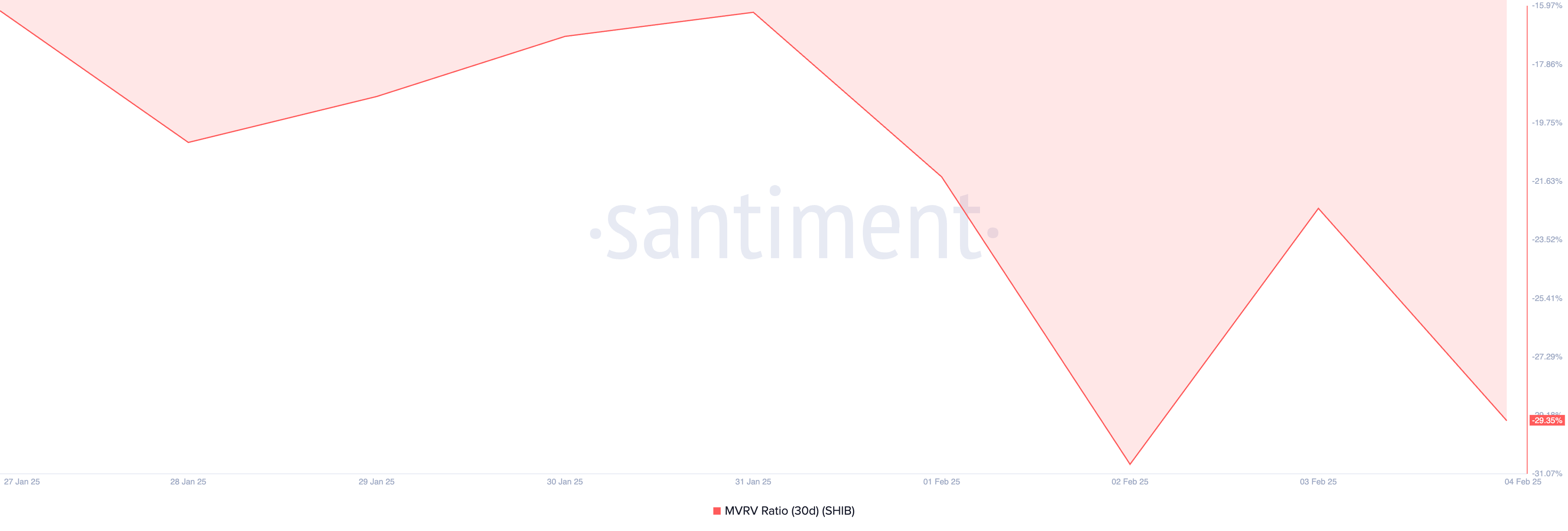

An assessment of SHIB’s market value to realized value (MVRV) ratio using a 30-day moving average confirms its undervalued status. According to Santiment’s data, this ratio is -29.35% at press time.

An asset’s MVRV ratio identifies whether it is overvalued or undervalued by measuring the relationship between its market value and its realized value. When an asset’s MVRV ratio is positive, its market value is higher than the realized value, suggesting it is overvalued.

On the other hand, as with SHIB, when the ratio is negative, the asset’s market value is lower than its realized value. This suggests that the coin is undervalued compared to what people originally paid for it.

Historically, negative MVRV ratios present a buying opportunity for those looking to “buy the dip” and “sell high.” However, the strong bearish sentiment plaguing SHIB suggests that the likelihood of a price rebound in the near term may be low.

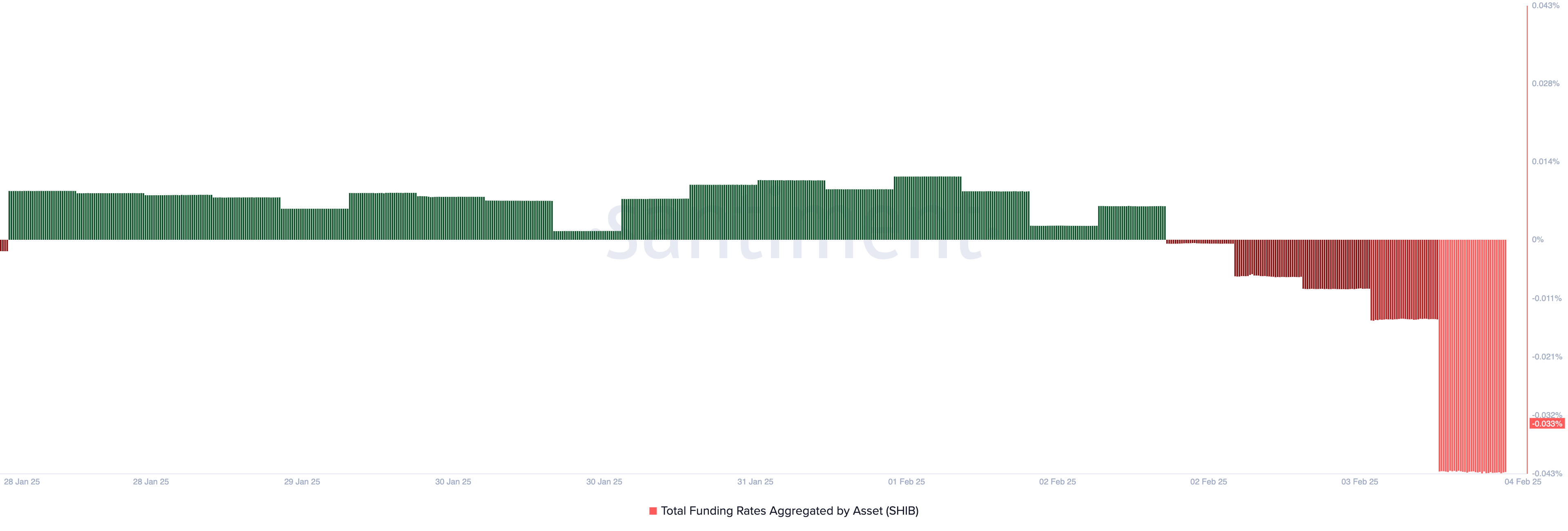

Notably, the bearish bias is reflected by the meme coin’s negative funding rate of -0.03% at press time.

The funding rate is the periodic payment exchanged between long and short traders in perpetual futures markets. It is designed to keep the price of a derivative close to the underlying asset. When the funding rate is negative, short traders pay long traders, indicating bearish sentiment as more traders bet on the price going down.

Therefore, while SHIB’s MVRV ratio indicates that the meme coin is currently undervalued, making it an attractive entry point for traders looking to “buy the dip,” the prevailing bearish sentiment suggests that the downtrend may not be over.

SHIB Price Prediction: Will Buyers Step In?

On the daily chart, SHIB’s Chaikin Money Flow (CMF) supports the bearish outlook above. As of this writing, the CMF indicator is below zero at -0.03, indicating a strong selling activity among traders.

An asset’s CMF measures money flow into and out of its market. When its value is below zero, buying activity is minimal. If SHIB’s demand remains low, it will extend its decline to $0.000014.

Conversely, if coin distribution stalls, it could drive SHIB’s value up to $0.000016.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.