Market

Is a Rebound on the Horizon?

After spending most of February trading within a range, Bitcoin (BTC) has broken below the consolidation zone, slipping under $90,000 for the first time since November. The leading coin now trades at $88,956.

This downturn signals growing bearish pressure, raising concerns that the decline could extend further into March.

Range-Bound or Breakout? Experts Weigh In

According to Brian, lead analyst at Santiment, Bitcoin whales continue to reduce their trading activity, increasing the likelihood of a further decline in the coin’s value.

“Bitcoin whales seem to have taken a bit of a breather and aren’t accumulating at the moment (mostly staying flat),” Brian told BeInCrypto.

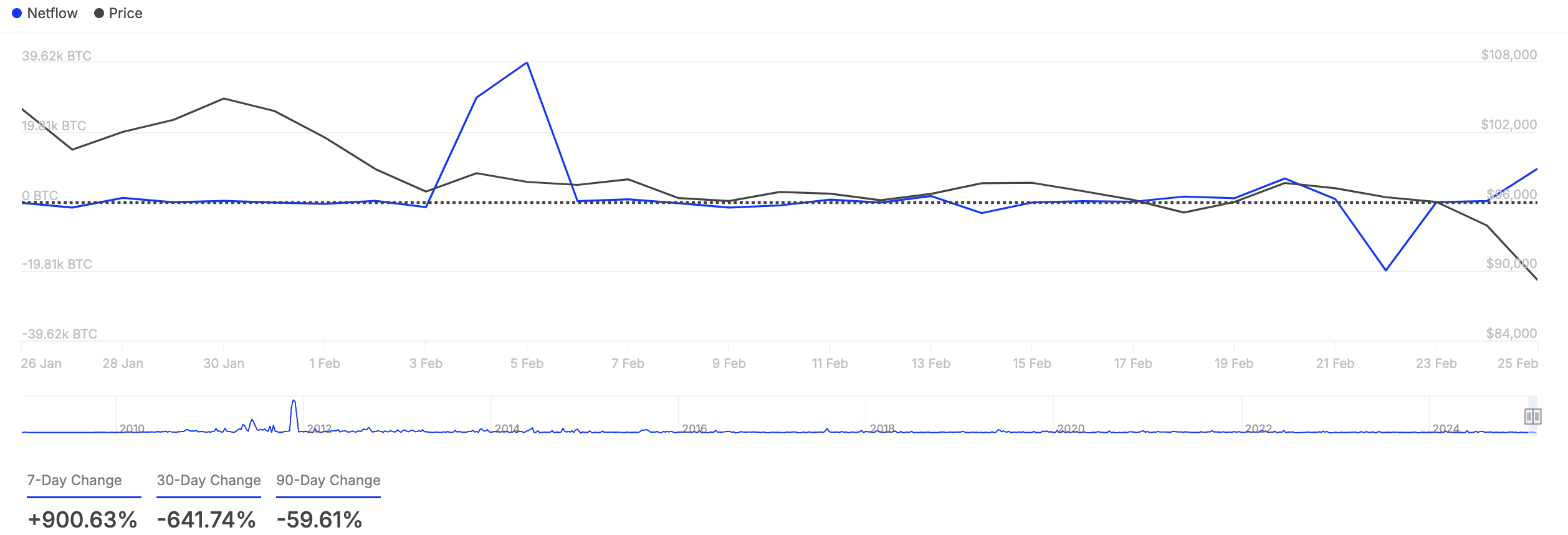

The decline in Bitcoin’s large holders’ netflow corroborates Brian’s position. According to IntoTheBlock, the metric has plummeted by over 600% in the past 30 days.

Large holders refer to whale addresses that hold more than 0.1% of an asset’s circulating supply. Their netflow tracks the amount of coins they buy and sell over a specific period.

When it falls, these key investors are reducing their token holdings, signaling increased selling activity. This may exacerbate the downward pressure on BTC’s price as supply increases in the market.

For John Glover, Ledn’s Chief Investment Officer (CIO), BTC will likely remain range-bound between $89,000 and $108,000 in March.

“From a technical perspective, BTC is following 1 of 2 paths. In the first place, there is a good potential for a dip to $89,000 or even $77,000 before the next rally. In the second, we have already seen the lows, and the next move will be higher, up to ~$130,000. It’s impossible to predict which path we’re on, and short-term predictions are meaningless when intraweek/intra-month moves are dictated by news and, recently, by the actions of big players like Strategy. My personal view is that we remain stuck in a range of $89,000 to 108,000 in March,” Glover said.

Further, given President Donald Trump’s pro-crypto stance, some investors wonder how his policies might impact Bitcoin’s price in March. However, Glover believes that most of the “Trump effect” has already played out.

“The majority of the “Trump effect” has already been felt. We know he is very supportive of digital assets and has set in motion his plans to streamline regulations associated with crypto. I don’t think he is a major factor in the short run,” Glover stated.

Bitcoin Nears Oversold Levels – Is a Rebound on the Horizon?

Bitcoin may be oversold and ready for a rebound, as reflected by its Relative Strength Index (RSI) readings. At press time, this momentum indicator is downward at 31.16.

The indicator measures an asset’s oversold and overbought market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a decline. On the other hand, values below 30 suggest that the asset is oversold and may witness a rebound.

BTC’s RSI reading suggests that it is nearing oversold territory. This hints at a possible rebound toward $92,325 if the selling pressure eases.

On the other hand, if this decline persists, the coin’s price could drop to $80,835.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.