Market

How Did EOS Market Cap Reclaim $1.70 Billion in 30 Days?

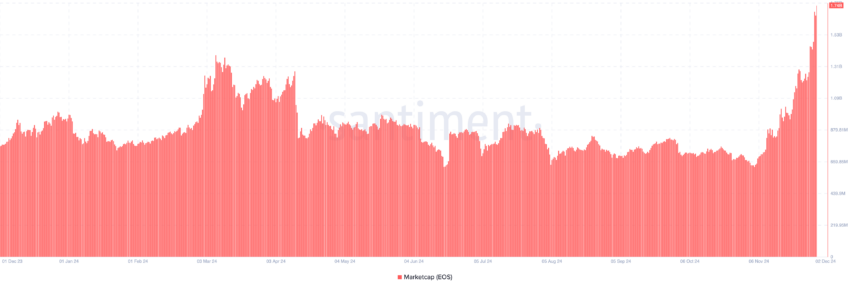

EOS, the native token of the open-source blockchain EOS Network, has seen its market cap soar to $1.74 billion, marking its highest level since November 2022. This milestone follows an impressive 165% price surge over the past 30 days, catching many market observers off guard.

With EOS still 95% below its all-time high, investors are questioning whether this rally has more room to run. This on-chain analysis explores the potential for further gains.

EOS Sees Growth in Key Areas

On November 4, the price of EOS was $0.42. However, as of this writing, it has risen to $1.12, indicating that the altcoin experienced an increase in demand over the past few weeks. While the project did not have any major development driving the rally, it appears that the rising interest in relatively old coins played a role in the hike.

Following the development, EOS’ market cap soared to $1.74 billion. Market cap is the product of price and circulating supply. Therefore, the rise in the metric is linked to the 165% price increase, especially as the project did not recently unlock any token to its 1.53 billion circulating supply.

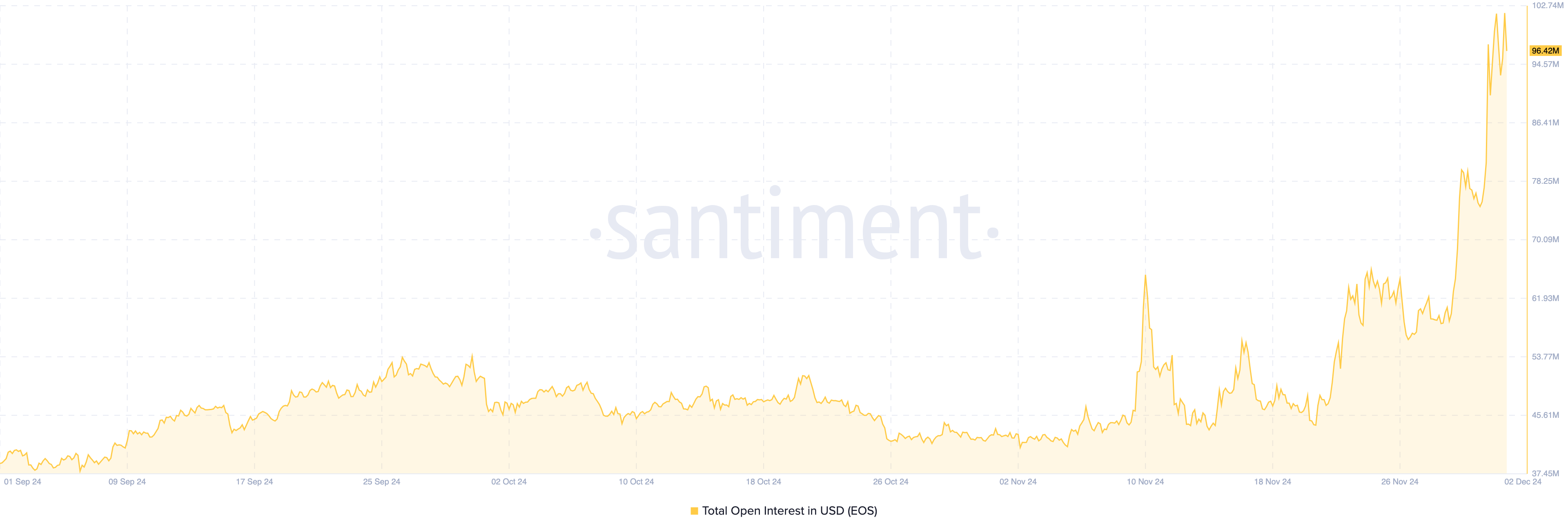

When the OI increases, it means that more liquidity has entered the derivatives market, indicating an increase in buying pressure for the cryptocurrency. On the other hand, if the OI decreases, it means that traders are increasingly closing their positions.

From a price perspective, the surge in OI, alongside the increase in EOS price, suggests that the market value might continue to climb.

EOS Price Prediction: Higher Levels On the Table

On the daily EOS/USD chart, the Awesome Oscillator (AO) reading has increased. The AO is a momentum indicator that measures the strength of recent market movements relative to historical trends, helping traders identify potential shifts in market momentum.

When the reading is positive, it means that momentum is bullish. On the other hand, if the reading is negative, the momentum is bearish. In EOS case, the positive reading, which also shows a green histogram bar, indicates that momentum is bullish.

If this remains the case, the price might rise to $1.21 and eventually $2 in the short term. On the other hand, if selling pressure rises, this might not happen. Instead, the EOS market cap might drop, and the price could slide to $0.93.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.