Market

Hedera (HBAR) Price Momentum Points to Further Gains

Hedera (HBAR) price has surged significantly, reaching its highest levels in three years this December while attempting to reclaim its $12 billion market cap.

Over the past 30 days, HBAR has risen an impressive 121%, driven by strong bullish momentum and key technical patterns like the recent golden cross. Indicators such as the ADX and Ichimoku Cloud suggest a strengthening uptrend, with buyers maintaining control and the potential for further gains.

Hedera Current Uptrend is Getting Stronger

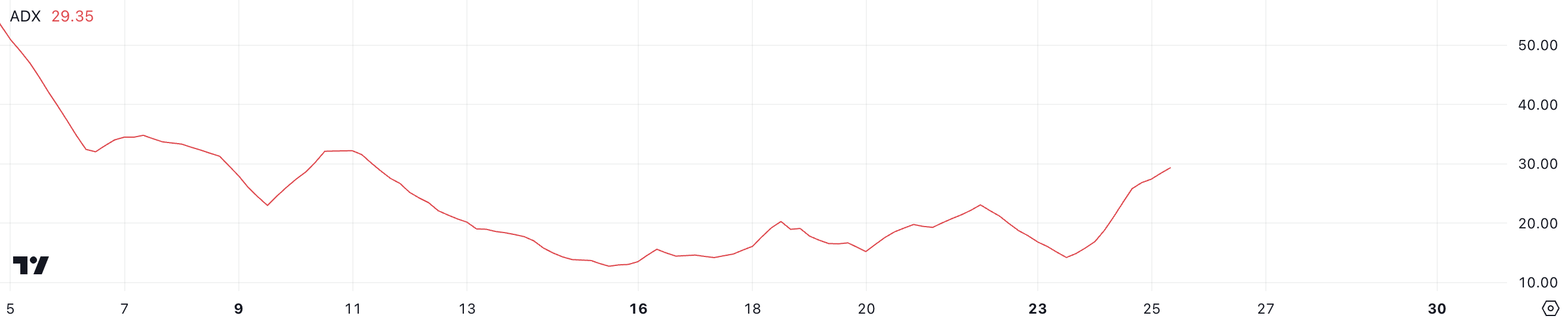

HBAR Average Directional Index (ADX) currently stands at 29.35, marking a significant rise from 15 just two days ago. This sharp increase reflects strengthening trend momentum, confirming that the current uptrend is gaining traction.

The rise in ADX indicates that HBAR price recent bullish action is supported by a solid trend. That suggest that buyers are firmly in control of the market.

ADX is a widely used trend strength indicator that measures the intensity of a trend without specifying its direction, on a scale from 0 to 100. Values below 20 suggest a weak or absent trend, while values above 25 indicate a strong trend.

With HBAR’s ADX at 29.35, the token’s ongoing uptrend is considered strong. That implies the potential for continued upward movement in the short term.

Ichimoku Cloud Shows a Bullish Scenario for Hedera

The Ichimoku Cloud chart for Hedera shows a strengthening bullish trend. The price has broken above the cloud (green and red shaded areas), signaling positive momentum.

The blue conversion line (Tenkan-sen) remains above the red baseline (Kijun-sen), further confirming the bullish sentiment. This alignment indicates that buyers are currently in control, and the upward trend may continue if the price stays above the cloud.

Additionally, the lagging span (green line) is positioned above both the price and the cloud, reinforcing the bullish outlook. The future cloud (green) also projects upward momentum, with the leading span A (green boundary) higher than span B (red boundary), suggesting that the Hedera bullish trend could persist.

These Ichimoku signals highlight a strong trend, and unless there is a significant reversal, HBAR price may continue its upward trajectory in the short term.

HBAR Price Prediction: Will HBAR Test $0.37 Soon?

HBAR recently formed a golden cross on December 24, with the short-term EMA crossing above the long-term EMA, signaling a potential bullish trend reversal.

This classic bullish pattern indicates increasing upward momentum, and the next significant resistance lies at $0.33. If this resistance is broken, HBAR price could gain further traction and rise to test $0.378.

However, if the uptrend begins to lose momentum, Hedera price may face a pullback, testing the support level at $0.27.

Should this support fail to hold, the price could decline further to $0.23, erasing much of the recent gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.