Market

Ethereum Price Dip Causes Justin Sun $66 Million Loss

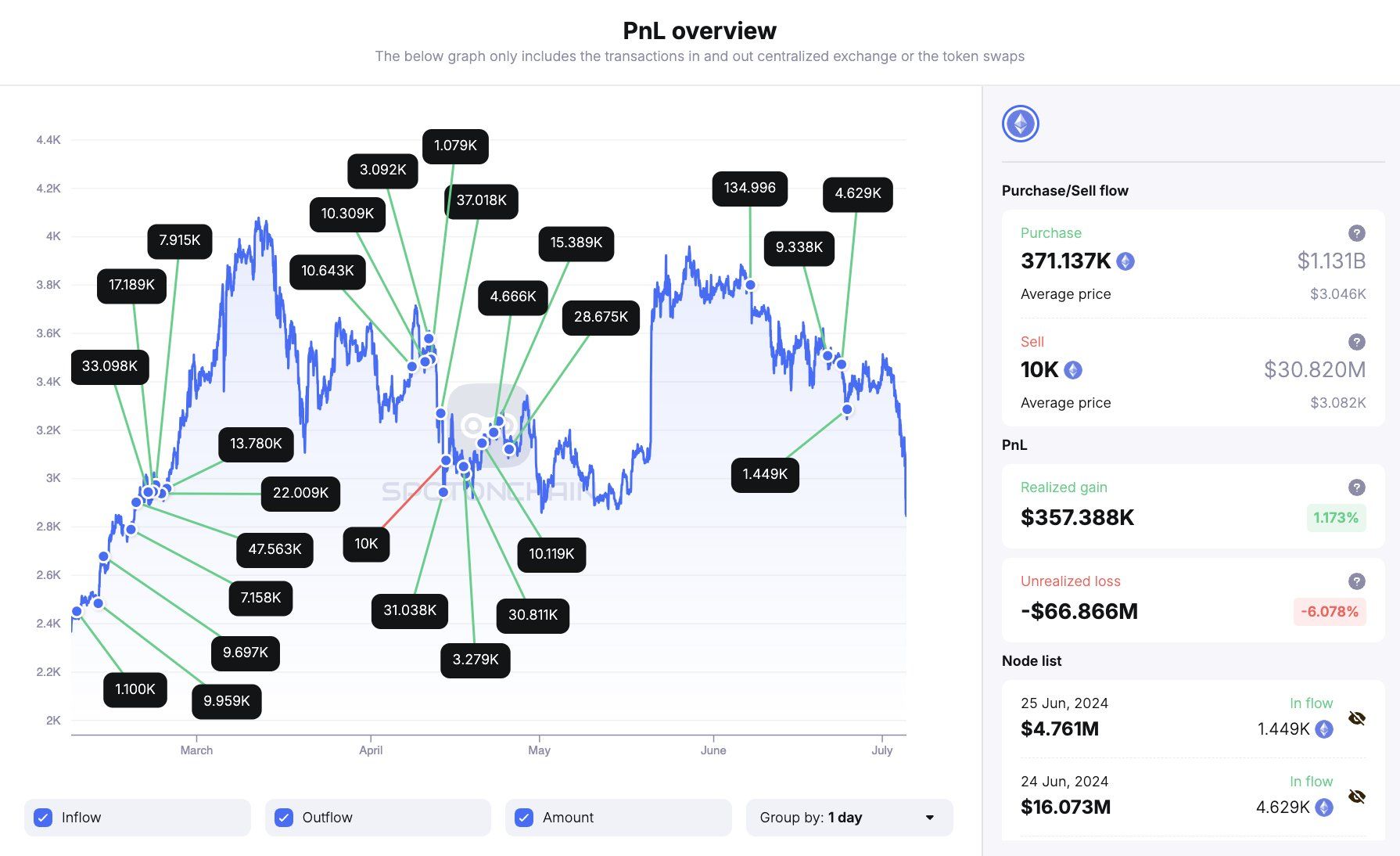

Reports suggest that Justin Sun lost $66 million on Friday as Ethereum price dipped to levels last seen in February. Crypto markets continue to endure a sell-off, overshadowing optimism for a possible launch of spot ETH ETFs.

Multiple signals indicate that the Ethereum price may not slide much lower after the 10% crash on Friday despite elevated

fear levels.

Justin Sun Loses $66 Million on Ethereum Price Crash

Spot On Chain reported that the Tron Founder and Huobi Global advisor could have seen all the $58 million in profit accrued in the last five months go down the drain as the Ethereum price descended to $2,810 on Friday.

“Such a volatile market! Just 24 hours ago, he had a $58M profit from these ETH transactions; but now, it is already a $66M loss after the dump,” the report read.

Based on the report, Justin Sun acquired 361,000 ETH tokens between February and June, worth approximately $1.1 billion. Most transactions happened on Binance, where he recently transferred several DeFi tokens.

The breakdown of transactions within the five months that Sun bought ETH through Binance includes:

- Bought 169,604 Ethereum (ETH) in February via “0x7a9” at an average price of $2,870

- Bought 176,117 Ethereum (ETH) in April via “0x435” at an average price of $3,177

- Bought 15,416 Ethereum (ETH) in June via “0xdbf” at an average price of $3,474

The three wallets often received ETH from Binance right after their stablecoin deposits.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

The report comes only hours after his proposal to engage the German government to salvage its Bitcoin sell-off and minimize market impact. While the idea was noble, the offer stirred mixed reactions, with speculation of a possible market manipulation case.

“I believe that the German Government should reject Justin’s offer to buy the BTC via a private OTC transaction. That action, although noble sounding, would indeed be market manipulation, as well as, potentially lead itself to corruptive or unethical practices. This is where only people with the right contacts have access to these BTC and potentially at a less than market price. Also, nothing guarantees that the buyer won’t turn around and dump part of the holdings themselves,” Founder & CEO of Blockpliance Guillermo Fernandes told BeInCrypto.

Whether the German Government will take up Justin Sun on his offer remains unknown. Meanwhile, the market continues to endure bearish sentiment, with experts reporting extreme fear. According to Coinglass, over $104 million in ETH liquidations happened in the last 24 hours.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

The crypto community’s eyes remain peeled on the week of July 15. According to Bloomberg analysts James Seyffart and Eric Balchunas, this is the revised timeline for possible ETH ETF launches as prospective issuers submit their amended S-1 forms. Nevertheless, Seyffart acknowledged “fairly low confidence in those launch date predictions.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.