Market

Dogwifhat (WIF) Whale Still Betting Big

The largest Dogwifhat (WIF) whale remains bullish on the Solana meme coin. Despite holding up to $68 million in unrealized profits, they continue growing their holdings and taking long positions.

This optimism persists even as Tron meme coins gain momentum, potentially overshadowing Solana-based counterparts.

Dogwifhat Whale Secures $68 Million Profit

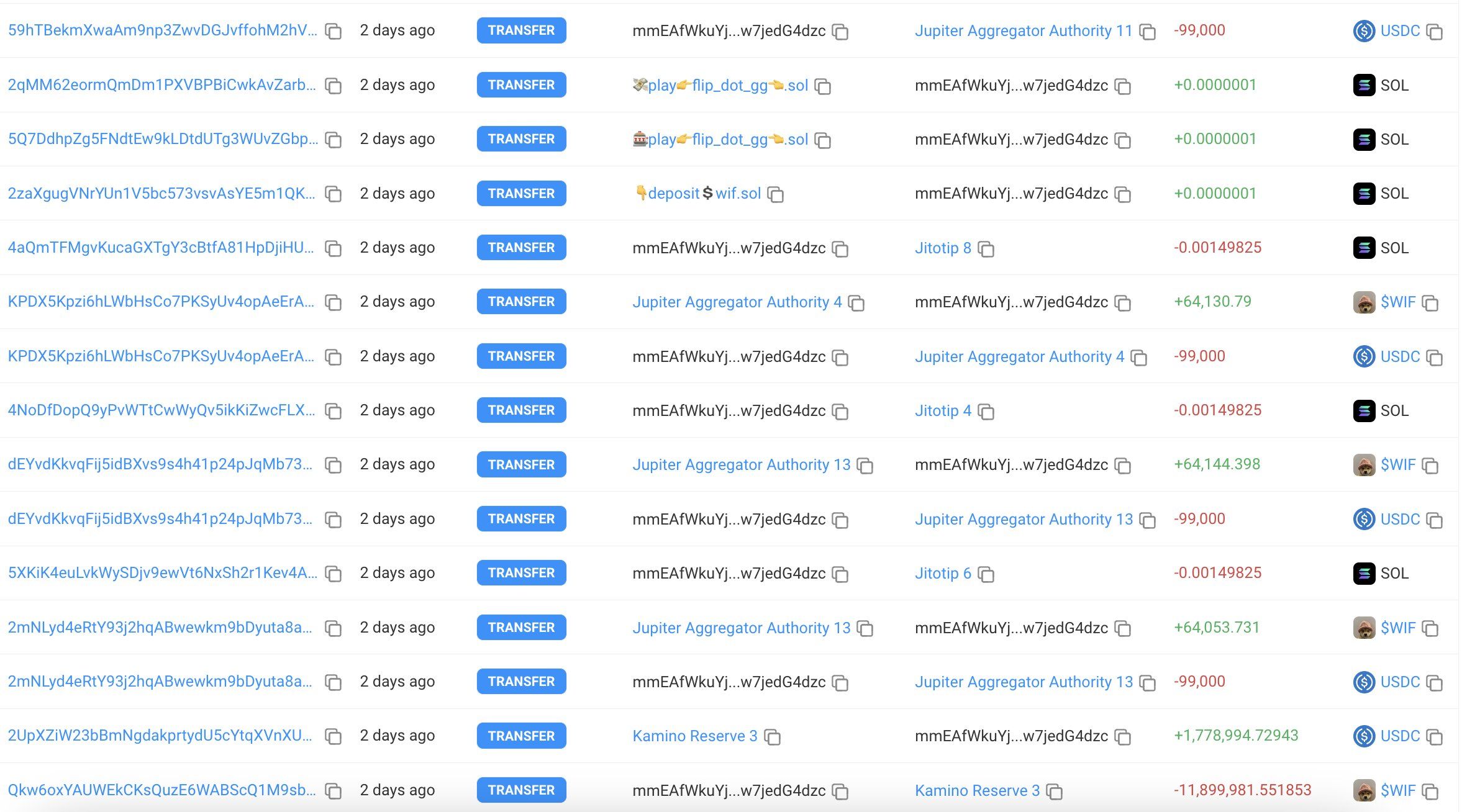

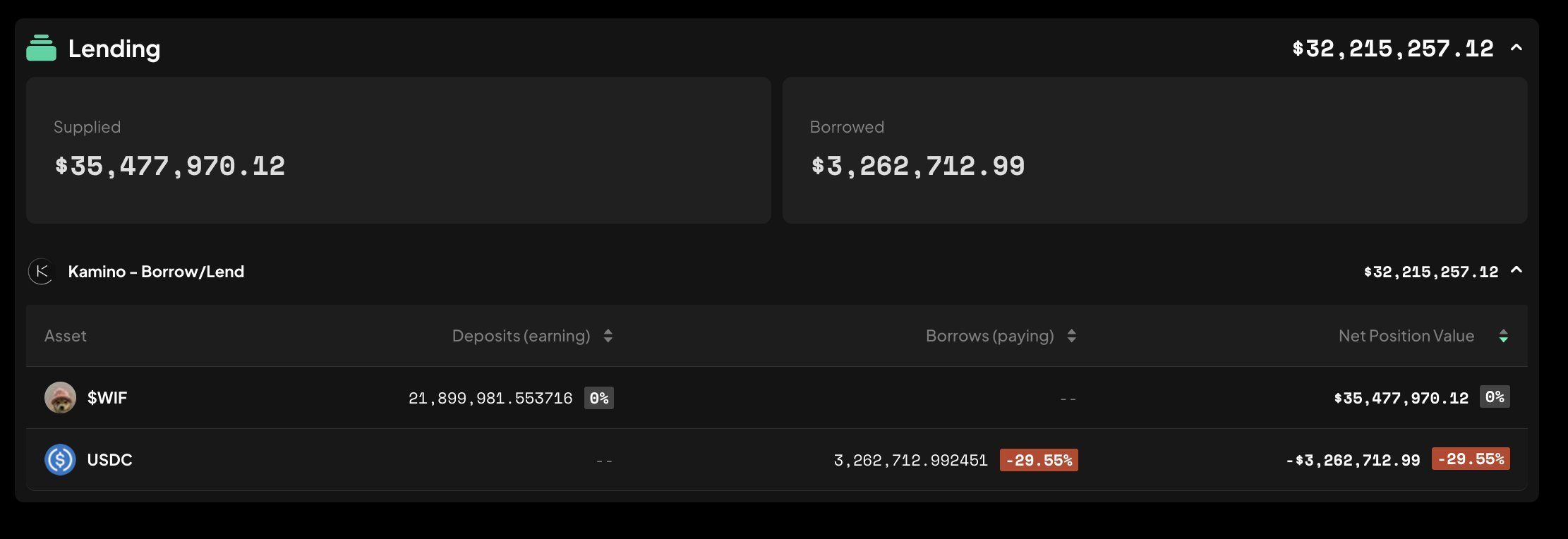

On-chain sleuth Lookonchain reported that the top Dogwifhat (WIF) whale has made significant transactions recently. Since Tuesday, this large holder deposited 21.9 million WIF tokens, worth $35.48 million, into Kamino Finance. Following this, they borrowed 3.24 million USDC, Circle’s stablecoin.

The whale continued their strategic moves by spending 2.7 million USDC to purchase approximately 1.8 million WIF. Notably, these transactions occurred on Kamino Finance, a Solana DeFi protocol that combines lending, liquidity, and leverage into a unified product suite with concentrated liquidity management.

Between December 13 and 15, the Dogwifhat whale spent $226,000 to acquire 19.86 million WIF tokens at an average price of $0.0114 per coin. Following this, they registered the domain “binance-insider.sol” and made a substantial purchase of 17.23 million WIF tokens in a single transaction, spending 86,738 SOL, worth $8.92 million.

Now holding the title of the largest WIF whale, this major holder has accumulated 27.2 million WIF tokens, valued at approximately $44.36 million. According to Lookonchain, they’ve realized around $68 million in profits and remain bullish on the asset.

“Now run to buy WIF so that this group of people who are behind this token can cash out their WIF,” one X user remarked.

Read more: How To Buy Dogwifhat (WIF) and Everything Else To Know

Earlier this month, five wallets, possibly controlled by the same individual, sold 14.53 million Dogwifhat (WIF) tokens worth $24 million, securing a staggering 4,497x return. Back in May, another early WIF whale spent 4.2 million USDC to buy 1.4 million WIF tokens at an average price of $2.99, generating a profit exceeding $8 million.

This activity coincides with a growing spotlight on Solana meme coins, which are currently facing competition from Justin Sun’s Tron-based meme coins created on the SunPump platform. SunPump products have recently become a sensation, with the Tron executive actively fueling the hype.

Dogwifhat (WIF) Price Outlook

Based on the WIF/USDT daily chart, Dogwifhat (WIF) has consolidated into a falling wedge pattern since late March. This technical formation is considered a bullish reversal pattern, occurring when an asset’s price compresses between two downward-sloping, converging trendlines. The upper trendline represents declining resistance, while the lower trendline shows declining support.

The profit target in a falling wedge is typically calculated by measuring the widest distance between the two trendlines and then applying that distance to the breakout point. If WIF breaks above the upper trendline, it may signal a strong bullish move.

To further validate this bullish setup, a break and close above the 61.8% Fibonacci retracement level of $2.518 would confirm the continuation of the uptrend. This level could present a favorable entry point for traders looking to go long on WIF, with multiple long opportunities likely to emerge over the coming months.

Read more: Dogwifhat (WIF) Price Prediction 2024/2025/2030

On the flip side, the Relative Strength Index (RSI) currently sits below 50, indicating weak buying pressure. If this weakness persists, WIF’s price might retest the lower trendline before a potential bounce.

However, if the price retraces and breaks below the lower trendline, a decisive daily candlestick close under $1.070 would invalidate the bullish scenario and suggest further downside. Traders should monitor these key levels closely for confirmation of the next move.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.