Market

Can Worldcoin (WLD) Bears Continue to Keep Pressure On Bulls?

Only 10% of the total holders of Worldcoin (WLD), the token of the open-source digital identity protocol, are holding it in profits. While others are either at breakeven point or losing, WLD is torn between the actions of two key stakeholders.

At press time, Worldcoin’s price is $2.02, representing a 5.30% decrease in the last 24 hours. Who will emerge victorious between bulls and bears?

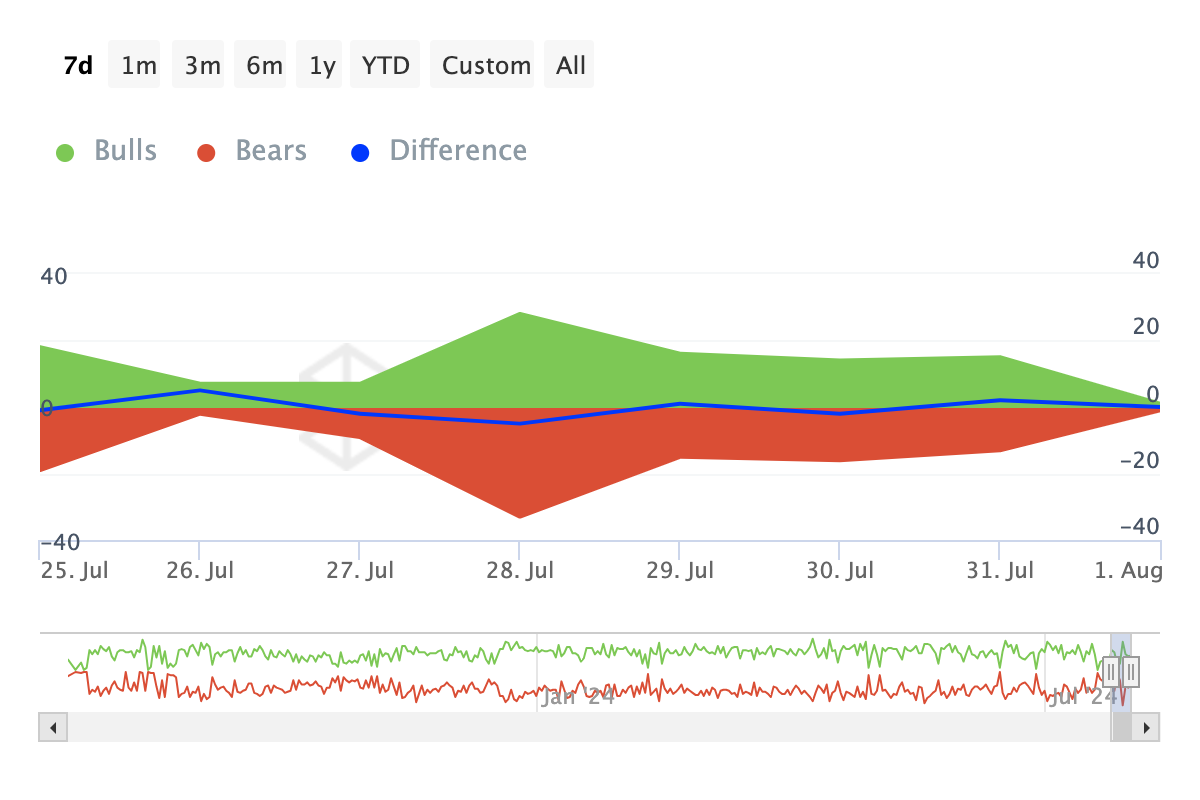

Balanced Battle Between Worldcoin Bulls and Bears

According to the Bulls And Bears Indicator, the difference between WLD bulls and bears over the last seven days is zero. For the purpose of this indicator, bulls are addresses involved in buying 1% of a cryptocurrency’s total volume.

Bears, on the other hand, are addresses that sold a similar percentage of the volume. When there are more bulls than bears, more tokens have been bought than those sold. In contrast, the opposite happens when there are more bears.

In WLD’s situation, bulls were involved in trading 124.40 million WLD tokens, while bears were involved in trading 124.48 million tokens.

Read More: Where To Buy Worldcoin (WLD): 5 Best Platforms for 2024

This close number suggests that the price may consolidate in the short term since selling pressure did not outrightly outpace the buying side.WLD’s recent decline could be attributed to the continuous unlocking of tokens.

The announcement initially drove the price up. However, the ongoing development prevents the cryptocurrency from experiencing a supply crunch.

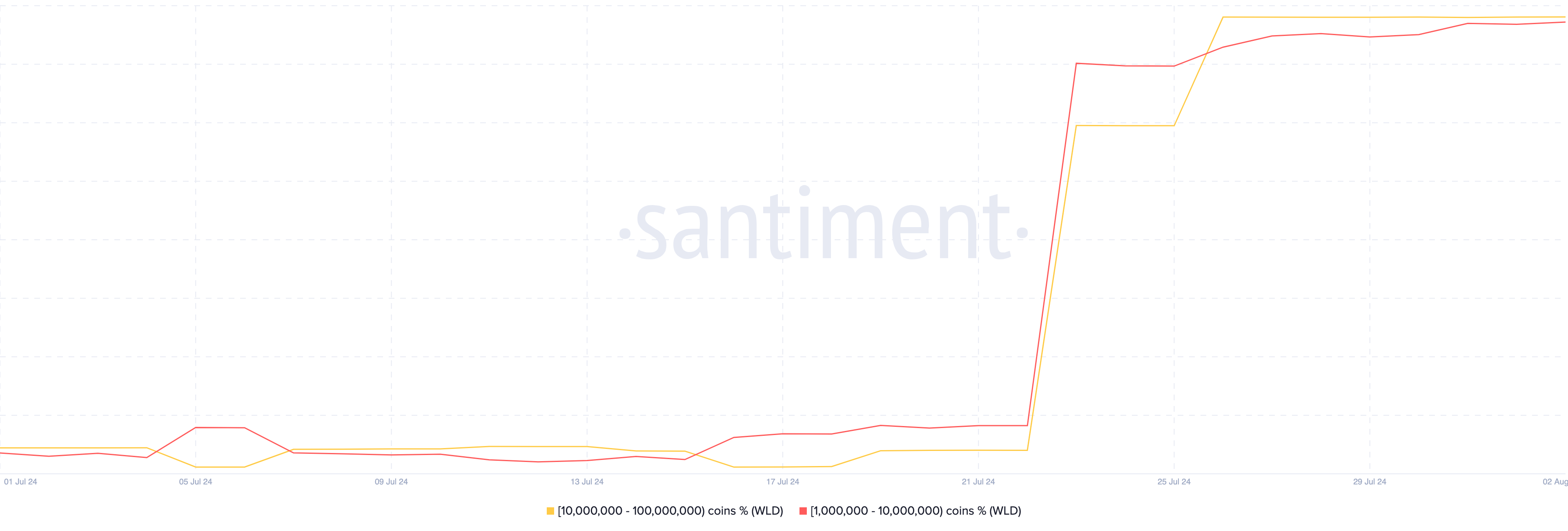

In terms of supply distribution, data from Santiment shows that there has been a change that could favor the price. As of this writing, the balance of addresses hodling 1 million to 10 million WLD has increased.

This accumulation has been going on since July 27, suggesting that lowered downward pressure, and a potential for the price to bounce.

WLD Price Prediction: $3 or Below $2, What’s Next?

On July 13, WLD broke out of a falling wedge on the daily chart. A falling wedge is a bullish pattern that reflects a situation where sellers are losing momentum, and buyers capitalize on the fatigue to help the price bounce.

The result of the formation was a price increase to $3.26 on July 17. Since that time, WLD has been steadily declining. However, at press time, WLD approaches a demand zone that sends the price upwards earlier on.

If this reaches the region, the token may rebound. Additionally, the Relative Strength Index (RSI), which measures momentum, is near the oversold point.

Read More: Worldcoin (WLD) Price Prediction 2024/2025/2030

Readings of the RSI at 70.00 or above indicate an overbought position. However, when it is 30.00 or below, it is oversold. Currently, WLD’s momentum is bearish, but a further decline to the oversold point could spark a bounce.

If this happens, WLD’s price may revisit $2.81. However, if bears dominate the 1% of the total trading volume, WLD may continue its downswing. If this happens, the price may drop to $1.73.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.