Market

Can SUI Price Maintain Its Uptrend with Renewed Market Interest?

SUI price is showing signs of recovery as the indicators begin to improve. The coin is up almost 20% in the last 24 hours, but new gains could happen soon. Despite the TVL still being below $1 billion, recent inflows indicate renewed interest and engagement from users.

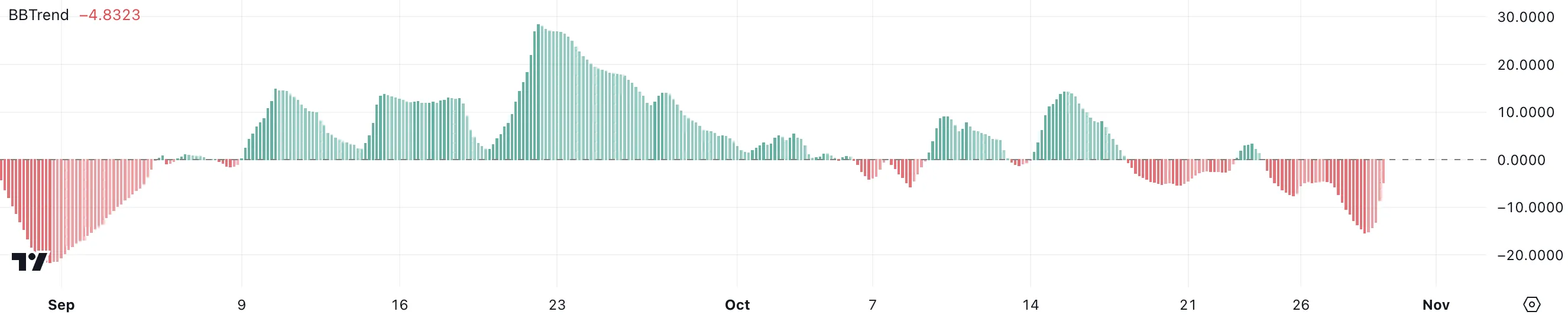

The BBTrend also suggests a potential shift from bearish to bullish, reflecting weakening downward pressure. Additionally, EMA lines hint at an upcoming “golden cross,” a positive signal for further upward movement.

SUI TVL Is Still Below $1 Billion

SUI’s Total-Value Locked (TVL) has reached $970 million, a major increase from $313 million on August 4.

Tracking TVL is essential for understanding the health of a blockchain ecosystem. A higher TVL often indicates greater adoption, user engagement, and liquidity. SUI’s TVL hit a record $1.1 billion on October 13 and stayed above $1 billion until October 22.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

Despite now being below $1 billion, SUI’s TVL jumped by nearly $100 million in a single day, indicating renewed market interest. Such fluctuations show that users are still actively interacting with the platform, with substantial inflows that suggest confidence in SUI’s growth potential.

SUI BBTrend Appears to Be Recovering

SUI’s BBTrend is currently at -4.8. BBTrend, or Bollinger Band Trend, measures the strength and direction of a price trend based on Bollinger Bands.

A negative BBTrend indicates a bearish phase, suggesting downward pressure on price. Currently, SUI’s current level of -4.8 shows that it is still in bearish territory, but less so than in previous days.

SUI’s BBTrend has been negative since October 24, when it was as low as -15. Although still negative, it appears to be gradually recovering, decreasing from -15 to -4.8 over the past few days.

This consistent upward movement in the BBTrend indicates a weakening of bearish momentum and potential trend reversal. The recovery signals growing strength, hinting at a possible shift to a bullish phase as sellers lose control and buying interest starts to re-emerge.

SUI Price Prediction: Can It Rise 19.7%?

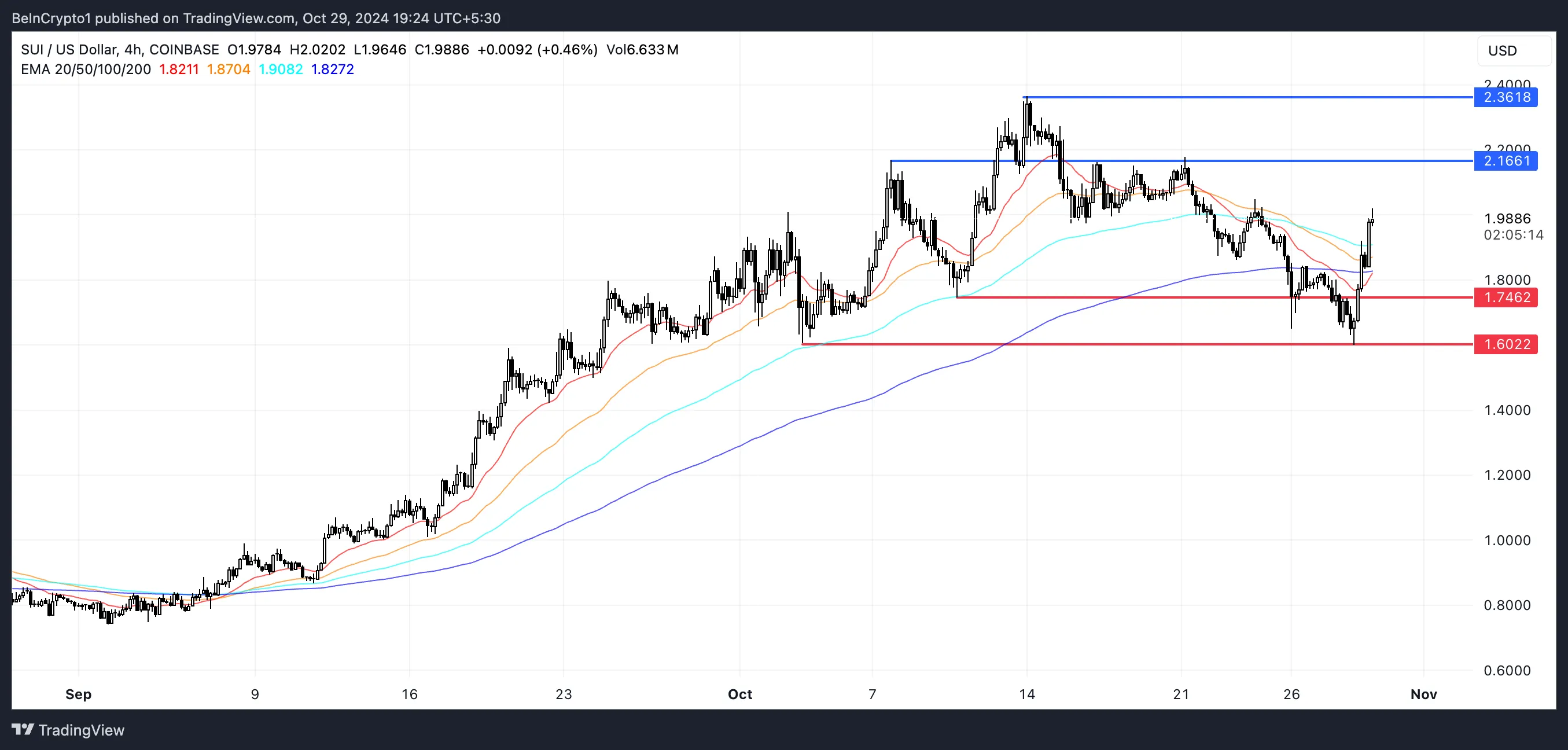

SUI’s EMA lines show the short-term EMAs are nearing a crossover above the long-term EMAs. This potential crossover is known as a “golden cross,” which is typically a bullish signal.

It suggests that short-term momentum is gaining strength, and buyers could be taking control, indicating an upcoming uptrend.

Read more: Everything You Need to Know About the Sui Blockchain

SUI’s immediate resistance is at $2.16. If this level is breached, the coin’s price could continue rising to $2.36, representing a potential 19.7% gain. However, if the uptrend fails to establish, SUI may face a downtrend and test support levels at $1.74 and possibly $1.60.

Breaking below these support levels could lead to more bearish pressure, so holding above them is crucial to maintaining positive momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.