Market

Bracket Launches Platform for Ethereum Liquid Staking Yields

Bracket, a DeFi platform backed by Binance Labs, has introduced its strategy management platform. The platform will offer liquid staking token (LST) holders access to higher staking yields on Ethereum.

Known as ‘ETH+,’ this feature will reportedly address inefficiencies in traditional LST liquidity pools. These pools are often fragmented and prevent seamless yield optimization.

Bracket is Changing Liquid Staking on Ethereum

According to the announcement, brktETH is at the core of Bracket’s platform. This is a non-rebasing token backed by a treasury of diverse LSTs and liquid restaking tokens (LRTs).

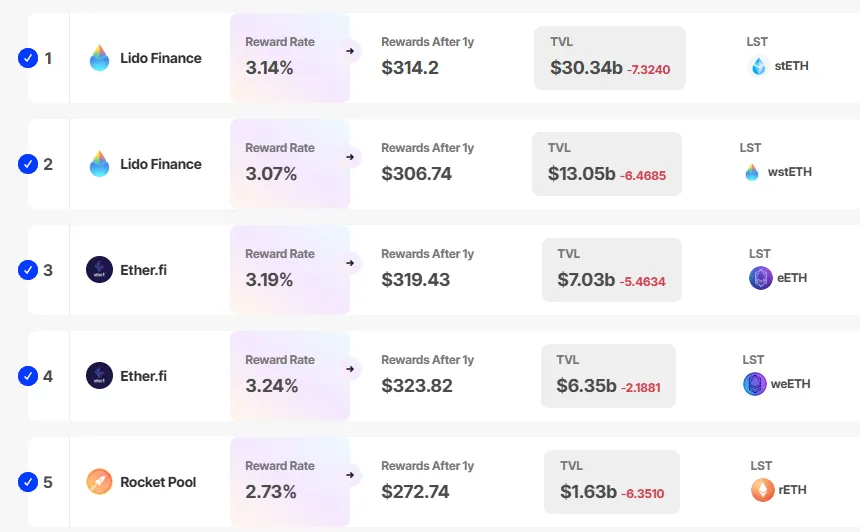

The token aggregates assets from providers like Lido, Rocket Pool, and Ether.fi. This simplifies staking on Ethereum and creates a unified approach to yield generation.

“The launch of our strategy management platform is a defining moment for Bracket. Phase II takes us closer to our vision of creating a secure, user-friendly platform where DeFi participants can maximize their yields without compromising transparency or safety,” Mike Wasyl, CEO of Bracket, told BeInCrypto.

Unlike conventional staking tokens that increase in quantity, brktETH gains value through a rising conversion rate relative to ETH.

The platform excludes users from the US and sanctioned regions due to regulatory restrictions.

Previously in an interview with BeInCrypto, Wasyl noted growing interest in passive investment strategies centered on LSTs.

The DeFi sector has seen increased adoption of these tokens as investors favor stable returns over speculative trading. Industry leaders like Lido continue to drive this trend, benefiting from a broader interest in liquid staking solutions.

Ethereum Staking Trends and Challenges

In 2024, Ethereum achieved a major milestone: 24% of its total supply was staked. This reflected the community’s preference for passive income options over immediate liquidity.

The Shapella upgrade further boosted flexibility by enabling withdrawals of staked ETH, yet staking activity has continued to rise.

Despite this growth, Ethereum’s staking rewards declined to 3% in Q3 2024. This drop has contributed to reduced validator interest. Queue times for staking shrunk from 45 days in mid-2024 to less than a day.

The Ethereum Foundation is now reevaluating its stance on staking ETH. Previous hesitations stemmed from regulatory concerns and the need to maintain neutrality in contentious hard forks.

Vitalik Buterin recently suggested that regulatory risks have diminished. However, challenges around neutrality persist.

Bracket’s platform launch and the continued evolution of Ethereum staking highlight the growing importance of innovative new solutions in addressing inefficiencies and boosting returns for DeFi participants.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.