Market

BlackRock’s IBIT ETF Surges Past Gold in Staggering Inflows

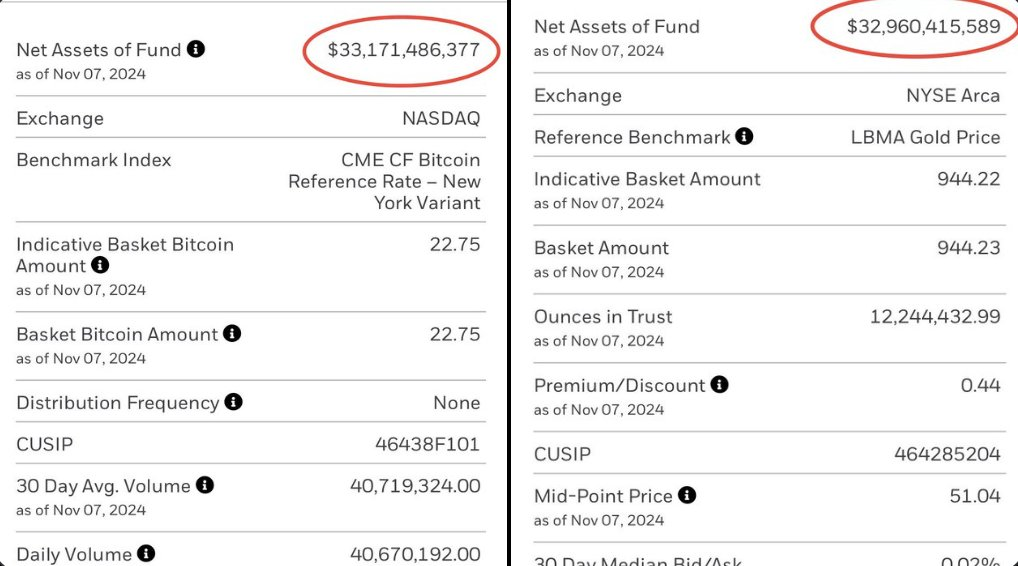

Trading data reveals that BlackRock’s Bitcoin ETF, IBIT, has surpassed the firm’s gold ETF offering. This comes despite the fact that gold is also enjoying intense price rallies.

A cocktail of positive signals, such as Donald Trump’s election and US interest rate cuts, is fueling this stupendous growth.

BlackRock’s Record-Breaking Inflows

According to recent trading data, BlackRock’s Bitcoin ETF (IBIT) is now larger than its Gold ETF. This remarkable milestone occurred while Bitcoin enjoyed an all-time high, but it is more impressive because gold has also been at its highest price since 1980. This figure plays into the long-time argument that Bitcoin is “digital gold,” with higher potential as a new store of value.

BlackRock’s IBIT has dramatically surged in value recently. By late October, it was already trading at a six-month high, and showed strong signs of new momentum. Since Donald Trump won re-election, however, this momentum was turbocharged, and the Bitcoin ETFs saw their highest single-day inflows with IBIT leading the pack.

Trump’s surprising Presidential victory is apparently creating a potent cocktail of bullish signals for the entire crypto sphere. The impact might be even more pronounced for Bitcoin ETFs in particular. Since the election, risk-on ETF assets of all categories are soaring, and crypto products are benefitting from the trend. These mutually beneficial market factors can feed into each other.

There is “a significant risk of a feedback loop, where rising ETF inflows push Bitcoin prices higher, attracting more capital,” claimed Caroline Bowler, Chief Executive Officer of crypto exchange BTC Markets Pty.

Even still, IBIT is reaping the greatest benefits in the whole ETF market. Yesterday, the Bitcoin ETFs saw $1.38 billion in inflows, but a staggering $1.1 billion of this went to IBIT. The closest runner-up, BitWise’s ETF, won a comparatively paltry $190 million, and none of the other products crossed the $100 million threshold.

In other words, IBIT is enjoying a commanding presence in a well-performing market. BlackRock has also been purchasing bitcoins at a heightened rate, surpassing all analyst expectations. Some commentators have worried that the firm is well-positioned to spur “de-decentralization” in crypto, by concentrating extremely high capital and momentum in a TradFi institution.

For now, however, IBIT doesn’t show any signs of slowing. The Fed’s cuts to interest rates yesterday are another ingredient spelling high gains for Bitcoin ETFs. At this rate, these rapacious gains may continue into the foreseeable future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.