Market

Bitcoin & Ethereum Option Expiry: Sentiment Weakens Amid Tariffs

Approximately $3.12 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today. With the pioneer crypto still below $100,000 this week, will its billion-dollar-plus notional value expiry push the price higher?

Market watchers are particularly attentive to this event due to its potential to influence short-term trends through the volume of contracts and their notional value. Examining the put-to-call ratios and maximum pain points can provide insights into traders’ expectations and possible market directions.

Insights on Today’s Expiring Bitcoin and Ethereum Options

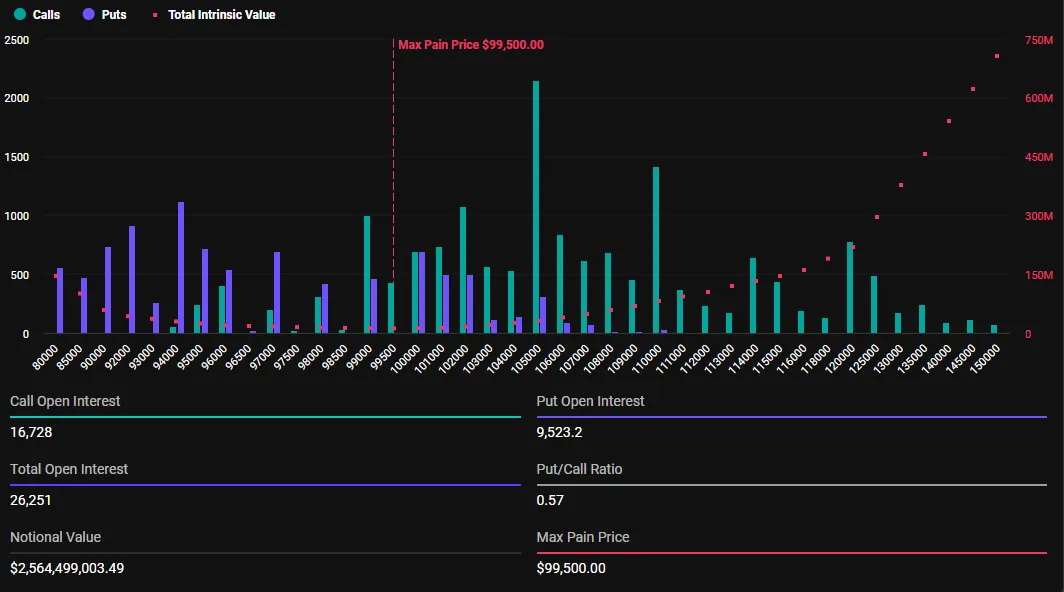

The notional value of today’s expiring BTC options is $2.56 billion. Deribit’s data shows that the 26,251 expiring Bitcoin options have a put-to-call ratio 0.57. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

The data also reveals that the maximum pain point for these expiring options is $99,500. The maximum pain point is the price at which the asset will cause the greatest number of holders’ financial losses.

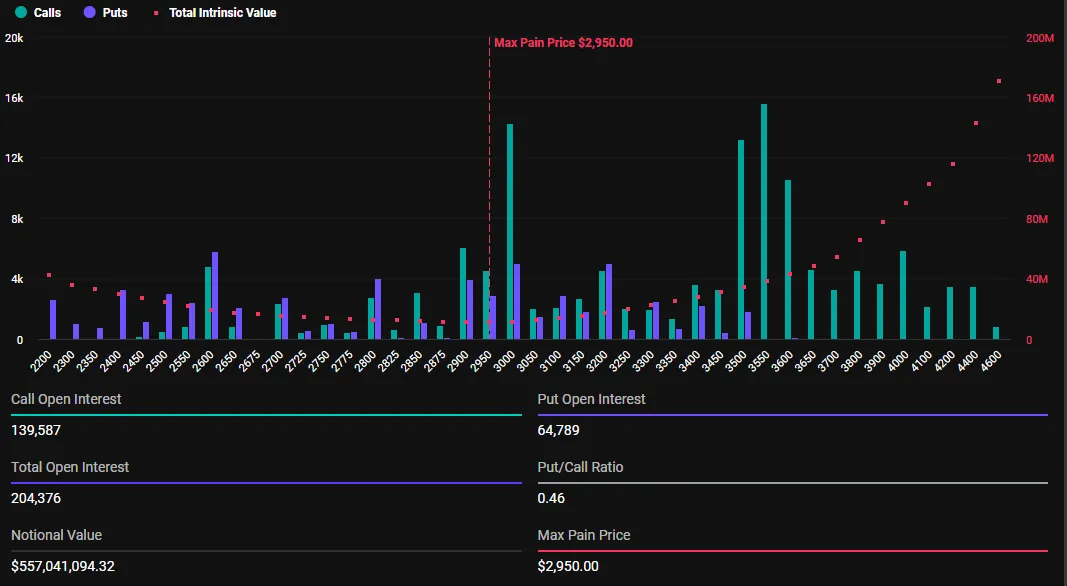

In addition to Bitcoin options, 204,376 Ethereum options contracts are set to expire today. These expiring options have a notional value of $557.04 million, a put-to-call ratio of 0.46, and a maximum pain point of $2,950.

The number of today’s expiring Bitcoin and Ethereum options is significantly lower than last week’s. BeInCrypto reported that last week’s expired BTC options were 80,179 contracts, compared to 603,426 for ETH.

This marginal difference comes from last week’s options, which represented the month’s total. Accordingly, the total number of options expiring surpassed $10 billion.

Ahead of the expiration, options trading tool provider Greeks.live shared its insights into the market. It highlighted the prevailing weak sentiment in the market this week and explained why the max pain levels for BTC and ETH were below the $100,000 and $3,000 levels, respectively.

“Market sentiment was weaker this week, with ETH’s Maxpain point falling below $3,000 again, with the coin dropping to $2,100 at one point during the session, a new low since 2024, and BTC effectively falling below the $100,000 mark, around which the market has been oscillating in a wide range since it broke above $95,000 in late November,” Greeks.live said.

Against this backdrop, the options trading tool indicates the role of US President Donald Trump’s tariffs in influencing sentiment. As BeInCrypto reported, the trade policies were a key market driver this week, having caused the largest single-day liquidation event in history. Traders remain wary of potential trade wars, which could exacerbate sentiment further.

Therefore, the analysts at Greeks.live ascribe current volatility to these concerns, citing expectations of further market adjustments.

“The market is still digesting the effects of 3 months of Trump Trade, with deliveries accounting for 10% of total positions this week, with call options trading down significantly and Block puts growing as a percentage of volume,” the analysts added.

Nevertheless, the influence of macroeconomics cannot be overlooked. With US Unemployment and Non-Farm Payrolls data for January expected today, traders will be looking for how these macro events influence markets, with overall risk in the crypto sector now more correlated.

“Today’s market movers: An uptick in unemployment could drive interest in Bitcoin as a hedge against economic instability. A drop might see investors favoring traditional markets. Strong payroll numbers could signal economic health, potentially reducing Bitcoin’s safe-haven appeal. Weak numbers might enhance Bitcoin’s attractiveness as an investment during times of economic uncertainty,” crypto analyst Mark Cullen observed.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.