Market

Bitcoin, Ethereum Face $2 Billion Options Expiration

The crypto market braces for volatility as approximately $2.06 billion in Bitcoin (BTC) and Ethereum (ETH) options will expire today.

How will the expiring options impact the market dynamics, with notable data points highlighting the significant stakes involved?

Key Insights on Today’s Bitcoin and Ethereum Options Expiration

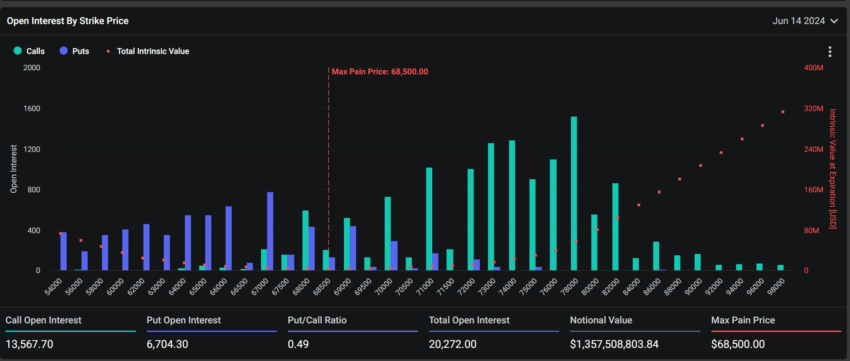

Approximately 20,276 Bitcoin options contracts are set to expire today. These contracts have a notional value of $1.35 billion, with a put-to-call ratio of 0.49. In the context of crypto options trading, this ratio suggests a prevalence of purchase options (calls) over sales options (puts).

Read more: An Introduction to Crypto Options Trading

These expiring Bitcoin options have a maximum pain point of $68,500. This represents the price level where the greatest financial losses will be experienced by option holders, marking critical thresholds for market participants.

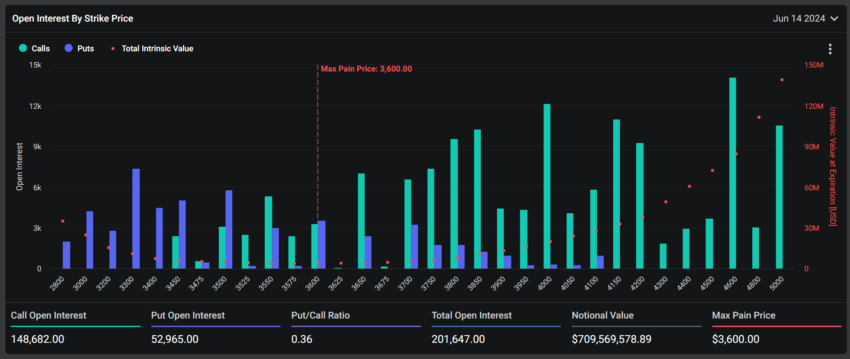

Additionally, 201,647 Ethereum contracts will expire at the same time. According to Deribit’s data, the notional value of these contracts is $709.76 million, with a maximum pain point of $3,600. The data further shows that the put-to-call ratio for these options is 0.36.

Adam, a macro researcher at options trading tool Greeks.Live, shared insights on today’s expiring Bitcoin and Ethereum contracts. He emphasized the week’s macroeconomic importance.

“This week is a big week for macroeconomics. Economic data is relatively favorable to the venture capital market. The US stock market has risen significantly, but the crypto market has performed poorly. Mainstream coins have fallen overall, and altcoins have fallen even more. There are fewer hot spots in the market recently, and the market is relatively quiet,” he noted.

He further explained the volatility and the potential strategic moves for traders.

“Currently, the major medium- and short-term implied volatilities of BTC are all below 50%, and the major medium- and short-term [implied volatilities] IVs of ETH are all below 60%. Both have fallen to relatively low levels, providing buyers with a high cost-effectiveness ratio. There should be new news on the approval of [spot] ETH [exchange-traded fund] ETF at the end of this month, so you can plan for next month’s call options in advance,” Adam suggested.

Bitcoin and Ethereum have faced price declines leading up to this expiration. Bitcoin, which traded at $71,643 on June 7, briefly dipped to $66,254 on June 11 before recovering to $69,945 on June 12.

Currently, Bitcoin trades at $67,064, reflecting a 6% drop over the past week. Meanwhile, Ethereum is trading at $3,519, marking a 7.8% decrease.

Read more: 9 Best Crypto Options Trading Platforms

While options expirations can cause temporary market disruptions, they are often followed by stabilization. Traders should remain vigilant, analyzing technical indicators and market sentiment to navigate the anticipated volatility effectively.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.