Market

Bitcoin (BTC) Faces Weak Buying Pressure as Bulls Remain on the Sidelines

Bitcoin (BTC) has seen a notable drop in buying pressure over the last few days as the cryptocurrency’s price continues to swing between $98,000 and $10,000. This drop in bullish momentum suggests that BTC might not be ready for its next leg up.

Instead, it indicates that the price might continue to trade sideways unless something changes.

Bitcoin Accumulation Lowers

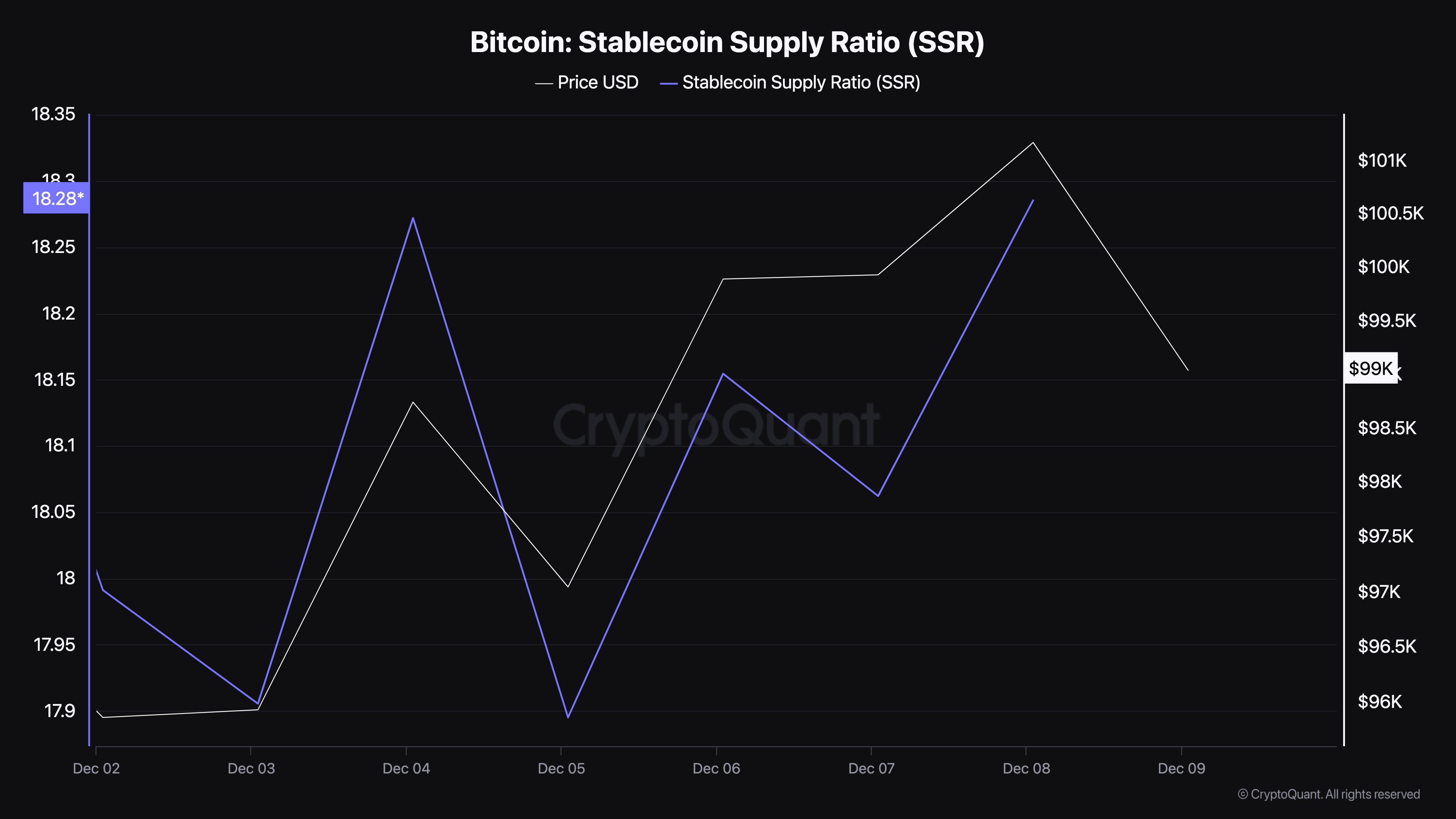

One indicator showing a decline in Bitcoin buying pressure is the Stablecoin Supply Ratio (SSR). The SSR measures the ratio of a cryptocurrency’s market capitalization to the aggregated market capitalization of all stablecoins in circulation.

Low SSR indicates higher buying power from stablecoins. It suggests that there is a large amount of stablecoin liquidity available, which could drive upward price momentum if converted into cryptocurrency. High SSR, on the other hand, reflects lower stablecoin liquidity relative to the cryptocurrency’s market cap, potentially indicating weaker BTC buying power or limited demand.

According to CryptoQuant, the Bitcoin SSR has spiked to 18.29. The conditions stated above indicate that buying power is no longer strong. As such, Bitcoin’s price might continue to trade below its all-time high of $103,900.

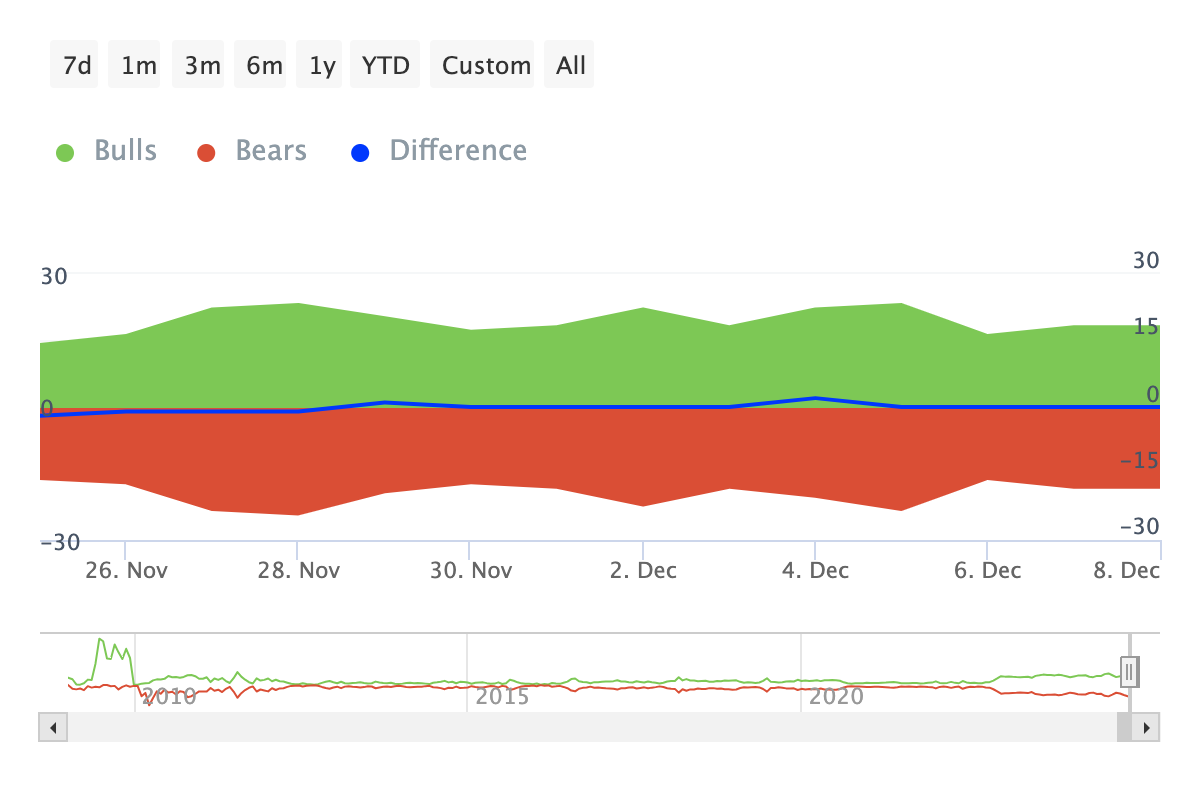

Another metric suggesting the same is the Bulls and Bears indicator. For context, bulls are addresses that bought at least 1% of the total trading volume within a specific period. Bears, on the flip side, are those who sold a similar amount.

When there are more bulls than bears, the BTC price is likely to increase. However, if bears have the upper hand, the opposite occurs. According to IntoTheBlock data, the number of bulls and bears over the last seven days has remained the same.

This indicates that Bitcoin bulls have refrained from buying more coins to raise the price. If this trend continues, then the BTC price might continue consolidating.

BTC Price Prediction: Further Decline Looms

On the daily chart, the Moving Average Convergence Divergence (MACD) has dropped to the negative region. The MACD measures the momentum around a cryptocurrency.

When the MACD is positive, momentum is bullish. However, in this case, the momentum is bearish, suggesting that BTC’s price might not experience a significant uptrend in the short term. The indicator’s position also signifies a drop in Bitcoin buying pressure.

If this remains the same, Bitcoin’s price is likely to drop to $90,623. However, if buying pressure increases and bulls buy in large volumes, the coin price might jump to $103,581.

The post Bitcoin (BTC) Faces Weak Buying Pressure as Bulls Remain on the Sidelines appeared first on BeInCrypto.