Market

Analyst Prediction for Bitcoin (BTC) Hints at $200,000: How?

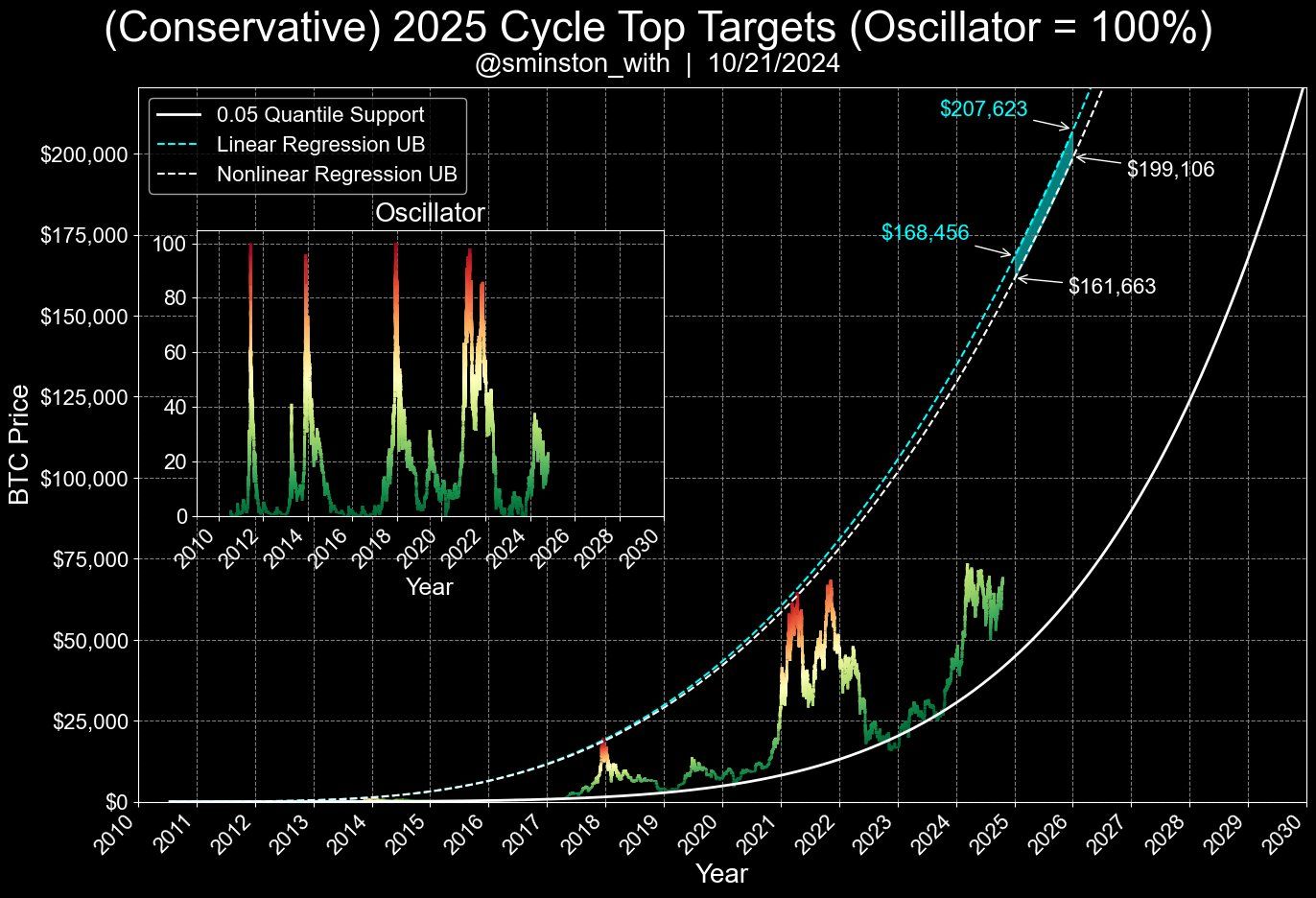

Sminston With, a crypto analyst, has predicted that Bitcoin’s (BTC) price could surpass $200,000. This forecast came on the same day that the Bitcoin price failed to hit the widely expected $70,000 mark.

However, With suggests that the prediction might not come to pass this year or next. In this analysis, the platform reveals how the analyst arrived at this conclusion and whether Bitcoin has a chance of hitting this target.

Bitcoin Decay Model Suggests Higher Highs, Analyst Reveals

On Monday, October 21, With posted on X (formerly Twitter), saying that BTC could hit between $199,106 and $207,623. The analyst came to this conclusion after evaluating the Decay Channel model.

The decay model was designed to challenge previous prediction models, particularly the widely recognized Rainbow Chart and Stock-to-Flow (S2F) model. Both of these earlier models have been influential in forecasting Bitcoin’s price movements.

Still, the decay model presents an alternative perspective by incorporating factors that may account for diminishing returns and slowing growth as the asset matures, as shown below. Interestingly, this forecast is another analyst’s prediction for Bitcoin, which predicts that the coin could reach $200,000 in 2025.

Read more: Top 7 Platforms To Earn Bitcoin Sign-Up Bonuses in 2024

“Depending on the regression method used, linear or nonlinear, the upper bound of decay on January 1st, 2026, looks to be either $199,106 or $207,623. Even with this much decay, this is bullish!” With said.

However, on-chain data obtained by looking at Bitcoin’s Cycle Top Indicator shows that the coin might not go that high. Instead, the 350-day Simple Moving Average (SMA), which spots the highest possible price of a cycle, reveals that BTC’s top could be around $114,256.

In a related development, Jurrien Timmer suggested that Bitcoin’s price might continue to trade sideways for an extended period.

In his post, Timmer pointed out that Bitcoin’s adoption curve currently lags behind that of gold, making it difficult for BTC to experience rapid acceleration in the near term. This slower adoption could be a limiting factor in Bitcoin’s price growth despite its potential as a store of value.

BTC Price Prediction: Drop Below $63,000 First

According to the daily chart, Bitcoin’s price attempted to hit $70,000, and the wick of the last green candle reached $69,126.

However, as seen below, the coin could not break out of the rising parallel channel, which could have sent it higher. Due to this, BTC is currently trading below $67,000. A look at the Relative Strength Index (RSI) shows that the reading has dropped.

The RSI measures momentum using the size and speed of price changes. When it increases, momentum is bullish. On the other hand, a decrease implies a rising bearish momentum, which seems to be the case with BTC currently.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

If sustained, Bitcoin’s price might drop to $62,995. On the flip side, if momentum becomes bullish again and buying pressure increases, BTC might climb to $69,400 and possibly surpass $73,000 in the short term, aligning with the analyst prediction for Bitcoin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.