Market

$3 Billion in BTC, ETH Options Expire as Bitcoin Hits $100,000

Today, approximately $3 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to expire, creating significant anticipation in the crypto market.

These expiring crypto options come ahead of President-elect Donald Trump’s inauguration week. Bitcoin is front-running the ascension by reclaiming the $100,000 mark.

Over $2.8 Billion Bitcoin and Ethereum Options Expire

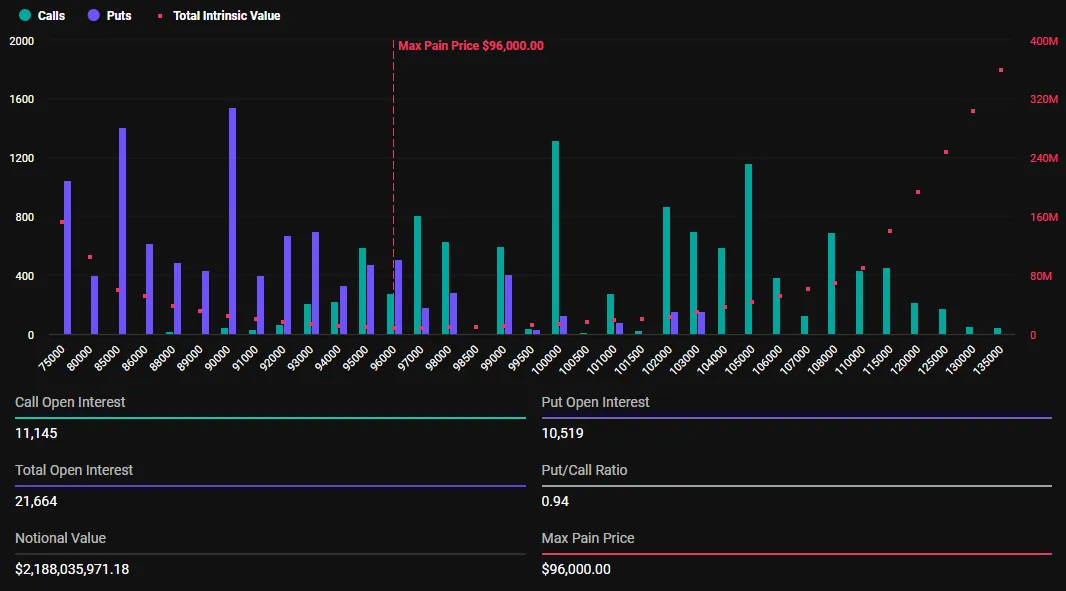

According to Deribit’s data, 21,664 Bitcoin contracts, with a notional value of approximately $2.2 billion, are set to expire today. Bitcoin’s put-to-call ratio is 0.94.

The maximum pain point — the price at which the asset will cause financial losses to the greatest number of holders — is $96,000. Here, most contracts will expire worthless.

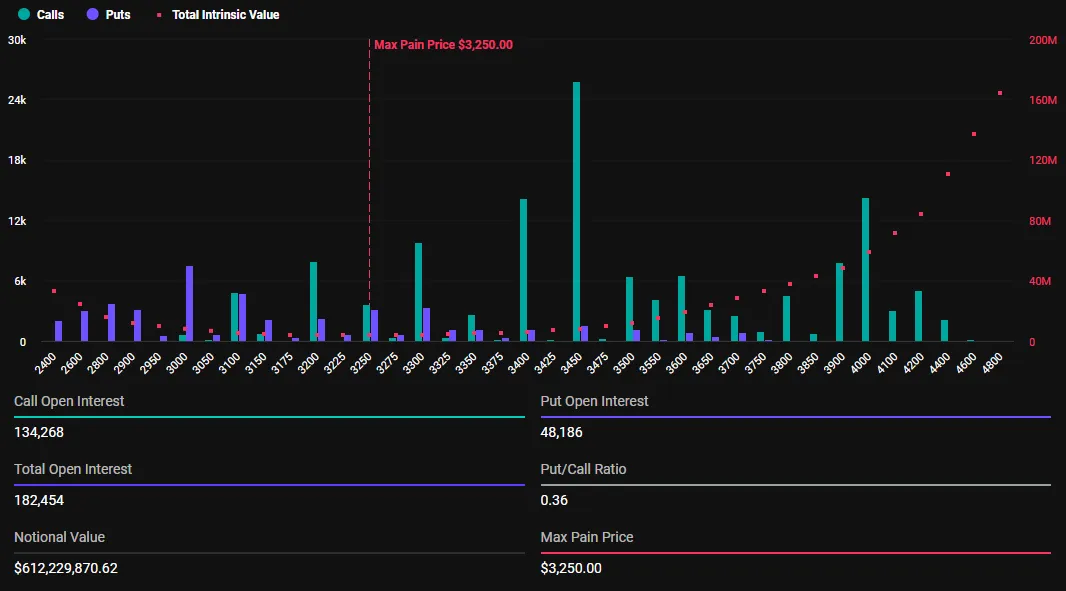

Similarly, crypto markets will witness the expiry of 182,454 Ethereum contracts, with a notional value of $612.2 million. The put-to-call ratio for these expiring Ethereum options is 0.36, with a maximum pain of $3,250.

Options expiry often leads to notable price volatility, which makes it imperative that traders and investors monitor today’s developments closely. The put-to-call ratios below 1 for both Bitcoin and Ethereum indicate optimism in the market. This suggests that more traders are betting on price increases, reflecting positive market sentiment.

Bitcoin’s move to reclaim the $100,000 aligns with this market optimism. Meanwhile, analysts at Greeks.live ascribe the sentiment to the anticipation of Donald Trump’s presidency, as he has promised to be a “crypto president,” potentially influencing industry policies favorably. The analysts also cite expectations of no rate cuts, which could influence market sentiment towards cryptocurrencies.

“Bitcoin rallied again above $100,000, sweeping away the weekend’s subdued market sentiment…Trump will officially take office as the new US President next week, and it is worth keeping an eye on whether or not he will enact policies directly favorable to cryptocurrencies this month. The US stocks have picked up in recent days, and the rate meeting at the end of the month will basically be to maintain no rate cuts,” Greeks.live shared on X (Twitter).

Nevertheless, the analysts observe that short-term option implied volatility (IV) has risen, with a significant increase in long strength. With this, they advise investors to purchase a portion of short-term options, citing a focus on the expected policy changes with the government incumbent and the inflow of ETFs (exchange-traded funds).

Further, Greeks.live highlights how the trading behavior of different regions affects Bitcoin’s price. Asia and Europe sold Bitcoin, leading to a price drop, which was then bought back by Americans, turning the market trend positive. This reflects the global interplay in cryptocurrency markets.

“Asia and EU sold BTC today and then the Americans bought it all back up on the lows? Turning a red day into a green day for BTC,” the post read.

Despite this otherwise snarky comment on price action, this interplay, right before the anticipated volatility due to Trump’s inauguration, suggests an underlying context of political events influencing market sentiment.

BeInCrypto data shows that at the time of writing, Bitcoin was trading at $101,187. This represents a modest climb of 1.62% since the Friday session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.