Bitcoin

What 500K BTC Holdings Mean for Crypto

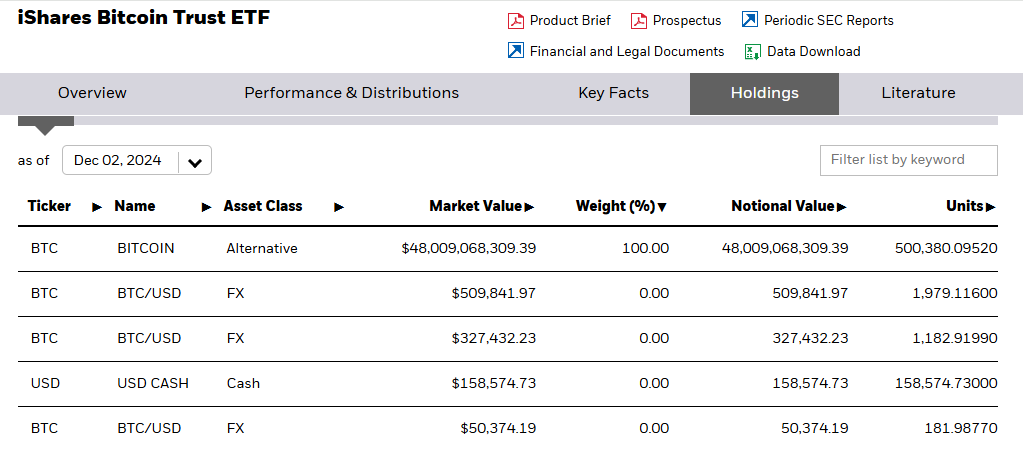

According to on-chain data, BlackRock’s iShares Bitcoin Trust (IBIT) now holds over 500,000 BTC. This positions BlackRock as the third-largest Bitcoin holder globally, trailing only Bitcoin’s pseudonymous creator, Satoshi Nakamoto, and crypto exchange giant Binance.

With holdings worth approximately $48 billion, BlackRock’s influence in the crypto market is expanding fast.

BlackRock’s Aggressive Bitcoin Accumulation

In just 233 trading days since the launch of IBIT, BlackRock has acquired 2.38% of all Bitcoin that will ever exist. This traction reflects its confidence in Bitcoin as a financial asset. Its series of purchases reflects this momentum, with total BlackRock Bitcoin holdings reaching 500,380 units as of Monday, December 2.

Recently, the firm made headlines with a $680 million Bitcoin buying spree amid a cumulative effort. The purchases continue to solidify its foothold in the market. BlackRock’s pivot toward Bitcoin aligns with CEO Larry Fink’s changing perspective. Once a skeptic who dismissed Bitcoin as speculative, Fink now describes it as an “independent asset” with transformative potential.

This shift has driven BlackRock’s deepening involvement in crypto markets. The firm’s US Head of Thematics and Active ETFs, Jay Jacobs, recently said Bitcoin could become a $30 trillion market. As BeInCrypto reported, he cited more room for BTC adoption.

BlackRock’s flagship product, the iShares Bitcoin Trust (IBIT), is a central component of its Bitcoin accumulation strategy. IBIT reached $40 billion in AUM (assets under management) earlier this year, shattering speed records in the ETF industry. On its first day of options trading alone, the fund recorded sales exceeding $425 million, signaling immense interest from institutional investors.

Four weeks ago, IBIT surpassed the performance of BlacRock’s gold ETF, evidence of Bitcoin’s rising prominence in traditional finance (TradFi). According to data on SoSoValue, IBIT continues to lead the charge in the Bitcoin spot ETF market.

The financial instrument recorded inflows nearing $340 million on Monday. Its cumulative net inflow was $32.08 billion as of December 2, with Fidelity’s FBTC trailing at $11.48 billion.

BTC Institutional Adoption Stirs Decentralization Concerns

BlackRock’s Bitcoin strategy extends beyond ETFs. The firm has also increased its exposure to Bitcoin through investments in MicroStrategy, the largest corporate holder of Bitcoin. This move reflects BlackRock’s confidence in Bitcoin’s long-term value proposition and its intent to dominate the institutional Bitcoin market.

The firm’s initiatives, among those of other TradFi players, have undeniably legitimized Bitcoin as an asset class. However, not all are celebrating.

Critics within the crypto community argue that institutional dominance contradicts Bitcoin’s founding ethos of decentralization. With BlackRock amassing such significant holdings, the firm risks centralizing control in a space that was designed to empower individuals over institutions.

“There once was a dream that was Bitcoin… this is not it,” one user on X lamented.

To some critics, the growing institutional acquisition of Bitcoin defeats the whole purpose of decentralization, with the likes of BlackRock steadily edging to become the biggest hodlers.

Nevertheless, BlackRock’s rise as a major Bitcoin holder marks a pivotal shift in the cryptocurrency playing field. On one hand, it highlights Bitcoin’s mainstream acceptance and potential as a global financial asset. On the other, it raises questions about the role of large financial institutions in a space traditionally associated with grassroots financial sovereignty.

With IBIT leading the charge and setting benchmarks, the firm is poised to remain a key player in the crypto industry. However, the debate over whether this benefits or undermines Bitcoin’s foundational principles is unlikely to subside.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.