Bitcoin

VanEck Suggests Kamala Harris Presidency Could Benefit Bitcoin

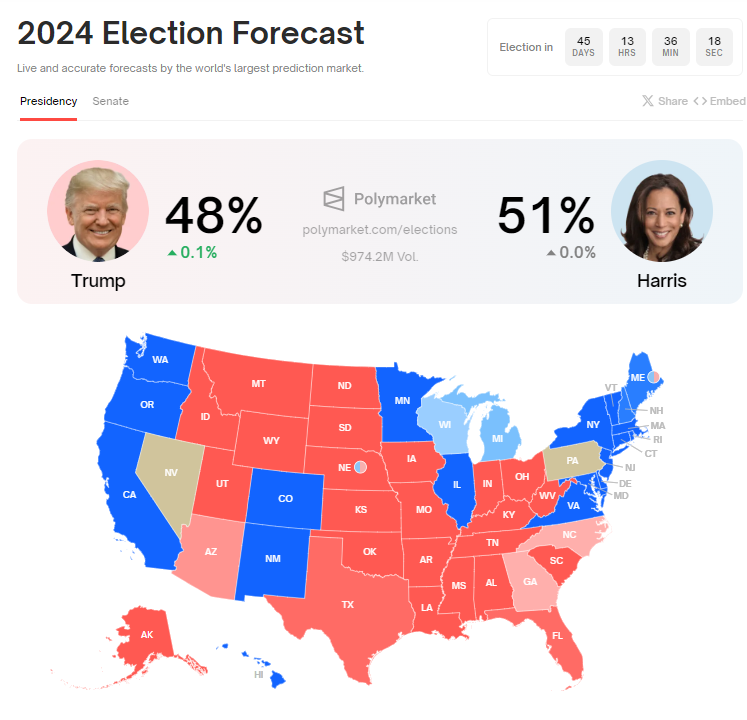

VanEck, an asset management firm, recently examined how the 2024 US Presidential election could impact Bitcoin. The firm believes both candidates—Kamala Harris and Donald Trump—present positive prospects for Bitcoin, though each offers different implications for the broader digital asset market.

VanEck also noted a significant rise in Bitcoin interest compared to the previous year, driven by institutional demand and growing global adoption. This is largely due to the increasing use of exchange-traded products (ETPs) and government involvement in mining and international transactions.

Harris’ Presidency May Favor Bitcoin

In a September 19 report, VanEck suggested that either a Kamala Harris or Donald Trump presidency would likely benefit Bitcoin. According to the firm, both administrations are expected to continue or even escalate fiscal spending, which could lead to further quantitative easing that would benefit the top digital asset.

Matthew Sigel, VanEck’s Head of Digital Assets Research, shared on X (formerly Twitter) that a Democratic administration, despite appearing unfriendly toward crypto, might actually boost Bitcoin. VanEck explained that a Harris presidency could accelerate Bitcoin adoption due to ongoing structural issues. With clearer regulations, Bitcoin might outpace other digital assets.

“On Bitcoin alone, however, we would argue that a Kamala Harris presidency might be even better for Bitcoin than a second term for Trump because it would, in our view, accelerate many of the structural issues that drive Bitcoin adoption in the first place,” VanEck wrote.

Read more: How Can Blockchain Be Used for Voting in 2024?

However, VanEck warned that if Harris retains Gary Gensler as SEC Chair or aligns with figures like Elizabeth Warren, the crypto sector might face stricter regulations.

In contrast, VanEck suggested that a Trump presidency could favor the entire crypto industry. Trump’s administration would likely promote deregulation and pro-business policies, easing the regulatory burden on crypto entrepreneurs. Notably, crypto stakeholders generally favor a Trump presidency, citing his stronger pro-crypto stance.

“Regardless of the election outcome, the trend of growing fiscal deficits and rising national debt will likely continue. This suggests a weakening of the US dollar, a macroeconomic environment in which Bitcoin has historically thrived,” VanEck added.

Rising Bitcoin Interest and Adoption

VanEck also reported a significant increase in Bitcoin interest over the past year, with institutional adoption reaching new heights. Bitcoin trading volumes surged 173% year-over-year, surpassing equity trading volumes. US dollar-based Bitcoin transfers rose by 202% during the same period despite a decline in retail on-chain activities.

“With Bitcoin’s on-chain activity diminished, bitcoin’s price appreciation this year is better explained by growing adoption as money: a vehicle for storing and transferring value,” VanEck wrote.”

The firm attributed this to rising institutional interest, which came to the fore with the launch of US Bitcoin ETFs in January. Notably, the spot ETFs have been a success, recording around $18 billion in inflows since they began trading.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

In addition, countries like Kenya, Ethiopia, and Argentina have also begun Bitcoin mining, increasing both sovereign and institutional involvement with the asset.

“We believe this trend is a key indicator of the global shift towards de-dollarization. […] The implications for Bitcoin are significant, as government-level mining and cross-border crypto transactions could bolster Bitcoin’s role as a global reserve asset,” VanEck stated.

Overall, the combination of institutional investment and government participation drives Bitcoin’s growing appeal, positioning it for continued expansion regardless of the 2024 election outcome.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.