Bitcoin

Metaplanet Issues $6.2 Million Bond to Boost Bitcoin Holdings

Japanese investment firm Metaplanet has announced the issuance of a $6.2 million bond to bolster its Bitcoin (BTC) holdings.

The issuance of bonds is a key step in improving Metaplanet’s financial situation and offering its customers new investment opportunities. As Metaplanet continues to expand its Bitcoin holdings, the firm is positioning itself as a key player in Japan’s crypto market.

Metaplanet revealed its bond issuance plan on June 24, and the Board of Directors approved it. The company intends to use the funds to buy Bitcoin, which aligns with its strategy to hold the cryptocurrency as a reserve asset. The bond issuance offers an annual interest rate of 0.5% and will mature on June 25, 2025.

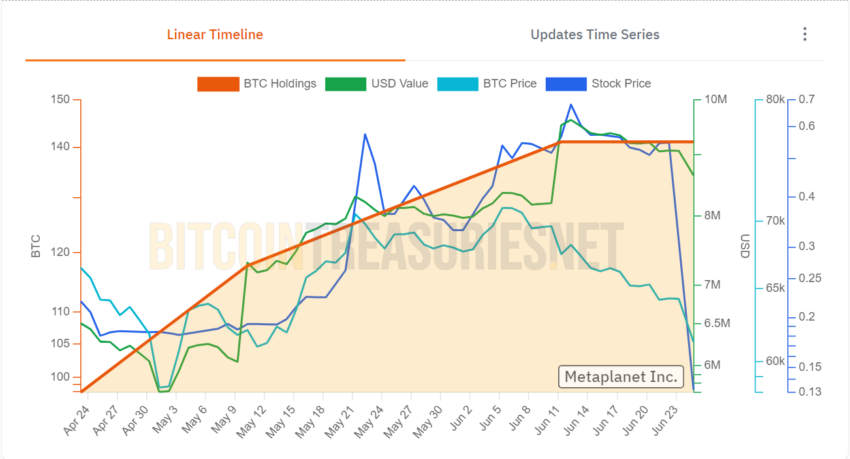

This move follows a recent acquisition of Bitcoin worth $1.6 million. Currently, Metaplanet’s total Bitcoin holdings are 141 BTC, valued at around $9.4 million.

Read more: Who Owns the Most Bitcoin in 2024?

Metaplanet initiated its Bitcoin purchases in April, influenced by the desire to reduce risks tied to Japan’s economic environment. By adopting Bitcoin as a reserve asset, Metaplanet aims to reduce its exposure to the yen. This strategy comes as the yen has been affected by high government debt levels and prolonged negative real interest rates.

The firm’s strategy echoes that of MicroStrategy, a US-based software company that has become the largest corporate holder of Bitcoin since 2020. Markus Thielen, founder of crypto research firm 10x Research, commented on Metaplanet’s alignment with MicroStrategy’s model.

“We like their approach as they are copying MicroStrategy to some extent, but their BTC purchases are minor. A few million will not move the needle. They need to go all in,” he noted.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Metaplanet’s move signals a growing trend among corporations seeking to leverage Bitcoin’s potential as a hedge against traditional economic vulnerabilities. BeInCrypto reported that Canadian fintech DeFi Technologies started to adopt Bitcoin as its primary treasury reserve asset earlier this month.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.