Bitcoin

Four Weeks of Crypto Outflows: Is Investor Confidence Collapsing?

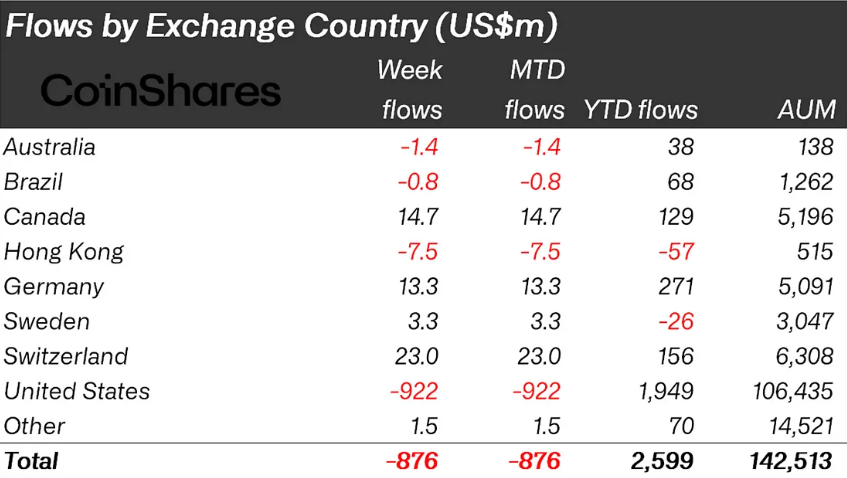

Crypto outflows totaled $876 million last week, completing a successive streak of negative flows in the previous four weeks.

This continued sell-off has resulted in cumulative outflows of $4.75 billion over the past month, significantly reducing the year-to-date inflows to $2.6 billion. Resultantly, total assets under management (AuM) have declined by $39 billion from their peak, now standing at $142 billion—the lowest level since mid-November 2024.

Crypto Outflows Reach $876 Million

The latest CoinShares report indicates that US investors primarily drove the outflows, withdrawing $922 million from digital asset investment products. This bearish sentiment in the US contrasted with other regions, where investors saw the recent market pullback as a buying opportunity.

Meanwhile, Bitcoin remained the primary focus of crypto outflows last week. According to the report, investors pulled $756 million from BTC investment products over the past week. Notably, short-Bitcoin products—designed to profit from price declines—also saw outflows of $19.8 million, the largest since December 2024.

This suggests that some investors may be nearing a point of capitulation in their Bitcoin investments, closing their short positions as uncertainty looms.

Notwithstanding, last week’s crypto outflows marked another significant decline following prior weeks of sustained withdrawals. In the first week of March, digital asset investment products saw record-breaking outflows of $2.9 billion. As BeInCrypto reported, this was fueled by weak investor sentiment and heightened market fear.

This had come on the heels of $508 million in outflows the previous week, amid investor caution, and $415 million in withdrawals before that, following the Federal Reserve’s hawkish rhetoric and concerns over inflation.

The Federal Reserve’s stance on monetary policy has shaped investor behavior in recent months. As inflation exceeds expectations, the Fed has signaled that interest rates may remain elevated for an extended period, reducing liquidity in financial markets and weighing on risk assets like crypto.

“We do not need to be in a hurry, and are well positioned to wait for greater clarity,” Fed chair Jerome Powell stated last week.

With four straight weeks of outflows and persistent macroeconomic headwinds, the crypto market remains under pressure. While certain assets like Solana (SOL) and XRP continue to attract inflows, the overall sentiment remains bearish, particularly among US investors.

If market conditions fail to improve, further outflows could follow in the coming weeks, reinforcing the cautious approach among investors.

Bitcoin and Ethereum ETFs Reflect Bearish Sentiment

The negative sentiment extended beyond Bitcoin, affecting blockchain-related equity exchange-traded products (ETPs). CoinShares’ latest report indicates outflows of $48 million during the same period for these financial instruments.

This decline reflects a broader risk-off sentiment, with investors exercising caution across the digital asset sector. It aligns with a recent BeInCrypto report, which showed that Bitcoin ETFs (exchange-traded funds) recorded four weeks of net outflows surpassing $4.5 billion.

Similarly, Ethereum ETFs continued their negative trend, logging a second consecutive week of net outflows. These negative flows come despite anticipation of last week’s White House Crypto Summit. The outflows suggest macroeconomic concerns and strategic market positioning overshadowed the event’s impact.

The general sentiment is that Trump’s tariffs cause the sour sentiment and weaken investor confidence. However, some crypto analysts hold different opinions, ascribing outflows from crypto investment products to hedge funds’ trading strategies.

“…hedge funds don’t care about Bitcoin. They were farming low-risk yield. Now that the trade is dead, they’re pulling liquidity—leaving the market in free fall…This is a classic case of liquidity games. ETFs didn’t just bring in long-term holders—they brought in hedge funds running short-term arbitrage,” crypto analyst Kyle Chassé explained.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.