Bitcoin

BlackRock CEO Larry Fink Explains Why to Invest in Bitcoin

BlackRock CEO Larry Fink has emerged as a vocal advocate for Bitcoin. On CNBC’s “Squawk on the Street,” Fink articulated why investors should consider Bitcoin a key portfolio component.

Fink’s endorsement is noteworthy given BlackRock’s stature, managing over $10 trillion in assets.

Why Larry Fink Believes in Bitcoin’s Potential

During his CNBC appearance, Fink emphasized Bitcoin’s unique attributes. He highlighted its role in providing financial autonomy, particularly in unstable economies.

“I’m a major believer that there is a role for Bitcoin in portfolios. I believe you’re going to see that as one of the asset classes that we all look at. I look at it as digital gold, as I said before,” he stated.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

Initially doubtful, Fink admitted his earlier views were misguided. He now sees Bitcoin as essential for diversifying portfolios and protecting against economic uncertainty.

“I studied it, learned about it. And I came away saying, ‘OK, you know, my opinion five years ago was wrong.’ Here’s my opinion. Say this is what I believe in today. I believe in the opportunity today. I believe Bitcoin is legitimate,” Fink stated.

Fink’s endorsement has not gone unnoticed. Prominent figures like Dan Held and Anthony Pompliano have praised Fink’s stance and recognized its significance.

“Larry Fink continues to be the best CMO of Bitcoin. The messenger matters more than the message now,” Pompliano noted.

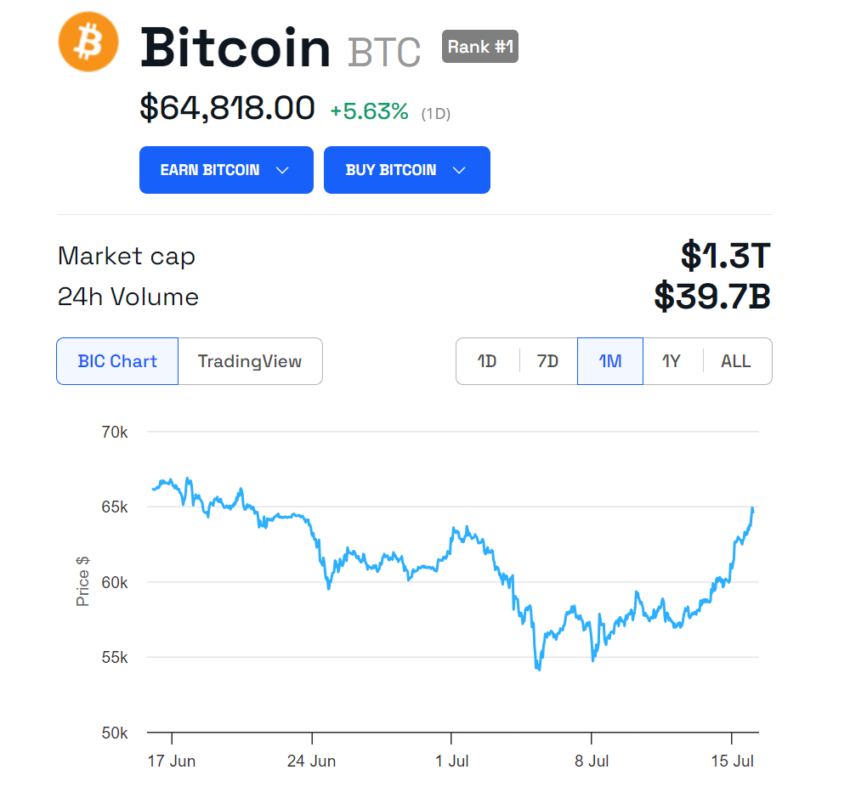

Bitcoin’s (BTC) price also responded positively to Fink’s comments. At the time of writing, BTC is trading at $64,818, marking a 5.63% increase in the last 24 hours.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Fink’s journey from skepticism to advocacy mirrors institutional acceptance of Bitcoin. For instance, Japanese investment firm Metaplanet has been regularly purchasing Bitcoin since April.

The company aims to reduce risks tied to Japan’s economic environment by adopting Bitcoin as a reserve asset. This strategy addresses the yen’s challenges, which include high government debt levels and prolonged negative real interest rates.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.