Bitcoin

BlackRock Buys $1 Billion in Bitcoin: Here’s What It Means

BlackRock bought $1 billion in Bitcoin last week, according to trading data, with an additional $300 million purchased on Monday.

The asset manager has also invested in MicroStrategy, signaling a deepening connection with the BTC market.

BlackRock’s Bitcoin Strategy

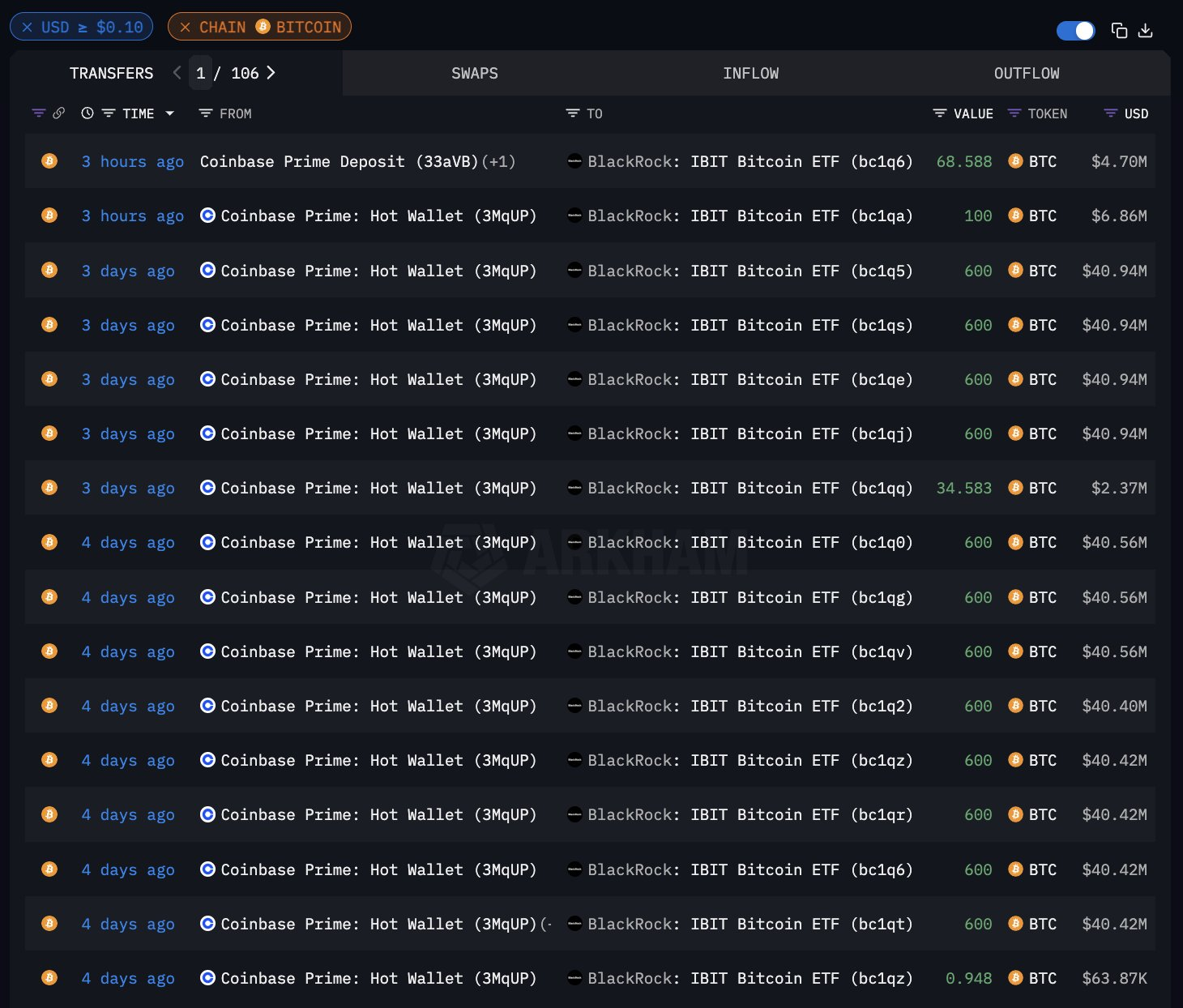

According to Arkham Intelligence data , BlackRock purchased $1 billion worth of Bitcoin in the last week. Its current total holdings sit at 399,525 BTC, which is a substantial amount, but nonetheless a far cry from Binance’s 667,526. Arkham’s data shows that BlackRock has been buying BTC steadily throughout each day, typically in 600 BTC transactions.

Read more: Who Owns the Most Bitcoin in 2024?

BlackRock has gone on a Bitcoin buying spree this October, initially purchasing $680 million worth of the asset over two days before shifting to a steady acquisition plan. Its Bitcoin ETF, IBIT, led October ETF inflows, reflecting the success of BlackRock’s deep BTC investments. CEO Larry Fink has endorsed Bitcoin as a distinct asset class and remains a strong supporter.

This pattern of major purchases by BlackRock shows no sign of slowing. Data from Lookonchain reveals that on Monday, BlackRock invested another $300 million into BTC, acquiring 4,369 coins. This accounted for the majority of Bitcoin bought by all ETF issuers on October 28.

However, BlackRock is also diversifying its Bitcoin-centric investment strategies. Last week, it expanded its stake in MicroStrategy to 5.2%. MicroStrategy may not be an ETF issuer, but it is also a leading corporate investor in Bitcoin, and their values are closely tied.

“T-Rex’s 2x Microstrategy ETF…is essentially a 4x Bitcoin ETF. It’s 30 day volatility is 168%; IBIT’s is 41%. It’s notable because you can’t launch a 4x Bitcoin ETF…but by [doubling] MicroStrategy, they effectively created the ultimate degenerate trading tool,” Bloomberg ETF analyst Eric Balchunas stated.

BlackRock’s investment in MicroStrategy carries less volatility than an ETF tied to Bitcoin’s valuation. However, it remains a relevant comparison, especially as Balchunas directly compared MicroStrategy’s volatility and returns to BlackRock’s IBIT. With Bitcoin’s recent strong performance, BlackRock’s involvement has helped drive MicroStrategy’s stock to a 24-year high.

Read more: What Is a Bitcoin ETF?

In conclusion, BlackRock has displayed a deep affinity towards continued BTC investment. The firm has been buying astronomical quantities of the asset on an elongated timeline. Besides this, it’s also been making major investments into Bitcoin-adjacent properties like MicroStrategy. On this trajectory, BlackRock is growing into one of the largest Bitcoin holders.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.