Bitcoin

Bitcoin Surpasses Meta, Now World’s 9th Largest Asset

Bitcoin has reached a milestone, surpassing Meta to secure the 9th position in global market capitalization rankings.

The rally, driven by investor optimism following Donald Trump’s win in the 2024 US presidential election, has propelled Bitcoin to a market cap of $1.48 trillion, once again edging out Meta’s $1.44 trillion.

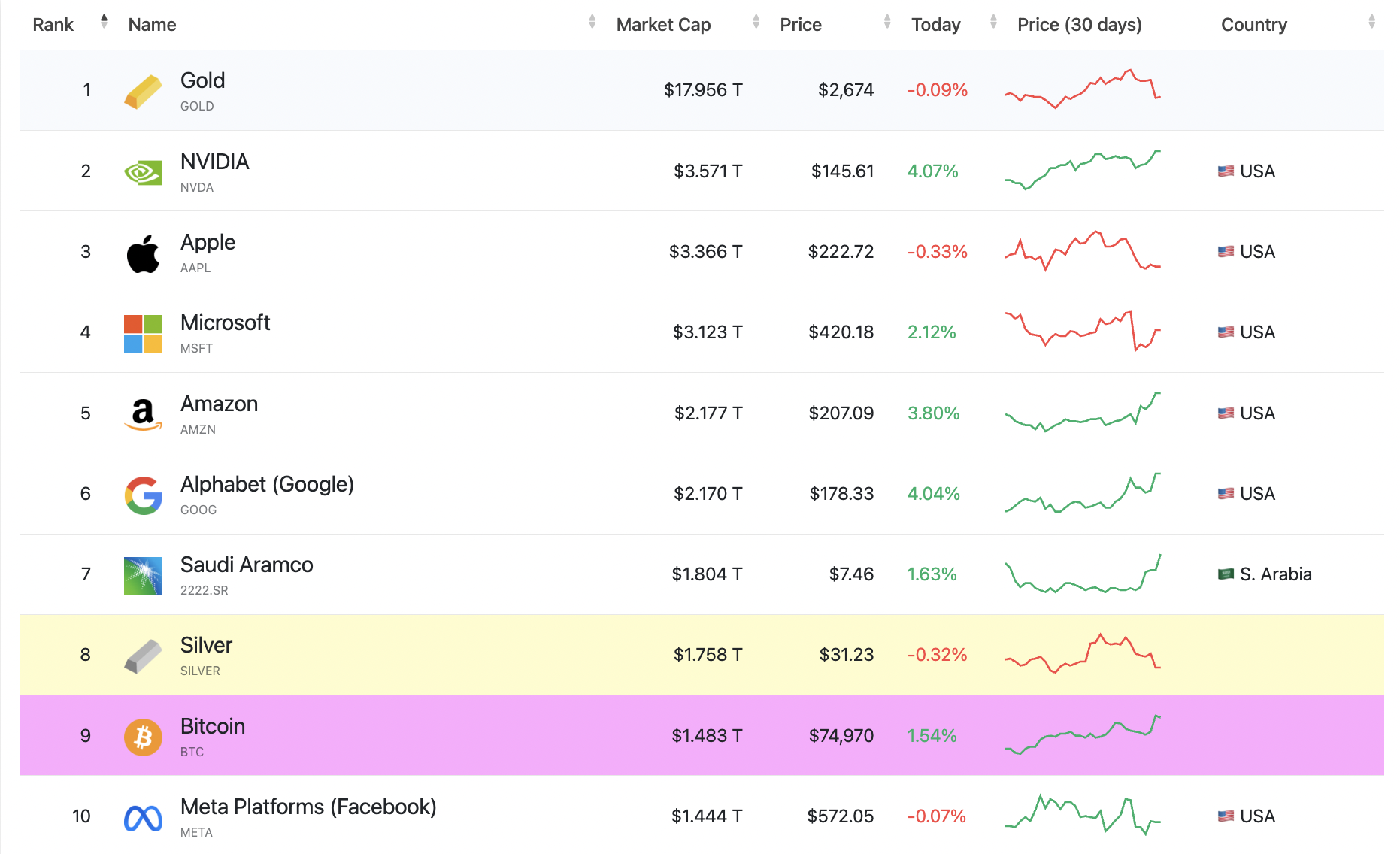

Bitcoin is Now the 9th Largest Asset Worldwide

With each Bitcoin now valued at approximately $74,900, the cryptocurrency has surpassed Meta’s market cap with notable resilience.

This marks the second time Bitcoin has overtaken Meta, following a rally in March when it briefly surged above $73,000. The milestone highlights Bitcoin’s increasing relevance and competitive positioning alongside other major tech giants.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

The list is topped by gold, which has a market cap of $17.95 trillion. Chip maker NVIDIA is next at $3.57 trillion, followed by Apple at $3.36 trillion.

Other companies in this ranking include Microsoft, Amazon, and Alphabet (Google). Bitcoin’s latest valuation places it just behind silver in 9th place. This development demonstrates Bitcoin’s evolution from a niche digital asset to a globally significant store of value.

Can Bitcoin Overtake Silver?

As Bitcoin climbs the global market cap rankings, many are now wondering if it could soon surpass silver. Silver currently holds a market cap of approximately $1.75 trillion, placing it just above Bitcoin’s $1.48 trillion.

In March 2024, Bitcoin briefly overtook silver as Bitcoin became the 8th-ranking global asset.

“I could potentially see Bitcoin to become the 21st century digital gold. Let’s not forget that gold was also volatile historically. But it is important to keep in mind that Bitcoin is risky: it is too volatile to be a reliable store of value today. And I expect it to remain ultra-volatile in the foreseeable future,” said Marion Laboure, analyst at Deutsche Bank Research.

At that time, its valuation surged to $1.42 trillion, surpassing silver at $1.387 trillion, with a 4% increase to an all-time high beyond $72,000. With Bitcoin’s recent momentum and continued interest from institutional investors, this event is likely to repeat.

Surpassing silver would further solidify Bitcoin’s position as a digital gold and strengthen its reputation as a valuable asset in the broader financial arena. If Bitcoin continues on this trajectory, overtaking silver could be the next milestone in its journey.

Mainstream Bitcoin Adoption

Bitcoin’s ascent into the world’s top assets is accompanied by growing interest, as shown by investment flows into various exchange-traded funds (ETFs).

For instance on November 6, the majority of Bitcoin products showed positive inflows. Fidelity’s FBTC led with a substantial $308.8 million inflow, suggesting strong investor interest. Bitwise’s BITB and Ark’s ARKB also gained, receiving $100.9 million and $127 million, respectively.

Grayscale’s GBTC, despite previous outflows, managed a modest change of $30.9 million. This day’s inflows highlight a general uptick in interest across various ETFs, contrasting with recent periods of volatility and outflows in other funds. Total inflows reached $621.9 million, reflecting a demand for Bitcoin products.

Read more: What Is a Bitcoin ETF?

As Bitcoin continues to solidify its position among the world’s largest assets, these investment patterns suggest that mainstream adoption is on the horizon. With institutional support growing and infrastructure maturing to facilitate broader access, Bitcoin is positioned as a viable asset in traditional finance.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.