Market

Will Toncoin (TON) Investors Lose Potential $5 Billion Profits?

Toncoin’s (TON) price is in a macro uptrend, but the last few days have seen their fair share of drawdown scares.

The reason behind this is the potential of selling exhibited by the investors as it could erase the recent gains.

Toncoin Investors Want Profits

Toncoin’s price could take a confusing direction in the coming days owing to investors’ mixed sentiments. The TON holders are looking to make profits, one way or another. One way is by HODLing, and the other is selling.

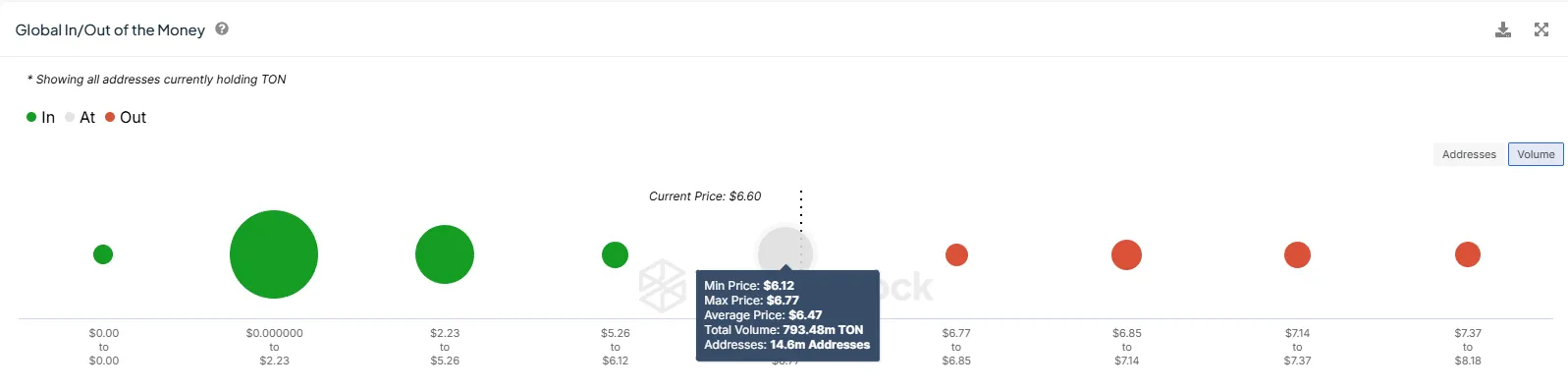

The Global In/Out of the Money indicator shows that between $6.12 and $6.77, the investors purchased about 793 million TON. This supply is worth well over $5.2 billion and is currently witnessing potential losses as Toncoin’s price is at $6.59.

Read more: 6 Best Toncoin (TON) Wallets in 2024

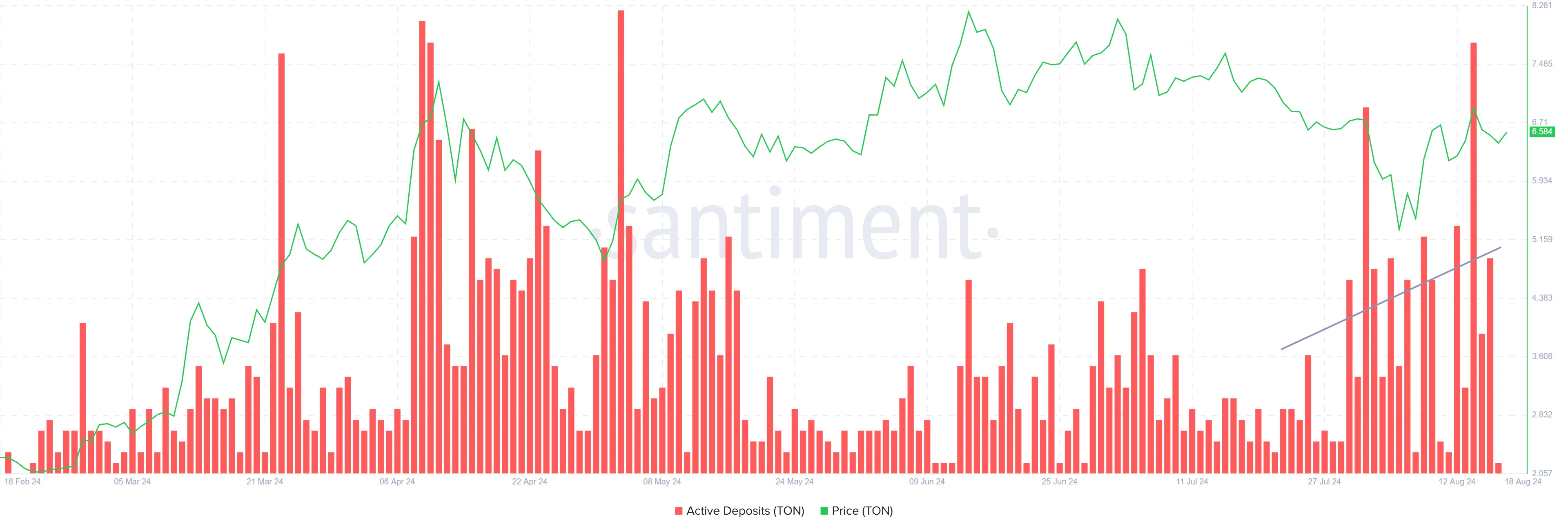

At the same time, the rise in active deposits suggests that TON investors might be preparing to sell. The increasing spikes in this indicator indicate a higher movement of assets from investors’ wallets to exchanges, typically a sign of potential selling pressure.

Put simply, TON holders are potentially looking to secure their gains as they have managed to recover the recent crash’s losses. The impact on the altcoin of this move however, may not necessarily be positive.

TON Price Prediction: Breaking $7 Level

Despite Toncoin’s price dropping by 6.5% in the last three days to $6.59, it appears positioned to continue its uptrend. The ongoing demand driven by expectations of $5.2 billion in profits is likely to outweigh the current profit-taking activity at these levels.

If Toncoin manages to break through the critical $7 resistance level, it could pave the way for further recovery. Surpassing this level would open the door for a potential rally towards $7.53, setting the stage for a climb toward its all-time high of $8.28.

Read more: What Are Telegram Bot Coins?

On the other hand, a potential slip below the support of $6.43 could end up sending Toncoin’s price to $6.04. Any further drawdown would invalidate the bullish thesis, extending the wait for investors’ profits.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.