Market

Will Solana All-Time High Happen In the Short Term?

The crypto market has evolved beyond macroeconomics — it now has ties to politics. If you have doubts, look at the prices of assets like Solana (SOL) since Donald Trump emerged as the winner of the US presidential elections. For instance, Solana all-time high, which was 40% away some weeks back, now only needs a 15% hike to clip a new peak.

However, that is not the only thing happening with the altcoin. In this analysis, BeInCrypto reveals what else is going on and what could be next for SOL’s price.

Solana Open Interest Hits Record High

Solana’s all-time high of $260 occurred in November 2021. In March this year, the altcoin attempted to surpass that level but encountered rejection, leading to a double-digit drawdown.

However, things have changed since last week, as SOL’s price has increased by 37% in the last seven days. This hike has brought it closer to its all-time high, and it now needs a 15% increase to retest the region. But that is not the only thing.

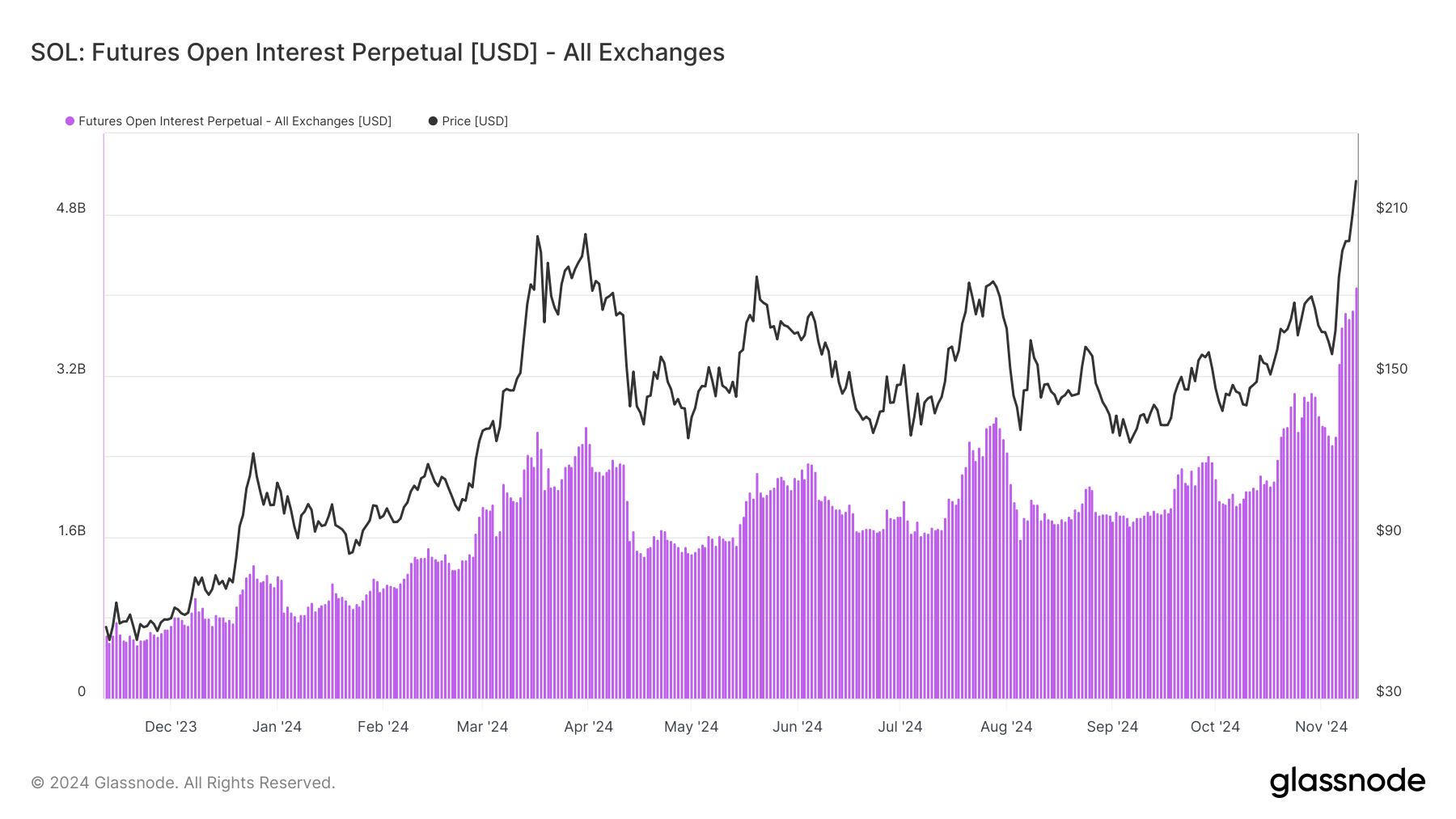

According to Glassnode, SOL Open Interest has hit a record high of $4 billion. OI, as the metric is commonly called, is the sum of the value of all open contracts in the market.

Increasing open interest signifies new capital entering the market and suggests a rise in speculative activity. Conversely, decreasing open interest suggests money is flowing out. Therefore, the recent hike in Solana’s OI suggests that, with new money flowing into the cryptocurrency’s contracts, the price might go higher.

The Sharpe ratio is another metric suggesting that Solana’s all-time high could become a reality in the short term. For context, the Sharpe ratio measures an asset’s risk-adjusted return.

Furthermore, the higher the Sharpe ratio, the better the returns relative to the amount of risk taken. On the other hand, if the ratio is negative, it means that the potential rewards might not be worth the risk.

Based on Messari’s data, the Sharpe ratio for SOL has risen to 0.48. This notable increase suggests that buying SOL at its current market value could yield strong returns for investors looking to accumulate.

SOL Price Prediction: Higher than $260 Soon

On the daily chart, SOL’s price encountered resistance at $222.26. However, the Chaikin Money Flow (CMF) suggests that this obstacle might not stop the altcoin from continuing its rally.

The CMF is an oscillator that measures buying and selling pressure, giving a score between -100 and +100. Positive values indicate an uptrend, while negative values suggest a downtrend. A CMF reading near zero signals balanced buying and selling pressure.

As of this writing, the indicator’s reading is 0.23, suggesting that Solana is experiencing a surge in buying pressure. With support at $186.58, a new Solana all-time high could be close, and the price could rally beyond $260.

However, if selling pressure occurs, this prediction might be invalidated. In that scenario, SOL’s price might drop to $157.89.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.