Market

Will Bitcoin Price Touch $67,000 Soon?

Bitcoin’s price has experienced a modest 2% increase over the past 24 hours. This reflects the broader uptrend in the cryptocurrency market, which has also seen a 2% rise in capitalization.

On-chain data indicates that this bullish momentum could continue, paving the way for Bitcoin to approach the $67,000 mark. In this analysis, BeinCrypto explores the factors that could make this happen in the near term.

Bitcoin Registers Uptick in Accumulation

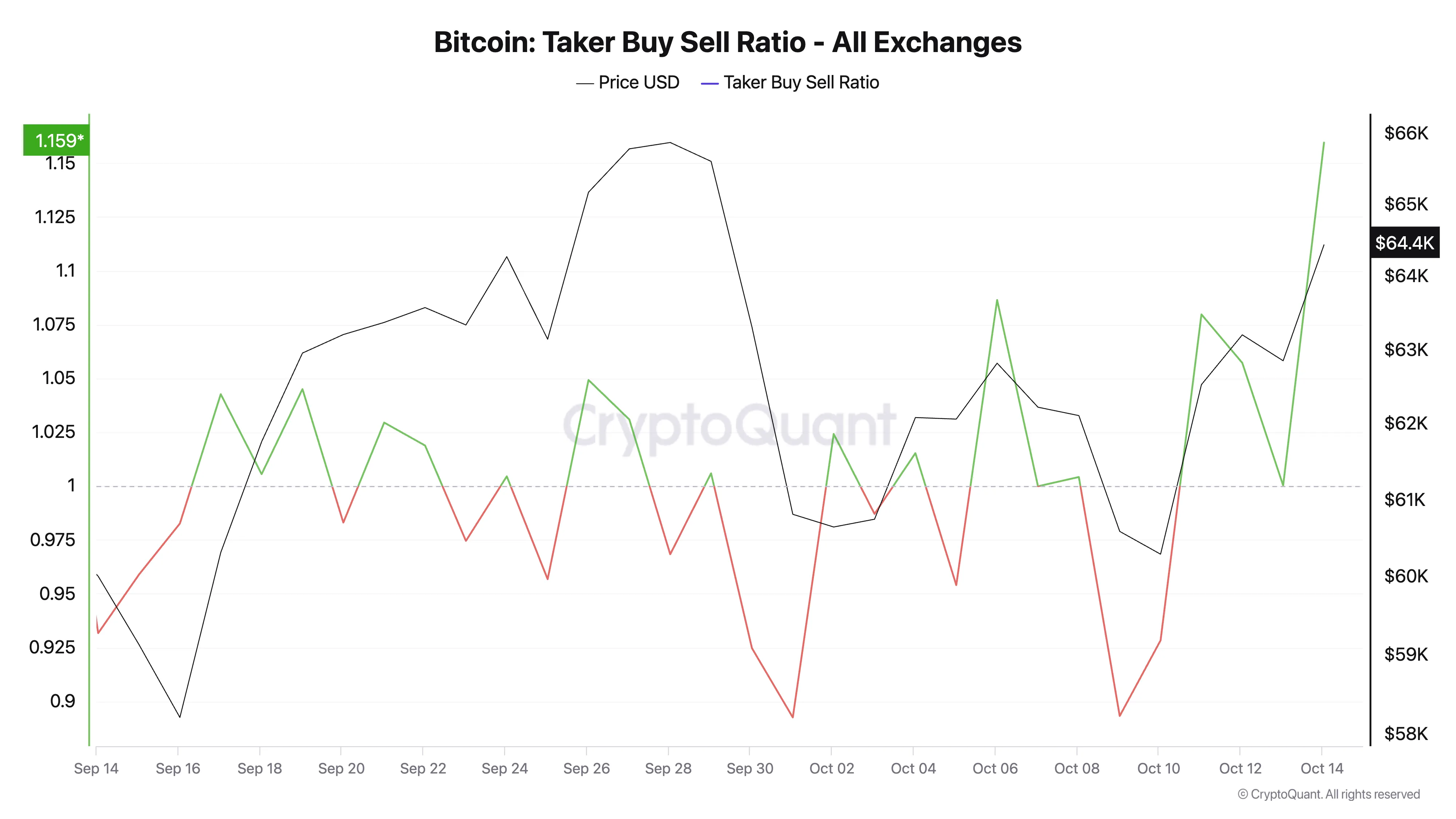

Bitcoin’s taker-buy-sell ratio has reached its highest level in the past month. Currently, this metric, which tracks the ratio of BTC’s buy-to-sell volumes in the futures market, stands at 1.19.

Read more: Top 7 Platforms To Earn Bitcoin Sign-Up Bonuses in 2024

A ratio greater than one means more buyers than sellers, indicating a bullish sentiment in the market. This suggests increasing demand for Bitcoin, hinting at a sustained upward trend.

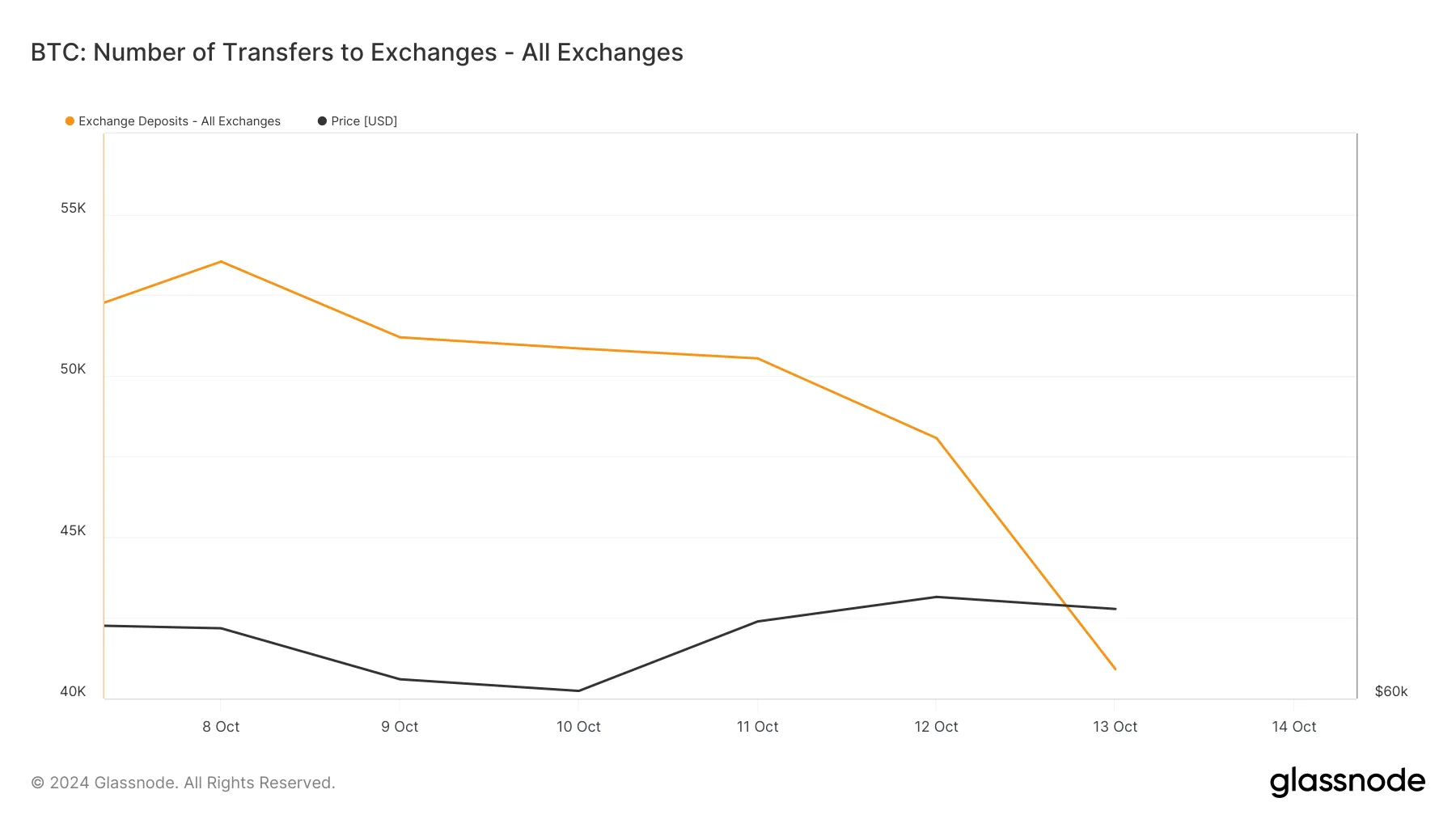

BeinCrypto’s assessment of the exchange activity supports this bullish outlook. Glassnode’s data reveals that the volume of BTC deposits to cryptocurrency exchanges fell to a weekly low of 40,908 coins on Sunday.

A reduction in deposits suggests that fewer investors are sending their assets to exchanges to sell. This reflects confidence in BTC’s long-term value, implying that holders expect its price to continue rising.

Moreover, BTC’s holding time has spiked by 301% over this past week, confirming that coins are being held for longer periods of time before being traded. This is a bullish signal indicating traders’ willingness to hold onto their coins for extended periods.

BTC Price Prediction: A Rally to a Five-Month High Is Possible

Bitcoin is currently trading at $64,315, just above the crucial resistance level of $63,289. If this upward trend persists, a retest of that resistance line will likely be successful, allowing BTC to continue its rally toward $67,078.

Should it clear this threshold, Bitcoin’s price could reclaim its five-month high of $71,906.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, this bullish outlook hinges on sustained buying momentum. If selling pressure increases, it may drive Bitcoin’s price down toward $60,627, invalidating the current bullish projection.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.