Market

Why XDC Price May Hit $0.10 Amid Growing Demand

The XDC Network token has defied the broader market trend, climbing 7% in the past 24 hours to become the top gainer among major cryptocurrencies.

With strong bullish momentum, XDC looks set to extend its rally in the short term. This analysis examines recent market trends and highlights potential price targets for the altcoin.

XDC Sees Surge in Demand on the Daily Chart

XDC currently trades above the dotted lines of its Parabolic Stop and Reverse (SAR) indicator. This indicator tracks an asset’s price trends and identifies potential reversals by plotting dots above or below an asset’s price.

When the asset’s price trades above the SAR dots, it suggests it is in an uptrend, signaling bullish momentum. Conversely, if the price drops below the SAR dots, it indicates a downtrend or bearish reversal may be underway.

Therefore, the setup of XDC’s Parabolic SAR indicator reflects the bullish sentiment toward it among market participants, hinting at more gains in the short term.

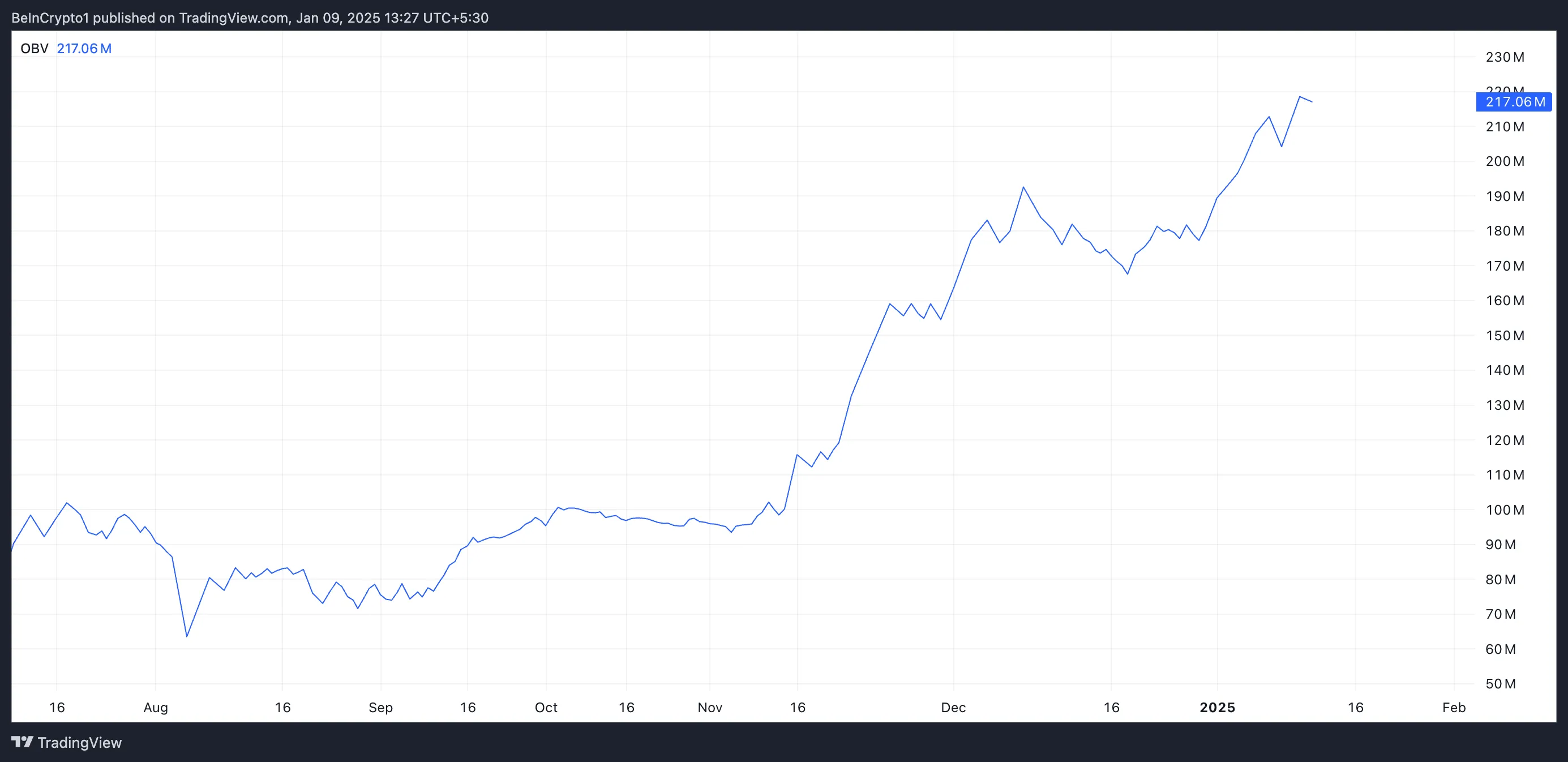

Moreover, XDC’s rising On-Balance-Volume (OBV) confirms the growing demand for the altcoin. At press time, this momentum indicator, which measures an asset’s buying and selling pressure, is in an upward trend at 217.06 million.

When an asset’s OBV climbs like this, it suggests strong buying interest, often signaling a continuation of an uptrend.

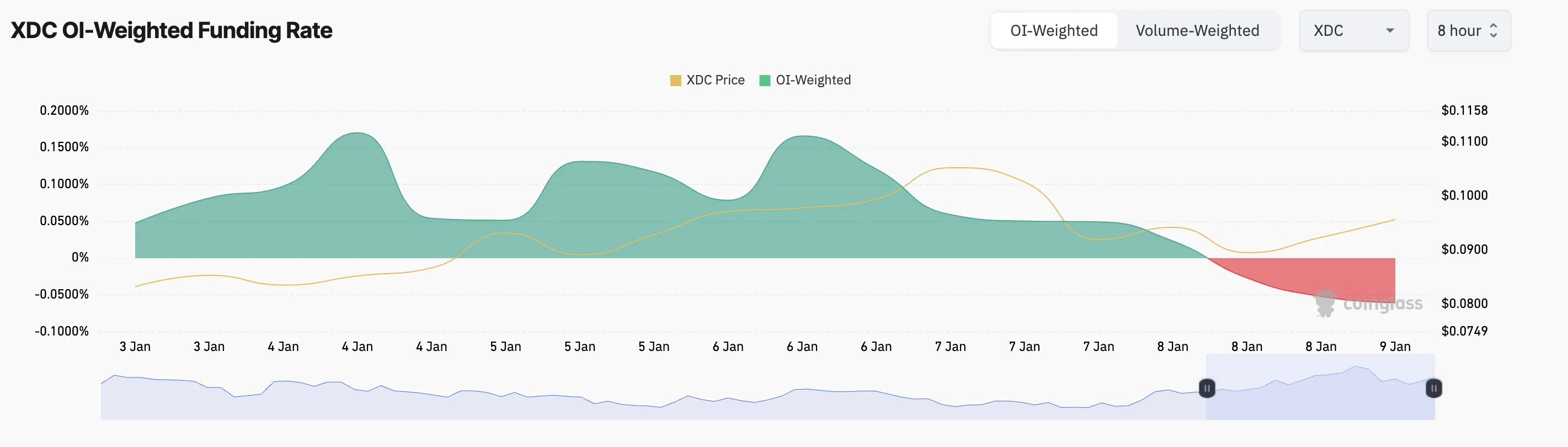

However, many XDC futures traders are challenging the uptrend, as evidenced by the token’s negative funding rate. Currently at -0.06, this reflects a strong demand for short positions.

The funding rate is a periodic fee exchanged between traders in perpetual futures markets to balance long and short positions, based on the difference between the contract price and the spot price. A negative funding rate means short positions are paying longs, indicating bearish sentiment and that traders expect the asset’s price to decline.

XDC Price Prediction: Short Squeeze Looms as Bullish Momentum Builds

If bullish momentum continues, XDC’s short sellers could face a squeeze. In that scenario, its price could touch $0.10, triggering the liquidation of some short positions.

However, if buying pressure weakens, XDC’s price could retreat to $0.07, offering profits to short traders.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.