Market

Why Solana User Demand Spike Hasn’t Lifted SOL Price

Layer-1 (L1) blockchain Solana saw a surge in user demand in October. During those 31 days, Solana’s monthly user activity climbed to its year-to-date high.

Despite this uptick in user demand, the price of SOL has struggled to maintain momentum. The popular altcoin has encountered significant resistance over the past month, keeping its value under $190.

Solana Welcomes New Users

In October, user demand on Solana skyrocketed, as reflected by the rise in its daily active addresses. During the 31-day period, the number of unique addresses that signed transactions on the L1 totaled 123 million, its highest count since the year began. It also represented a 41% uptick from September’s 86 million unique addresses.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

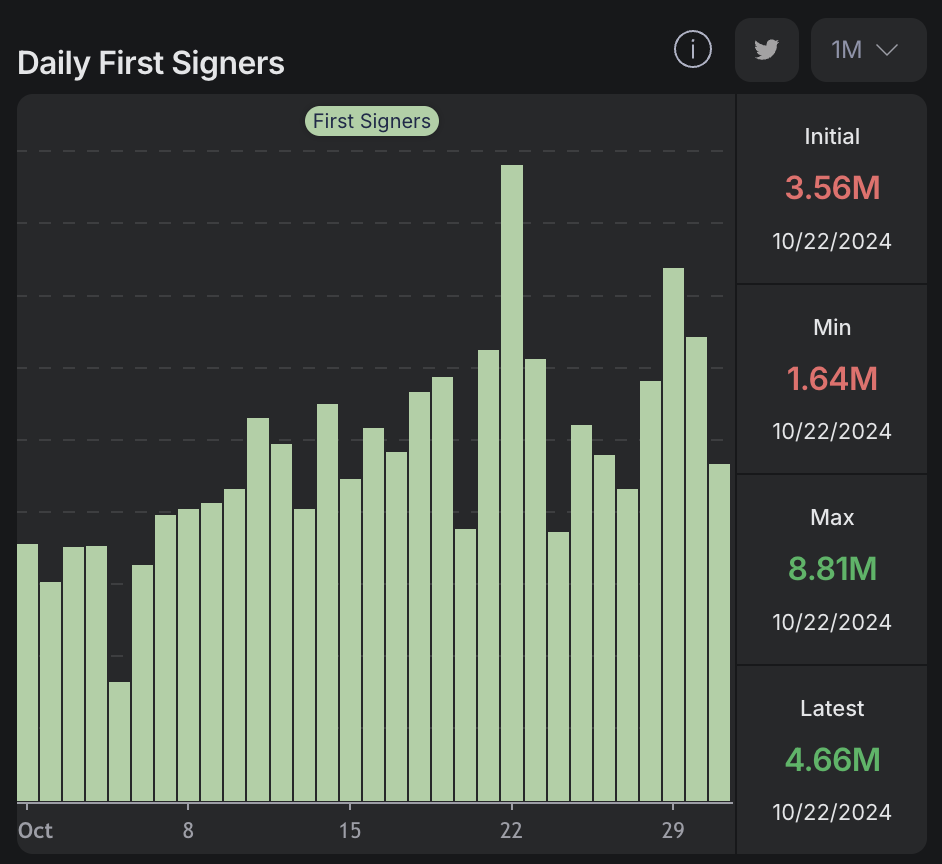

During the review period, Solana also saw an influx of new users. On-chain data shows that the total number of unique first signers to transact on the Solana Network was 148 million in October — the highest count this year and a 32% increase from September’s 100 million new users.

Altcoin’s Reaction Is Subdued

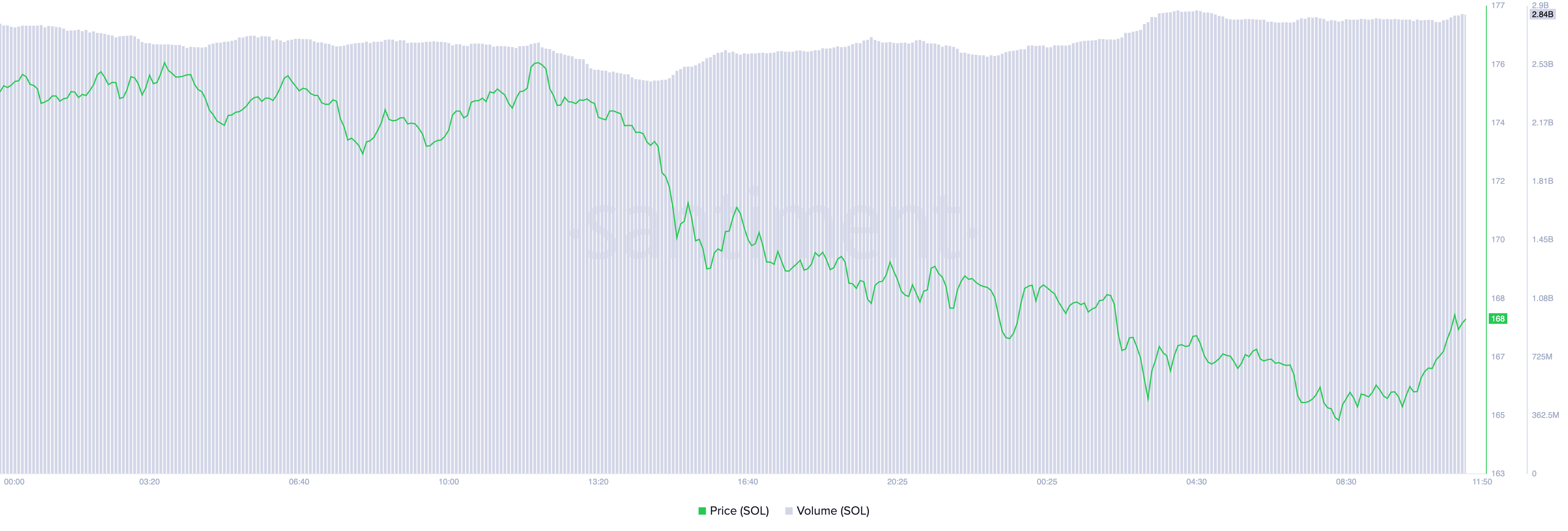

Despite the surge in network activity, SOL’s reaction has remained mostly muted. A series of resistance levels have prevented it from reaching the $190 mark. BeInCrypto’s analysis of the SOL/USD daily chart shows key resistance at $159.96 and $171.78 — levels where the coin has experienced significant selling pressure over the past month.

SOL is currently trading at $168.01, reflecting a 4% drop over the past 24 hours. Meanwhile, a 6% surge in trading volume signals intensified selling activity in the market.

When price declines alongside increased trading volume, it generally signals a bearish market sentiment. This pattern suggests that more traders are offloading their assets, adding further downward pressure on SOL’s price.

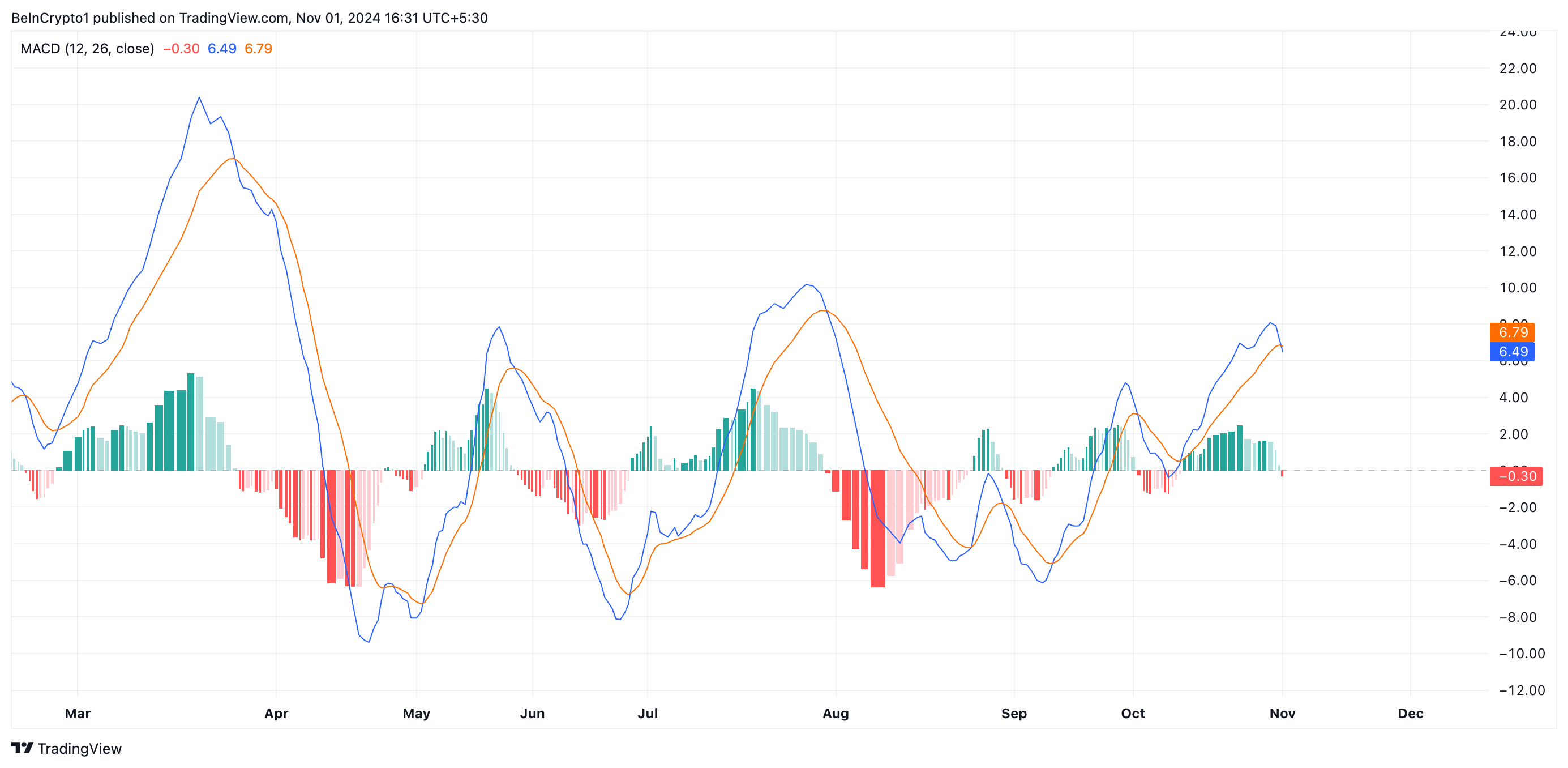

Further, the setup of SOL’s moving average convergence/divergence (MACD) indicator confirms the spike in selloffs. The coin’s MACD line (blue) has just crossed below the signal line (orange), suggesting a shift in the market trend from bullish to bearish.

The MACD indicator measures an asset’s price trends and momentum and identifies its potential buy or sell signals. When the MACD line falls below the signal line, it signals a bearish trend reversal, indicating that the asset’s momentum is weakening. Traders often view this crossover as a sign to consider selling or reducing positions.

SOL Price Prediction: This Level Must Become Support

As of this writing, SOL trades at $168.01, hovering just below the $171.78 level, which recently served as brief support. With demand waning, this level could soon turn into a resistance point, increasing selling pressure on the altcoin.

If $171.78 turns into resistance, SOL’s price may slide further to $159.96. Should this support level fail, a decline toward $148.14 becomes likely.

Read more: Solana vs. Ethereum: An Ultimate Comparison

On the upside, a demand rebound could flip $171.78 back into support, potentially pushing SOL toward $188.60 — a critical hurdle before targeting its year-to-date high of $210.03.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.