Market

Why Solana Price May Climb Above $200

Layer 1 (L1) blockchain Solana (SOL) has witnessed a notable surge in user activity over the past month. The chain’s daily active address and transaction count have skyrocketed by double digits in the past 30 days.

This uptick in network demand may directly fuel SOL’s rally above the $200 price mark for the first time since April. This analysis delves into the factors that may make that happen.

Solana Users Increase in Number

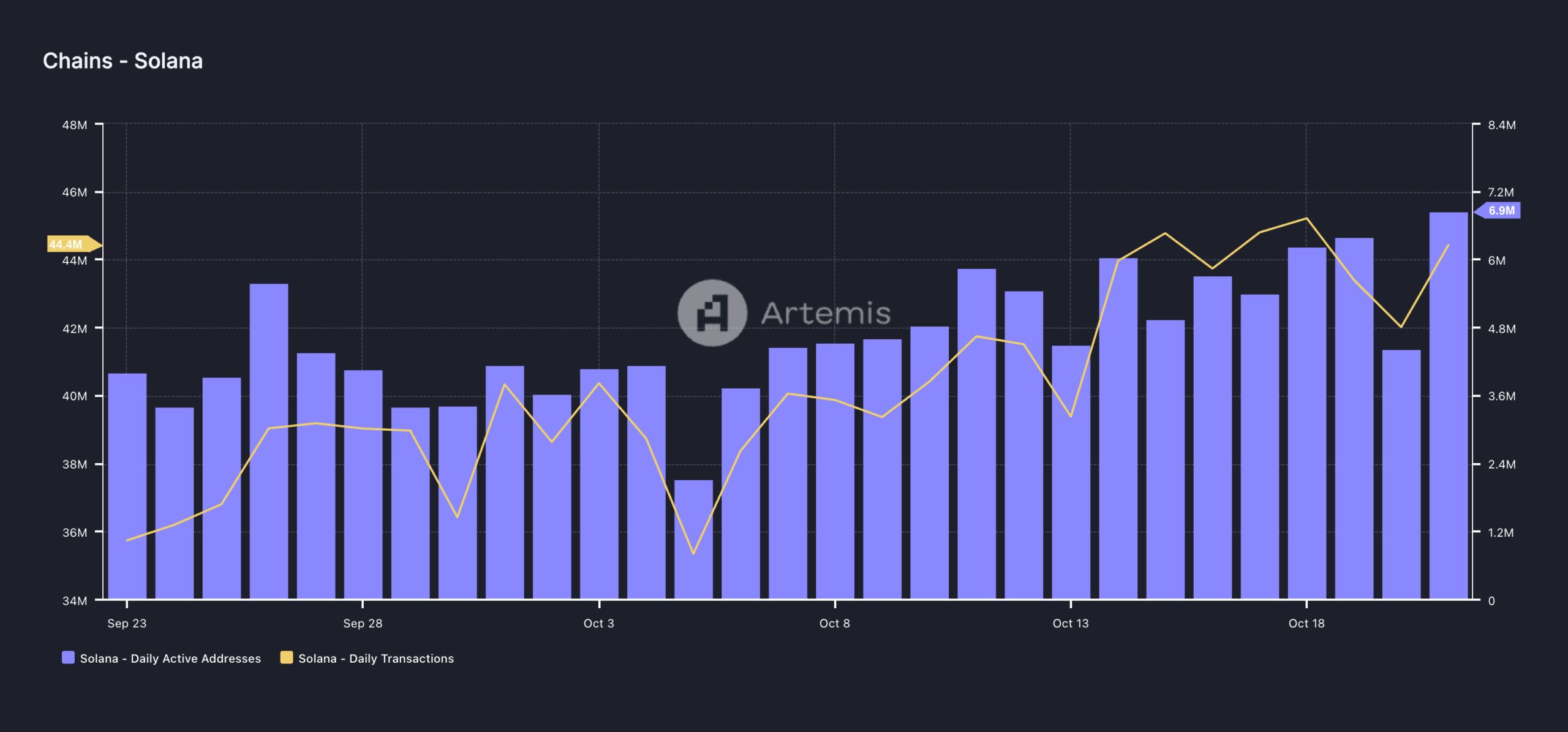

Over the past 30 days, demand for the Solana network has surged, as evidenced by an increase in daily active addresses. According to data from Artemis, 7 million unique addresses have completed at least one transaction on Solana during this period, marking a remarkable 70% increase.

This rise in active addresses has naturally led to a corresponding uptick in daily transaction volume on the network. Over the same 30-day period, Solana has processed 44 million transactions, representing a 24% increase in daily transaction count on the L1.

Read more: 13 Best Solana (SOL) Wallets To Consider in October 2024

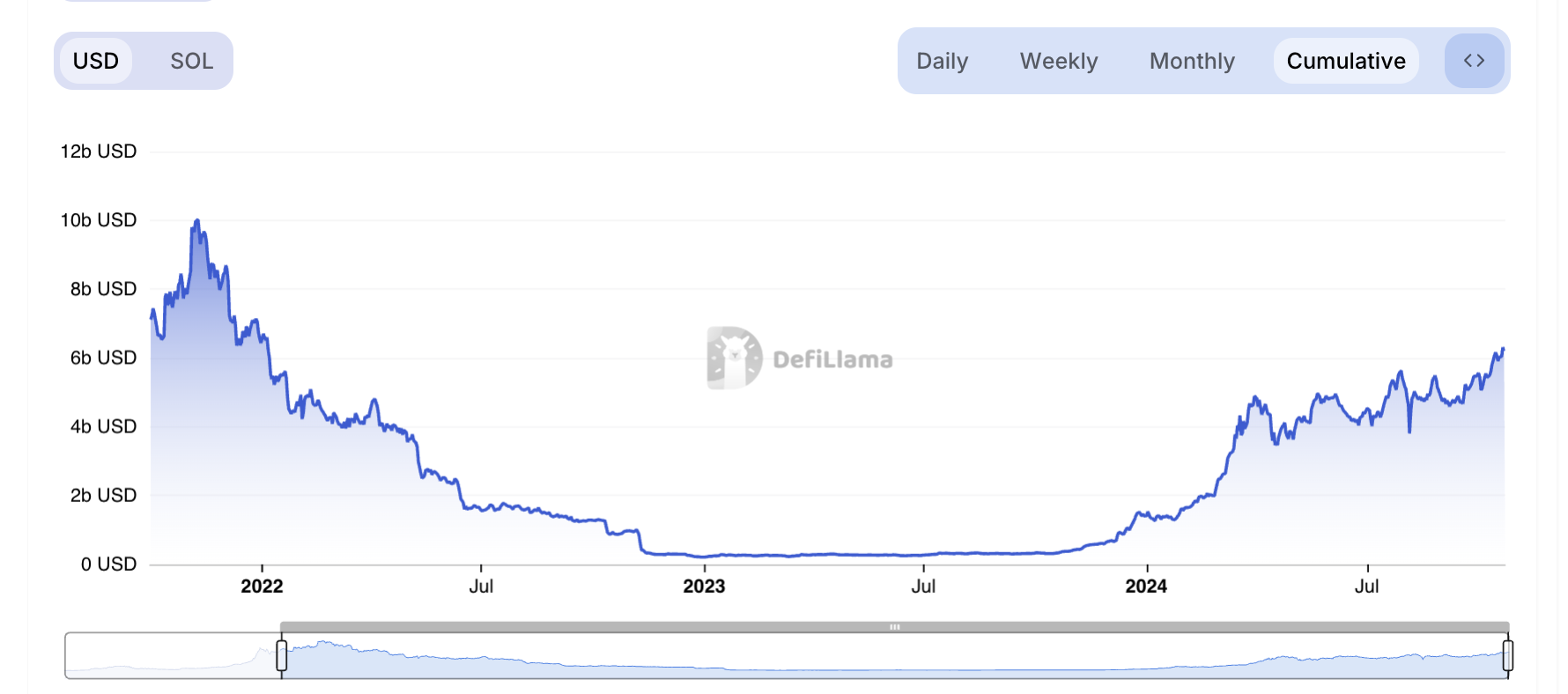

Notably, the influx of users to Solana has helped its decentralized finance (DeFi) grow. Solana has outpaced Ethereum and other major networks like Base, Arbitrum, and Polygon in daily decentralized exchange (DEX) volume in the past week. During this period, Solana’s DEX volume exceeded $13 billion, significantly surpassing Ethereum’s $8 billion.

Additionally, Solana’s total value locked (TVL) is currently at $6.22 billion, the highest it has been since January 2022.

SOL Price Prediction: High Network Usage is the Key

As more users engage with a blockchain network, the utility of its native asset (SOL in this case) increases. High usage indicates that more transactions are occurring, often requiring more of the network’s token to pay transaction fees. This boosts demand for the asset, driving up its price.

If Solana continues to experience increased network activity, driving demand for SOL, its price—currently at $166.15—could break past the resistance level of $172.53.

A successful breach of this resistance would set the altcoin on course to reach $194.12. Should buying momentum continue to increase, Solana’s price could reclaim $210.18, a level it last touched in March.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

However, if user activity on Solana declines and demand for SOL weakens, the price may test support at $148.15. Failure to hold this level could push the coin down further to $133.76, invalidating the bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.