Market

Why Notcoin’s Price is Falling Despite Surging Active Addresses

Notcoin has witnessed a noticeable surge in demand over the past week. However, its value has plunged by double digits during the same period.

Key indicators assessed on a one-day chart hint at the likelihood of a continued price decline.

Notcoin: Rise in Demand Does Not Equal Price Rise

Since the arrest of Telegram’s CEO Pavel Durov on August 24, the values of Telegram-linked assets like NOT have plunged. Trading at $0.0076 as of this writing, NOT’s price has since declined by 23%.

At its current price, NOT is trading at a low last seen in May, creating a buying opportunity for those looking to trade against the market. This dip has driven a surge in demand for NOT over the past week.

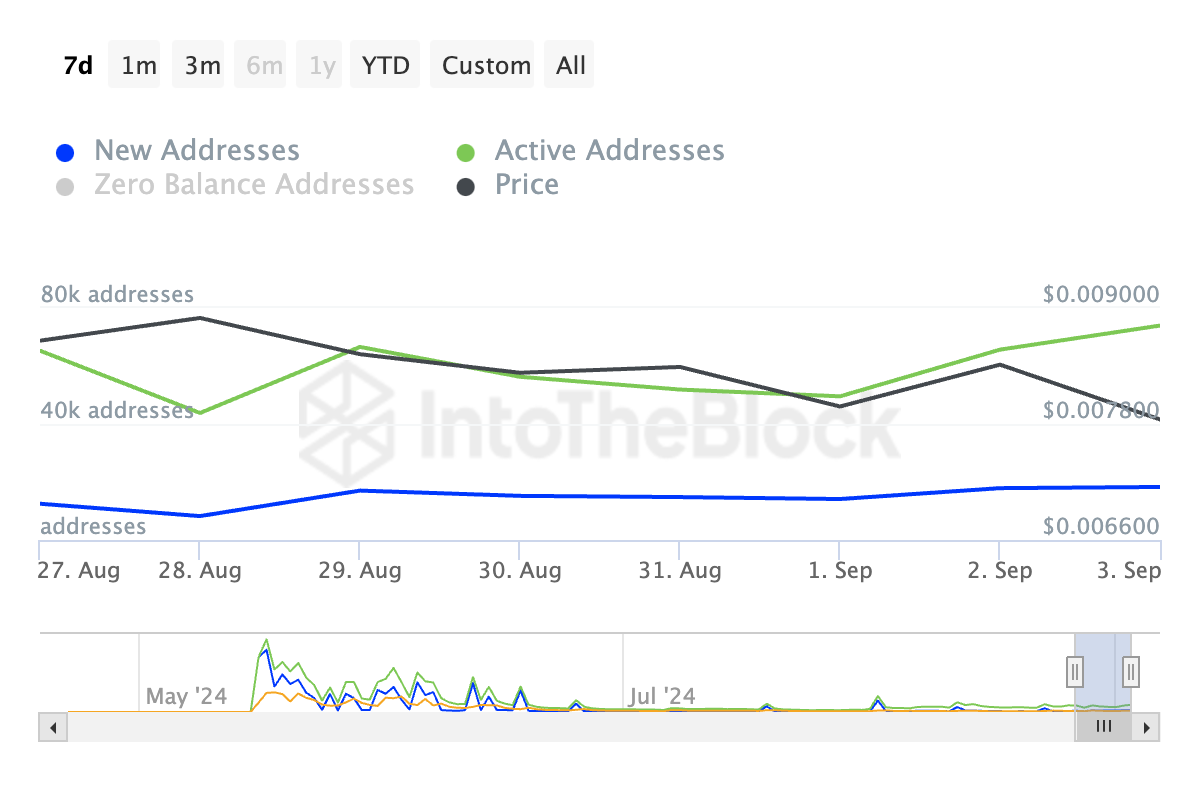

According to IntoTheBlock, the altcoin has experienced a 13% increase in daily active addresses in the last seven days. Additionally, new demand for NOT has surged, with a 46% rise in the daily count of new addresses trading the token during this period.

Read more: 5 Top Notcoin Wallets in 2024

However, apart from traders buying NOT’s dip, there is another explanation for the uptick in its active addresses while its price drops.

NOT’s existing holders might be distributing their tokens to new users to prevent further losses to their investments. This would ordinarily increase the number of active and new addresses. As these early adopters or whales cash out, the token’s price will continue to drop.

The declining large holders’ netflow for the token indicates that its whales have been steadily reducing balances since Durov’s arrest. Over the past week, this netflow has dropped by more than 90%, confirming the gradual exit of major holders. This is a bearish signal that may also prompt retail investors to sell their tokens.

NOT Price Prediction: Is a Rebound On the Horizon?

At press time, NOT’s Relative Strength Index (RSI) stands at 32, indicating it is approaching the oversold zone of 30, where a price rebound is often expected. If sellers’ exhaustion sets in, the token could reverse course and start an uptrend, potentially rallying toward $0.013.

However, this depends on new liquidity entering the market. The token’s Chaikin Money Flow (CMF) currently shows increased liquidity outflow, with a value of -0.20, signaling a risk of further devaluation.

Read more: Where To Buy Notcoin: Top 5 Platforms In 2024

If NOT traders continue to remove capital from the market, the token may revisit its all-time low of $0.00004.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.