Market

Uniswap Launches Unichain to Tackle Cross-Chain Liquidity Issues

Uniswap, the leading decentralized crypto exchange, has announced plans to launch its own Layer-2 network, Unichain. Built on the Optimism Superchain, Unichain aims to enhance speed, efficiency, and cross-chain interactions.

Uniswap CEO Hayden Adams called the project a “labor of love” and hopes it will transform the DeFi space.

Uniswap’s New Protocol

Uniswap announced the upcoming launch of Unichain through a blog post, highlighting its goal to address scaling and liquidity issues. Earlier this year, the exchange introduced the ERC-7683 cross-chain token standard to tackle similar concerns. According to the announcement, Unichain will integrate this standard as part of its infrastructure.

However, the core of Unichain lies in its collaboration with the Optimism Superchain, which significantly improves cross-chain interactions with other Layer-2 networks. CEO Hayden Adams called Unichain a “labor of love” and shared insights into the project’s ethos, reflecting Uniswap’s commitment to enhancing DeFi scalability and functionality.

“The internet of value can’t run on a single chain. Ethereum’s rollup-centric roadmap aims to scale by having many L2 chains that seamlessly interface with each other. We are excited by this vision, and aim to accelerate it. Unichain will be MIT licensed, and we hope to see our tech adopted by others,” Adams claimed.

Read more: A Beginner’s Guide to Layer-2 Scaling Solutions

Ultimately, Unichain is designed to enhance speed and cross-chain functionality, with a strong emphasis on decentralization. CEO Hayden Adams described it as “the best home for DeFi,” reflecting the project’s ambition to create a more scalable and efficient solution for decentralized finance.

Unichain’s developers, firm believers in the Ethereum project, aim to address its most pressing scaling issues. Their whitepaper approaches these challenges with optimism, offering a forward-looking solution to improve the Ethereum ecosystem.

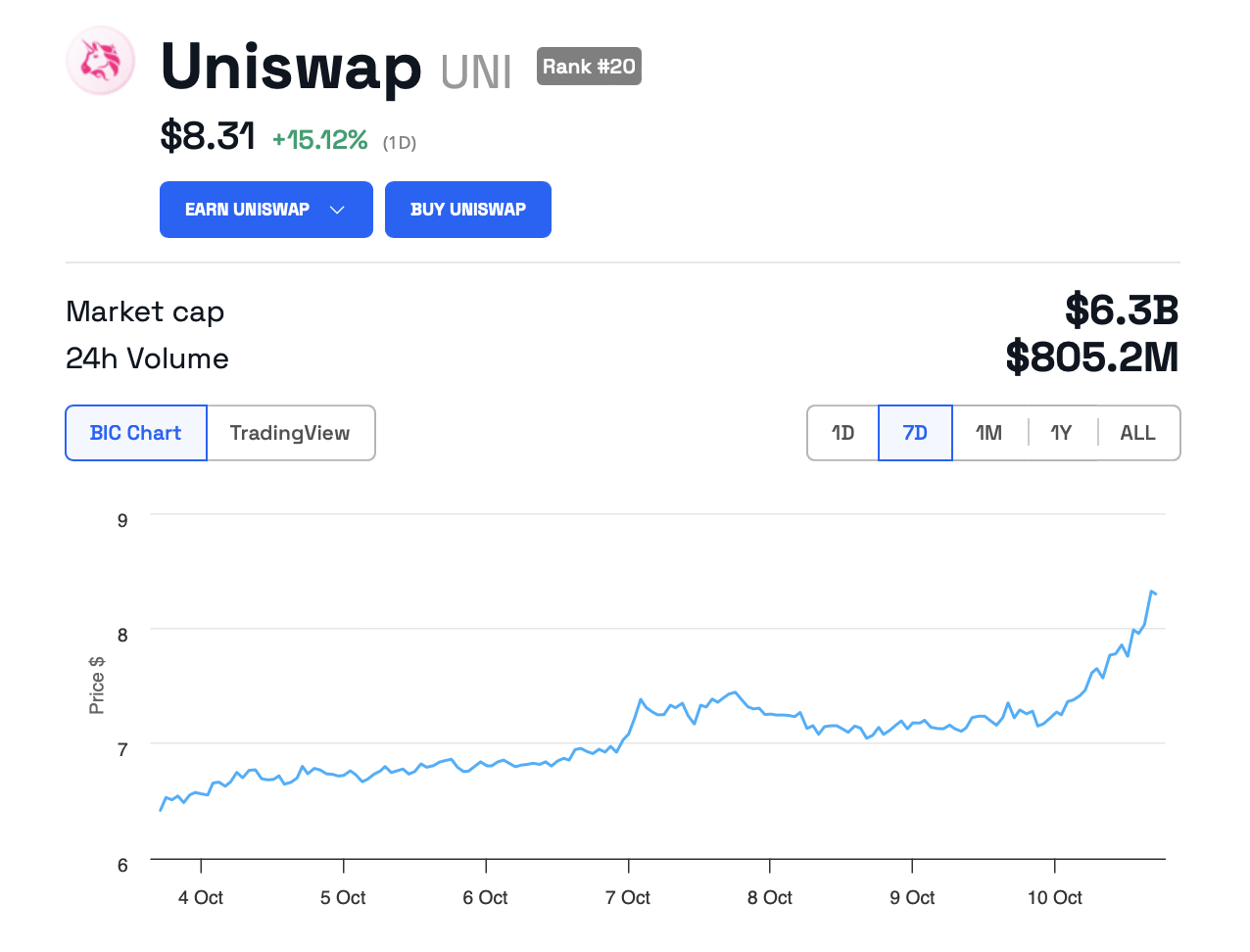

According to BeInCrypto data, Uniswap’s token UNI surged 15% in the last 24 hours. Despite this jump, the altcoin has yet to fully recover from the legal battles the firm faced with the SEC earlier this year.

Read more: How To Buy Uniswap (UNI) and Everything You Need To Know

UNI has held steady growth over several months, and initiatives like the launch of Unichain may create opportunities for future price increase.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.