Market

Uniswap Foundation Secures $165.5 Million for DeFi Innovation

The Uniswap (UNI) community has voted in favor of two significant governance proposals, allocating $165.5 million to the Uniswap Foundation to stimulate ecosystem development.

This move follows the launch of Uniswap v4 and Unichain earlier this year and has led to an uptick in UNI’s price.

Uniswap Secures Funding Approval for Growth and DeFi Innovation

In a recent post on X, the Uniswap Foundation celebrated the approval of two proposals introduced on February 14 as part of the “Uniswap Unleashed” initiative.

“This marks the beginning of our community’s next era: one that unlocks new opportunities to build, grow and to create and capture value,” the post read.

One of the most significant aspects of the governance decision is that it lays the groundwork for activating the much-anticipated “fee switch.” This mechanism enhances the protocol’s sustainability and rewards UNI token holders. Moreover, it signals a shift toward a more sustainable and rewarding ecosystem.

“These campaigns will lead to other benefits for the Uniswap community. For example, 65% of Unichain net chain revenue is set to be earned by UVN validators and stakers, once the UVN launches,” the proposal noted.

The first proposal outlines the Uniswap Foundation’s strategic priorities for 2025 and beyond. It focuses on four key areas. The first is scaling network supply by optimizing liquidity across active Ethereum Virtual Machine (EVM) chains.

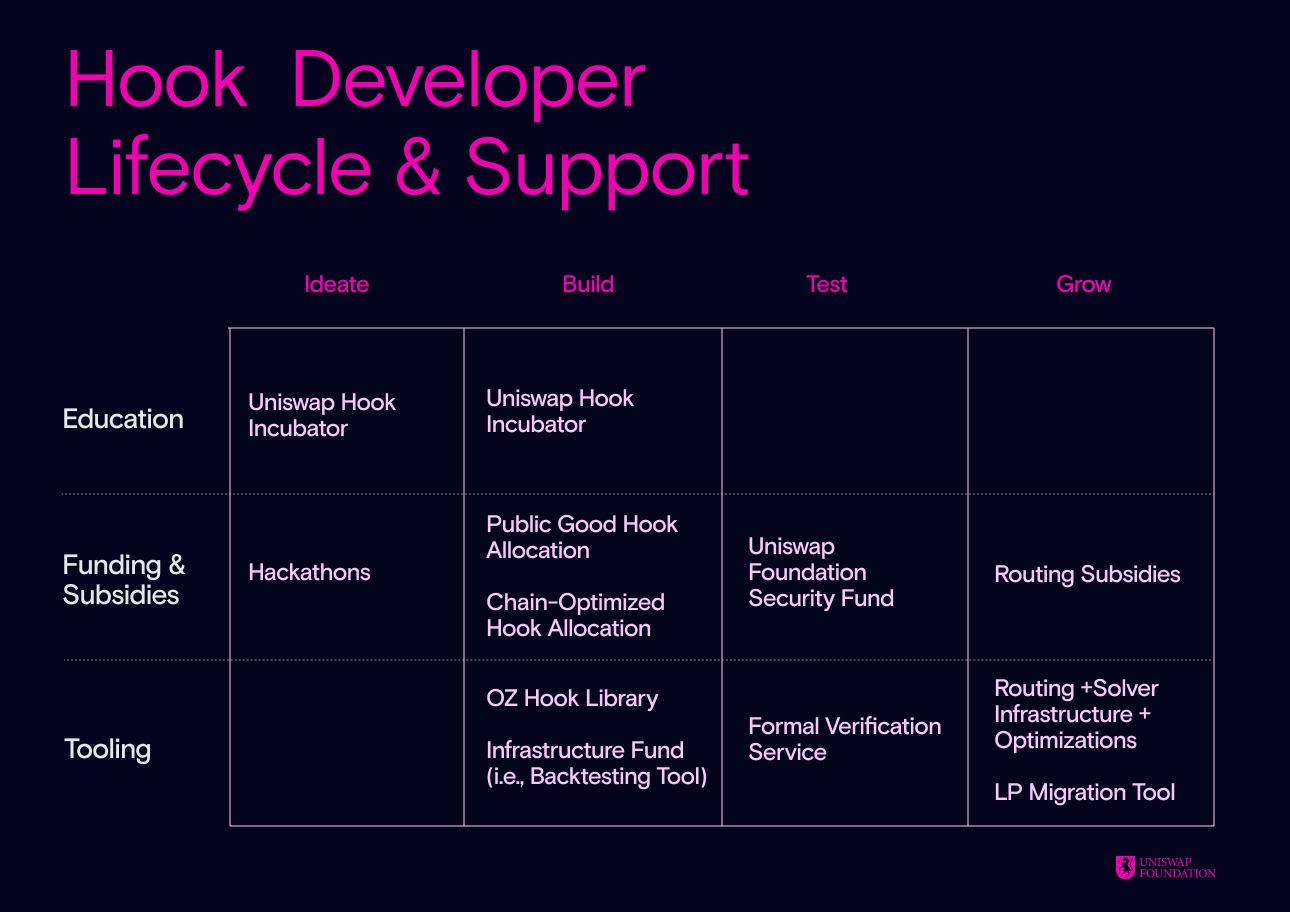

The second priority is scaling network demand by developing platforms that encourage DeFi innovation and attract developers. This includes initiatives such as funding programs, infrastructure development, and educational resources. These aim to support developers throughout the hook development lifecycle.

In addition, the third priority is strengthening governance by activating revenue sources and onboarding new protocol contributors. It emphasizes distributing a portion of Unichain’s net chain revenue to validators and stakers and exploring the creation of a legal entity for governance purposes.

Lastly, the proposal aims to establish a Core Contributor Program. This program will create incentive-aligned development teams to advance the protocol and ecosystem.

The proposal also includes a total investment of $120.5 million, with $95.4 million allocated to the foundation’s grant budget and $25.1 million designated for operational costs.

“It reflects an investment into the success of the Uniswap Protocol and Unichain, and into value for the Uniswap community, and will be backstopped by best-in-industry transparency reporting and an unrelenting drive to create value,” the proposal read.

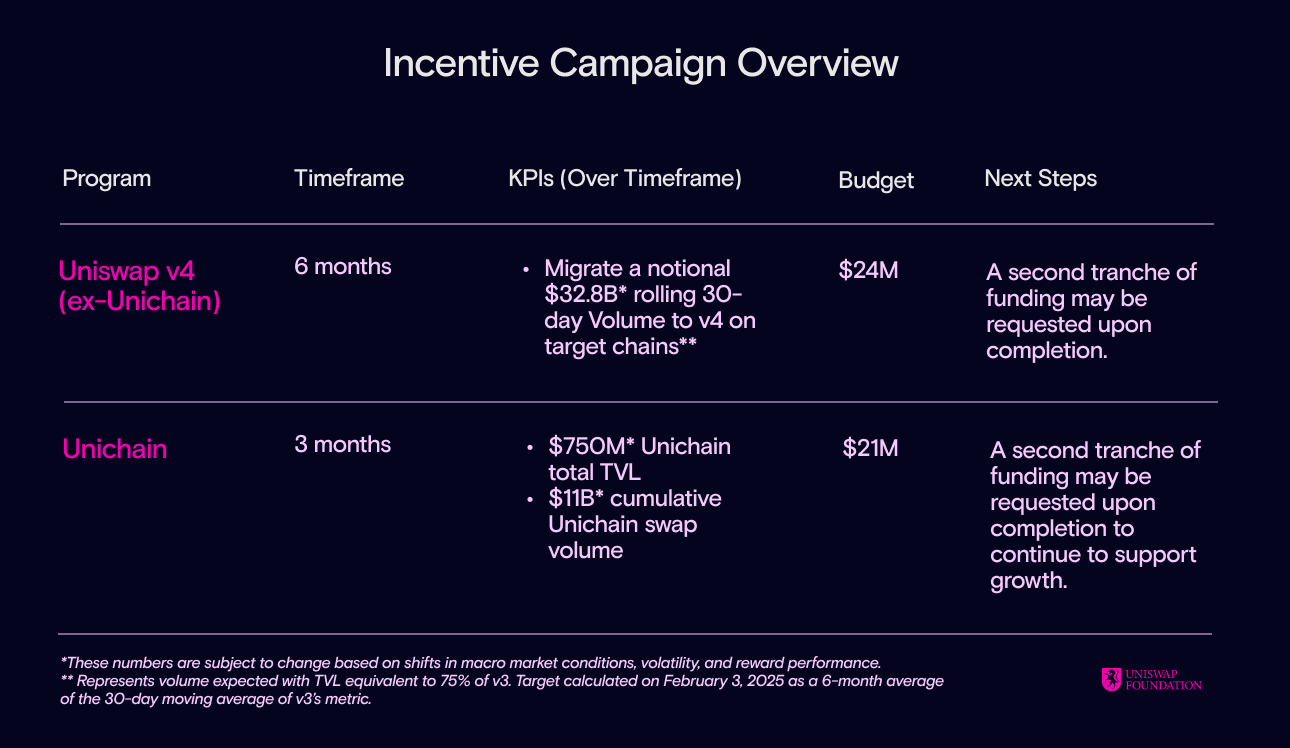

The second proposal, which included input from Gauntlet, focuses on funding two liquidity incentive programs to drive growth for Uniswap v4 and Unichain. Thus, the primary objective is to attract liquidity providers (LPs), swappers, and developers to these platforms, which will play key roles in DeFi’s future. The Uniswap Foundation requested a $45 million budget to support these liquidity incentives.

The Aera platform will be used to ensure full governance control over the funds. This platform will allow Uniswap Governance to recall unused funds if necessary. Gauntlet has already set up an Aera vault on the Ethereum (ETH) mainnet.

Furthermore, with the proposal’s approval, the vault will be resumed. A total of 7,588,532 UNI tokens will be deposited to fund ongoing liquidity incentives.

Meanwhile, UNI reacted positively to the news. According to data from BeInCrypto, its value surged by 7.5% over the past 24 hours.

At press time, UNI was trading at $6.8. Additionally, trading volume saw a remarkable 207.9% spike, further highlighting a substantial increase in activity.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.