Market

Top 5 Made in USA Cryptos to Watch This Week

Hedera (HBAR), Chainlink (LINK), Aptos (APT), Ondo Finance (ONDO), and Story (IP) are five of the most important Made in USA cryptos to watch this week. While IP has been the best-performing of the group in the last month, it is now undergoing a sharp correction, similar to ONDO, which has dropped over 22% in the past seven days.

Meanwhile, speculation is growing that HBAR and LINK could potentially be included in the U.S. strategic crypto reserve, which could impact their prices. With key support and resistance levels approaching, the coming days will determine whether these coins can regain bullish momentum or face further downside.

Hedera (HBAR)

Hedera is currently among the top 10 largest Made in USA cryptos by market cap, and there is growing speculation that it could be considered for inclusion in the U.S. strategic crypto reserve.

Despite this, HBAR has struggled in the past week, dropping 16.7% as its market cap hovers around $8.8 billion. The recent downturn has raised concerns about whether it can regain bullish momentum or continue facing selling pressure.

If HBAR can establish an uptrend, it could look to test key resistance levels at $0.219 and $0.258, with a stronger rally potentially pushing it toward $0.287. However, if the current price retracement deepens, it may face additional downside risk.

The $0.179 level stands out as a critical support area, where a breakdown could signal further losses. Whether HBAR can recover or extend its decline will depend on its ability to attract renewed buying interest.

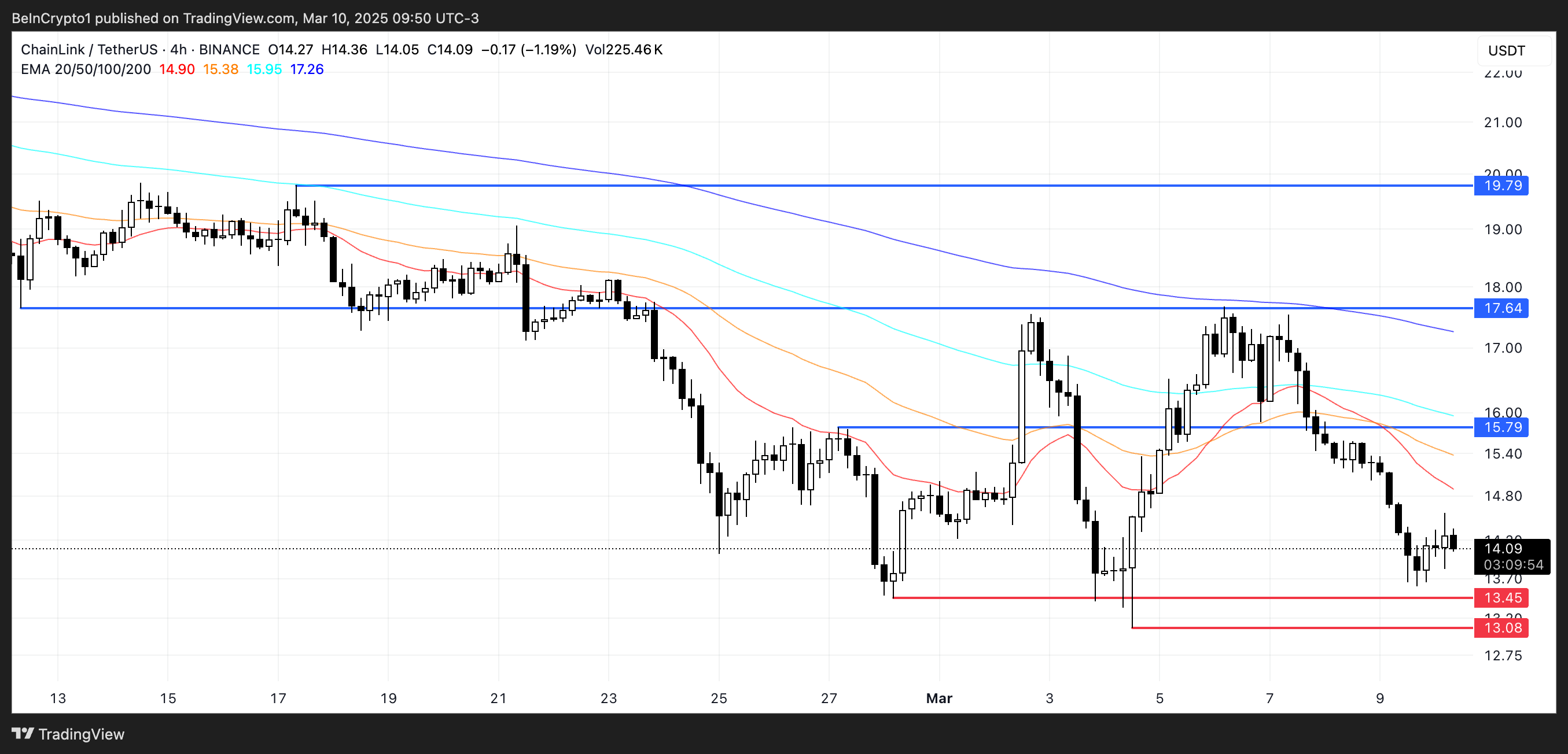

Chainlink (LINK)

Chainlink is a dominant force in the oracle sector and has been expanding its presence in real-world assets (RWA), solidifying its importance in blockchain infrastructure.

Its key role in these industries strengthens the case for its potential inclusion in the U.S. strategic crypto reserve, alongside XRP and Solana.

A potential inclusion could push LINK toward key resistance at $15.79, with further upside targeting $17.64 and $19.79 if momentum continues.

However, if market conditions turn bearish, LINK may retest support at $13.45, with the risk of further declines toward $13 or lower.

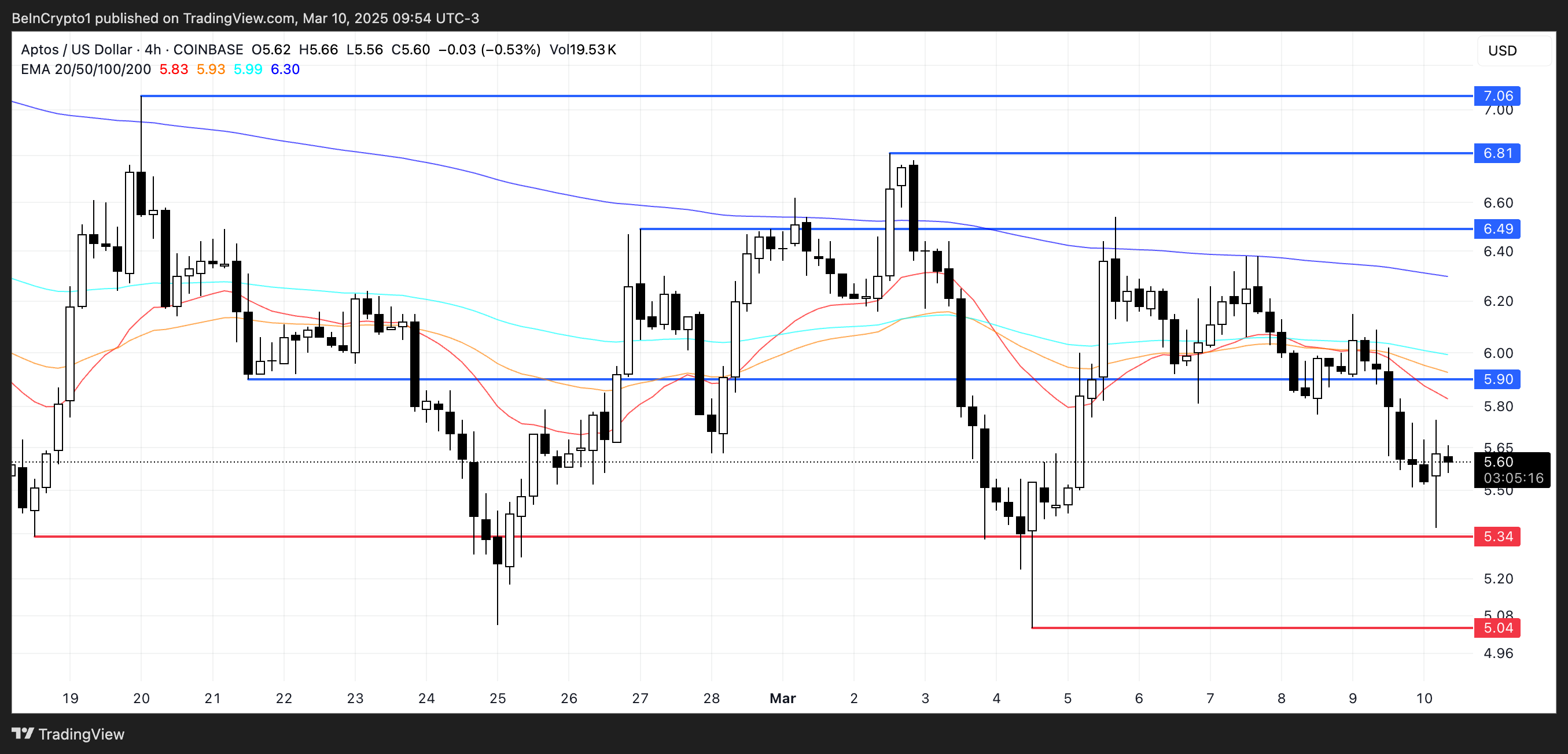

Aptos (APT)

Aptos has been one of the most hyped new layer-1 blockchains in recent years, and speculation about a potential ETF has fuelled discussions over the past week.

Despite this, APT has struggled, dropping nearly 12% in the last seven days. The recent downturn raises questions about whether it can regain bullish momentum or if further downside is ahead.

If the correction continues, APT could test support at $5.34, with a breakdown potentially sending it as low as $5.04. On the other hand, a reversal could see APT rising toward $5.90, with further resistance at $6.49.

If bullish momentum from previous months returns, APT could extend gains toward $6.81 or even $7.06. Whether it can turn the tide will depend on renewed buying interest and broader market conditions.

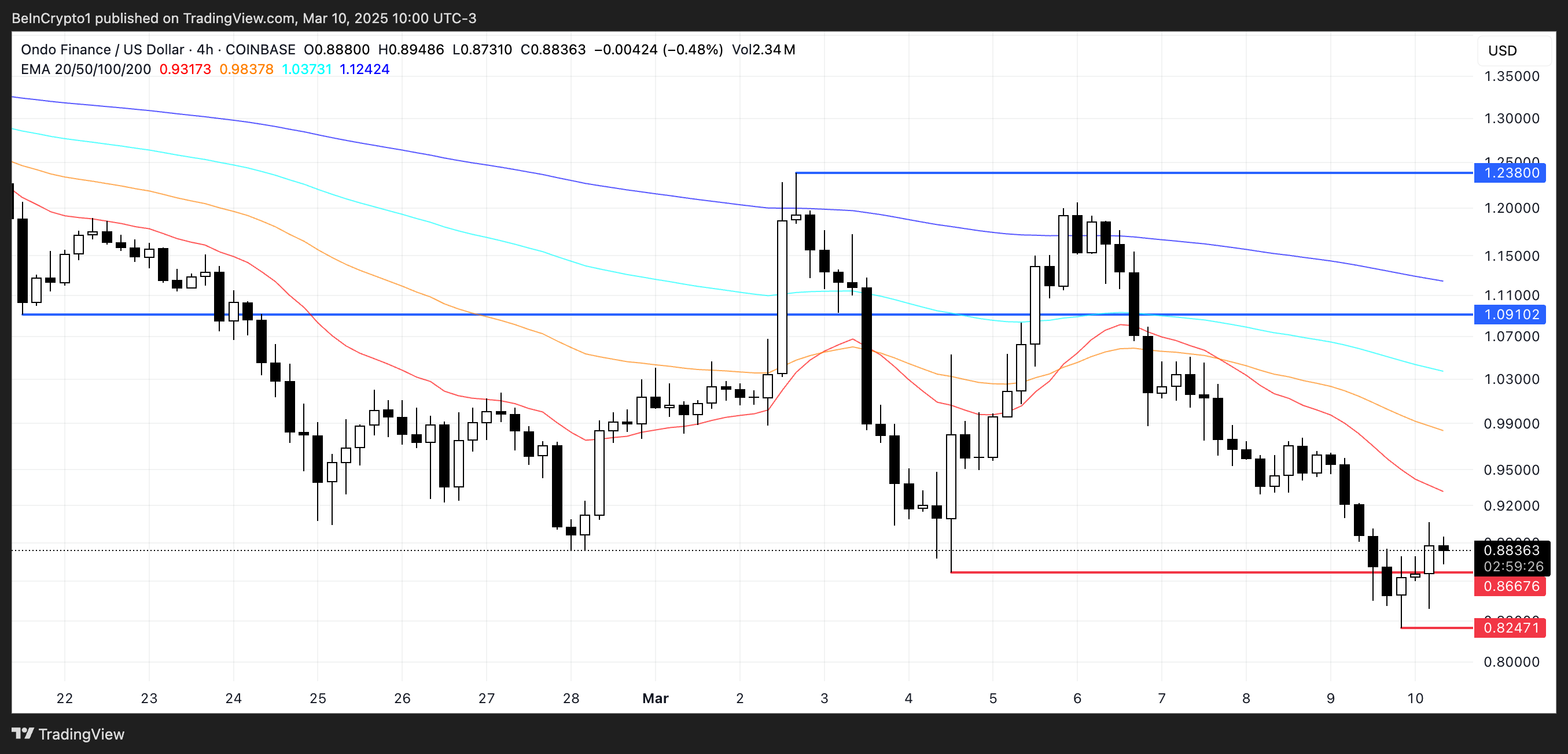

Ondo Finance (ONDO)

ONDO has dropped 22% in the last seven days, but it remains one of the most relevant real-world asset (RWA) tokens in the market. Despite the correction, its market cap still hovers around $2.8 billion, reflecting its strong position in the sector.

The recent pullback has put pressure on ONDO, raising questions about whether it can regain momentum or if further downside is ahead.

If the decline continues, ONDO could test support at $0.866, with a breakdown potentially sending it as low as $0.82.

On the upside, a recovery in momentum and renewed interest in RWA coins could push ONDO toward the $1.09 resistance level. If bullish momentum strengthens further, it could climb to $1.23

Story (IP)

IP has been one of the best-performing Made in USA cryptos, surging 77% in the last 30 days and standing out among top altcoins.

Despite its strong overall performance, IP has experienced a 19% correction over the past week, bringing its market cap to $1.27 billion.

If IP can recover its strength from last month, it could rise toward $6.96 and potentially test $7.95, with the possibility of breaking above $8 for the first time, making it one of the most important Made in USA cryptos.

However, if the current downtrend intensifies, the price may test support at $4.49, and a further breakdown could push it as low as $3.65.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.