Market

Toncoin Weak Hands Puts TON Price Under Pressure

On August 14, the Toncoin (TON) price rose above $7 for the first time this month. This price increase offered the token holders a glimmer of hope after the cryptocurrency failed to replicate its performance in the first quarter of 2024.

But that did not happen, as TON now trades at $6.76. As it stands, the altcoin looks exposed to another price decline, and here is why.

Toncoin Holders Lack the Required Conviction

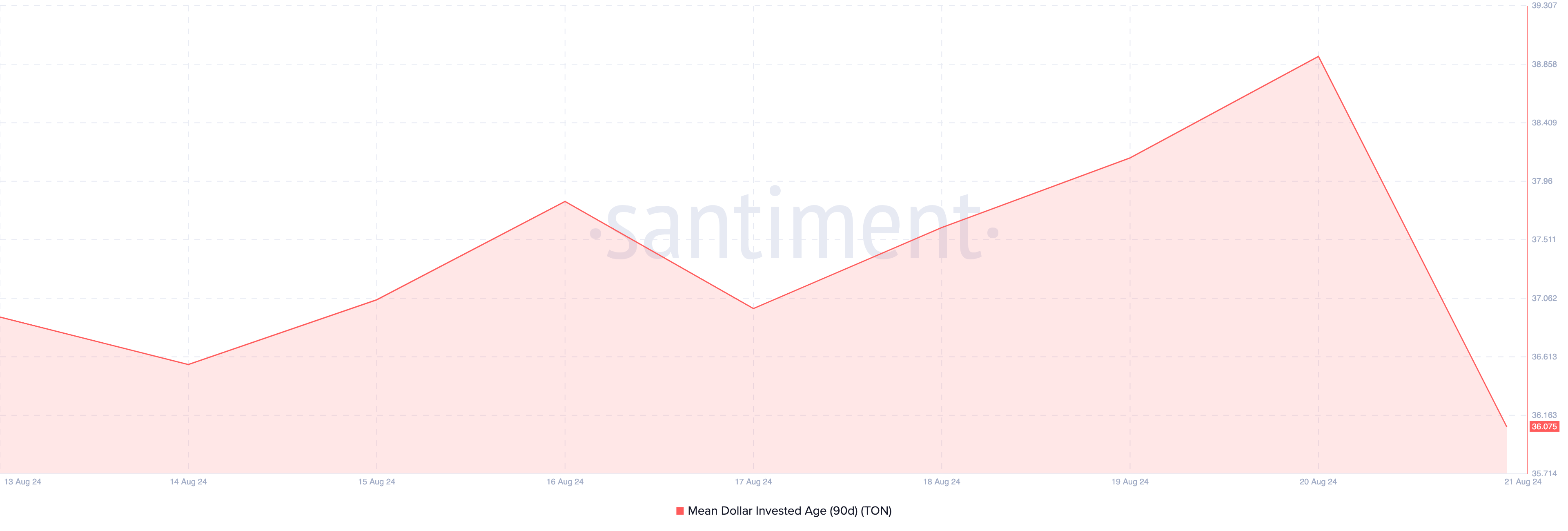

Toncoin’s Mean Dollar Invested Age (MDIA) is one metric supporting this bias. By definition, the MDIA measures the average time that all holders of a cryptocurrency have held their assets.

A rising line in this metric indicates long-term holding, suggesting that a bunch of holders are diamond hands who will not liquidate, irrespective of the price action. In most cases, a rise in the MDIA provides an avenue for the price to increase.

As seen below, TON’s price increased during the same period the metric surged. But things have changed as the 90-day MDIA is now down from that peak. Typically, a falling line in this aspect suggests an increase in transaction activity, indicating that some holders are weak hands who are not ready to HODL regardless of price swings.

Read more: 6 Best Toncoin (TON) Wallets in 2024

Reinforcing this thesis is the Coins Holding Time metric provided by IntoTheBlock. Like the MDIA, this on-chain indicator tracks the amount of time holders have resisted potentially transacting a cryptocurrency or selling it.

When the holding time increases, it implies holders are refraining from selling. In Toncoin’s situation, that is not the case, as the holding time has decreased by 95% within the past week.

If this continues, TON’s price might continue to fall, and a return to the $7 region might become a herculean task.

TON Price Prediction: a 10% Fall Seems Possible

Toncoin’s recent price decrease aligns with BeInCrypto’s prediction of an unsustainable rally. This sharp decline starkly contrasts the sentiment that some market participants had hoped for.

According to the daily chart, TON trades around $6.75 — a supply zone historically known to trigger approximately a 10% decrease for the token. For instance, in May, the Telegram-based crypto traded around this region. Shortly after, the price dropped to $6.19.

As seen below, a similar thing happened between the last days of July and August 1. Therefore, if TON fails to attract increased demand, the price risks falling to $6.19.

Read more: Top 7 Telegram Tap-to-Earn Games to Play in 2024

However, the cryptocurrency’s price might not drop this low if demand increases. Should this be the case, TON’s price could climb to the upper-level resistance at $7.26.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.