Market

This Is Why Accumulating Solana Could Be the Right Decision

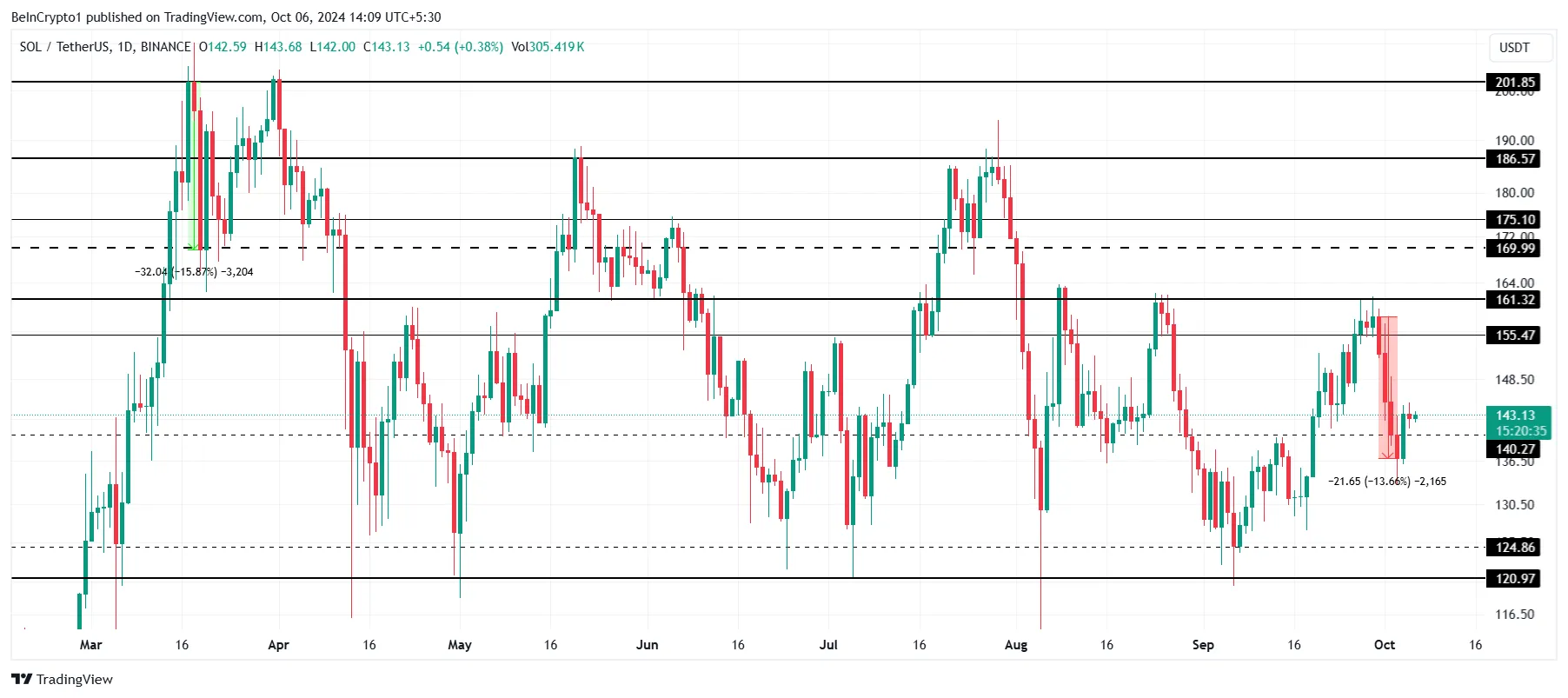

Solana’s (SOL) price recently dropped to $143, raising concerns about its recovery amid the current market conditions.

However, based on Solana’s historical performance and market trends, this could present a promising opportunity for long-term investors to accumulate SOL at this level.

Gains Ahead of Solana

Solana’s Sharpe Ratio, a measure of risk-adjusted returns, is showing a familiar pattern. Every time the ratio turns deeply negative, Solana’s price rallies. This week, the Sharpe Ratio again dropped into negative territory, hinting at the possibility of an upward price surge.

Historically, a negative Sharpe Ratio has signaled that the altcoin is oversold, attracting buyers and driving the price higher. This pattern could repeat itself, providing investors an opportunity to accumulate SOL before its next potential rally. As indicated by the Sharpe Ratio, the current market sentiment suggests that Solana could see renewed momentum in the coming weeks.

Read more: Solana vs. Ethereum: An Ultimate Comparison

The overall macro momentum for Solana is also showing positive signs. Initially, traders turned bearish as SOL’s price declined, anticipating further drops. However, this sentiment has since shifted, and traders have become bullish again. The renewed optimism reflects growing confidence in Solana’s ability to recover and rally.

This shift is supported by broader market conditions and the historical patterns noted in Solana’s Sharpe Ratio. The convergence of these factors suggests that Solana is in a position to regain its lost momentum and start climbing again.

SOL Price Prediction: Barriers Ahead

Solana’s price remains above the crucial $140 support level, which is a positive indicator for continued recovery. Holding this level is essential for SOL to attempt a breakout, particularly as it targets $161 once again.

Given the current market conditions and positive indicators, Solana’s price could see an uptick if it manages to break through the $155 barrier. Breaching this resistance would pave the way for a rise back to $161, marking a solid recovery for the altcoin.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

However, if Solana fails to break $155, it could experience a pullback to $140. While this would still offer short-term gains for investors, it would invalidate the bullish outlook, leaving SOL holders vulnerable to further losses. Maintaining support above $140 is key to sustaining the upward trajectory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.