Market

Tether Appoints New CFO to Manage Transparency and Audits

Tether, the stablecoin giant, has announced the appointment of Simon McWilliams as its new Chief Financial Officer (CFO).

With Simon McWilliams’ expertise in financial auditing, it appears that Tether is hoping he can conduct a comprehensive financial audit. The company is aiming to become more transparent about its reserves as regulatory pressure mounts.

Simon McWilliams Becomes Tether’s New CFO

According to the latest announcement, Tether has appointed Simon McWilliams as its new Chief Financial Officer (CFO). With this appointment, Tether aims to strengthen the trust of users, regulators, and institutional partners while solidifying its dominant position in the $232 billion stablecoin market.

“Simon’s expertise in financial audits makes him the perfect CFO to lead Tether into this new era of transparency. With his leadership, we are moving decisively toward a full audit, reinforcing our role in supporting US financial strength and expanding institutional engagement,” wrote Paolo Ardoino, CEO of Tether.

Simon McWilliams brings over 20 years of experience in financial management. He has previously guided large investment firms through rigorous audits.

His appointment marks a significant step for Tether, especially given the ongoing skepticism regarding the legitimacy and transparency of its reserves.

Challenges Tether Faced Under CFO Giancarlo Devasini

Following McWilliams’ appointment, Tether’s former CFO, Giancarlo Devasini, will transition to the role of Chairman. In this new position, Devasini will now focus on macroeconomic strategy, steering Tether toward becoming part of the US financial system and promoting the global adoption of digital assets.

Under Devasini, Tether consistently faced criticism for lacking a comprehensive audit. From 2022 until now, the company relied solely on quarterly attestation reports from the accounting firm BDO.

These reports are considered to lack the detail that a comprehensive audit would require.

This lack of transparency has been creating many doubts, particularly after a 2021 settlement with the New York Attorney General (NYAG). The NYAG investigation revealed that Tether had misrepresented that USDT was backed 1:1 by the U.S. dollar.

Furthermore, Tether and Bitfinex, a closely affiliated company, denounced the amended price manipulation lawsuit.

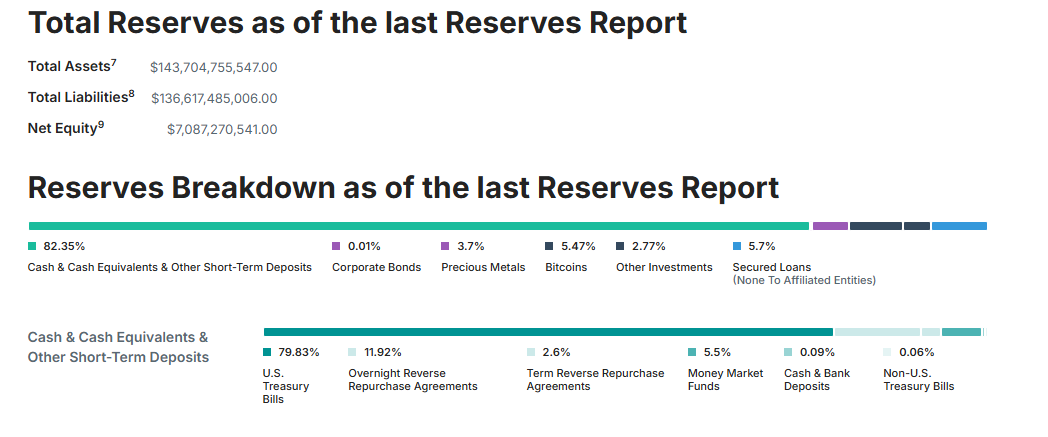

Although Tether has made efforts to disclose its reserves, 82.35% consist of Cash, Cash Equivalents, and Other Short-Term Deposits. Nearly 80% of them are in US Treasury Bills.

However, critics argue that only a full audit can fully dispel doubts about the company’s financial health.

Pushing for a comprehensive audit aligns with Tether’s broader strategic goals. The company recently relocated its headquarters to El Salvador, aiming to secure a Digital Asset Service Provider (DASP) license.

This move is seen as an effort to strengthen its operational foundation and signal intentions to expand within the institutional financial system.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.