Market

SushiSwap (SUSHI) Faces Bearish Trends Amid Weakness

SushiSwap (SUSHI) shows clear bearish trends on the daily chart, but it is struggling to break key resistance levels.

Recent on-chain analysis highlights SUSHI’s downward trajectory, particularly after breaking below significant support levels.

SushiSwap Shows Strong Bearish Trend in Price Action

The price of SUSHI is showing clear bearish signs on the daily chart. It has repeatedly tested both the 200 EMA (green) and the 100 EMA (blue) while moving within the Ichimoku Cloud.

On June 7, during Bitcoin’s correction to $66,800, SUSHI broke below the Ichimoku Cloud’s baseline, a crucial support and resistance level marked in red.

Read More: How To Use SushiSwap: A Step-by-Step Guide

After breaking the lower boundary of the Ichimoku Cloud, SUSHI found this level to act as strong resistance on subsequent attempts to break back above it. This is evident from the chart.

With Bitcoin’s recent drop from $70,000, SUSHI followed suit, declining 12% to a week low of $0.935. This trend is decidedly bearish, and for SUSHI to turn bullish again, it would need to climb back into the Ichimoku Cloud and break above the baseline in red.

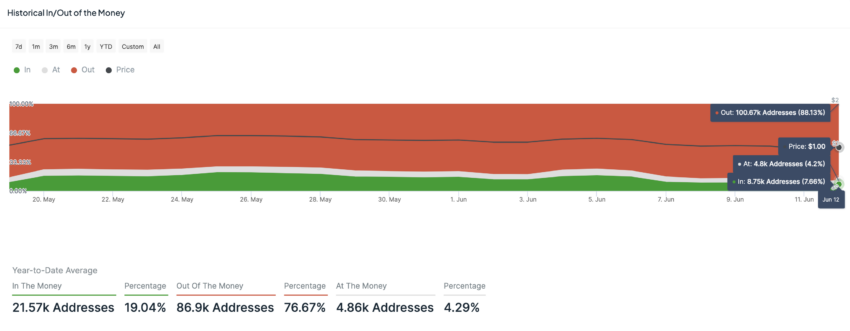

SUSHI Holders on Ethereum are Facing Bearish Trends

The following chart displays the historical In/Out of the Money addresses for SUSHI holders on the Ethereum blockchain. This indicator provides insights into the profitability of addresses holding SUSHI based on the token’s current price.

On the Ethereum blockchain, 100,670 addresses, or 88.13%, hold SUSHI at a loss. Meanwhile, 8,750 addresses, representing 7.66%, are profitable, and 4,800 addresses, or 4.2%, are breaking even.

From June 1 to June 12, there have been notable changes in the profitability of addresses holding SUSHI on Ethereum.

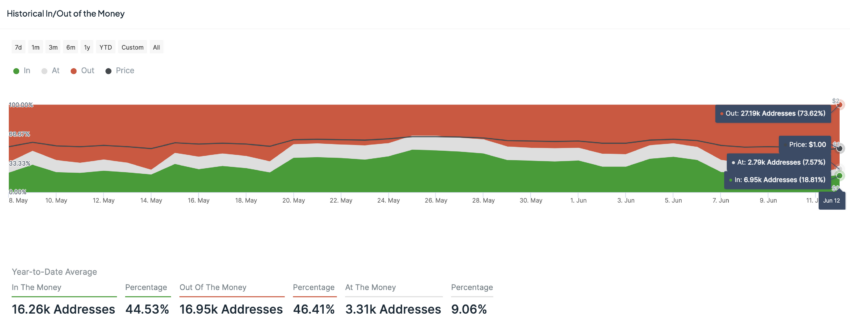

Holders on Arbitrum Confront Losses Amidst Declining Market Conditions

Since the start of the month on the Arbitrum network, the number of addresses holding SUSHI and being Out of the Money increased by 10.35k, a rise of 13.30%. Conversely, the number of addresses At the Money decreased by 2.39k, a drop of 36.30%. Additionally, addresses In the Money fell by 7.95k, representing a decline of 50.92%.

These shifts indicate a bearish trend, with a higher percentage of SUSHI holders now experiencing losses compared to the start of the month.

Read More: SushiSwap (SUSHI) Price Prediction 2024/2025/2030

Between June 1 and June 12, there were notable shifts in the addresses holding SUSHI on the Arbitrum network. The number of addresses at a loss, or Out of the Money, surged by 23,804, marking an increase of 47.78%. On the flip side, the At the Money addresses, those in breaking even positions, dropped by 7,081, a decrease of 48.34%. In the Money addresses, or those in profit, fell by 16,724, a decline of 47.06%.

This trend highlights a growing bearish sentiment. On the Arbitrum Network, more SUSHI holders are now facing losses than at the beginning of the month.

Technical indicators point to continued downward pressure to $0.768 (the local price low). A significant number of holders are experiencing losses across both the Ethereum and Arbitrum networks.

For SUSHI to turn bullish again, it would need to climb back above the baseline in red.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.