Market

Stablecoin Reserves Surge, but Altcoin Market Struggles

Stablecoins on exchanges are often seen as a key indicator of investors’ purchasing power. A higher stablecoin balance suggests traders are ready to buy altcoins, setting the stage for a market rebound.

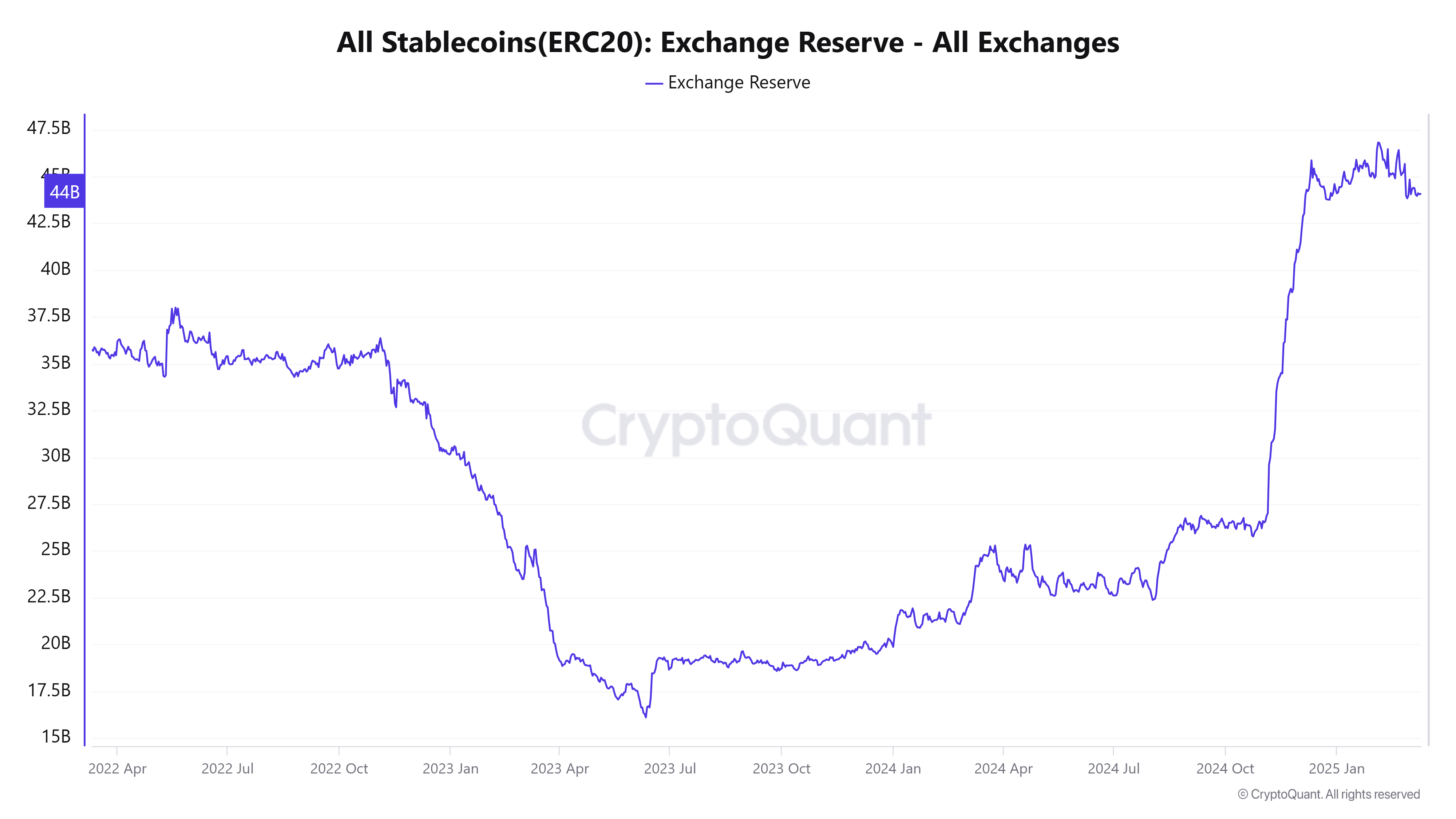

On-chain data reveals that stablecoin reserves on exchanges have reached a three-year high. However, altcoin market capitalization continues to decline sharply.

Stablecoin Reserves Surpass $45 Billion in Early 2025

According to CryptoQuant, the total value of ERC-20 stablecoins on exchanges hit $46.5 billion at the start of 2025. As of now, this figure stands at $44 billion. The data has led investors like The DeFi Investor to believe that the capital is readily available to fuel a market recovery.

“Stablecoin CEX reserves are at an all-time high. There’s a lot of capital waiting to be deployed. But we need the macro situation to improve first,” The DeFi Investor commented.

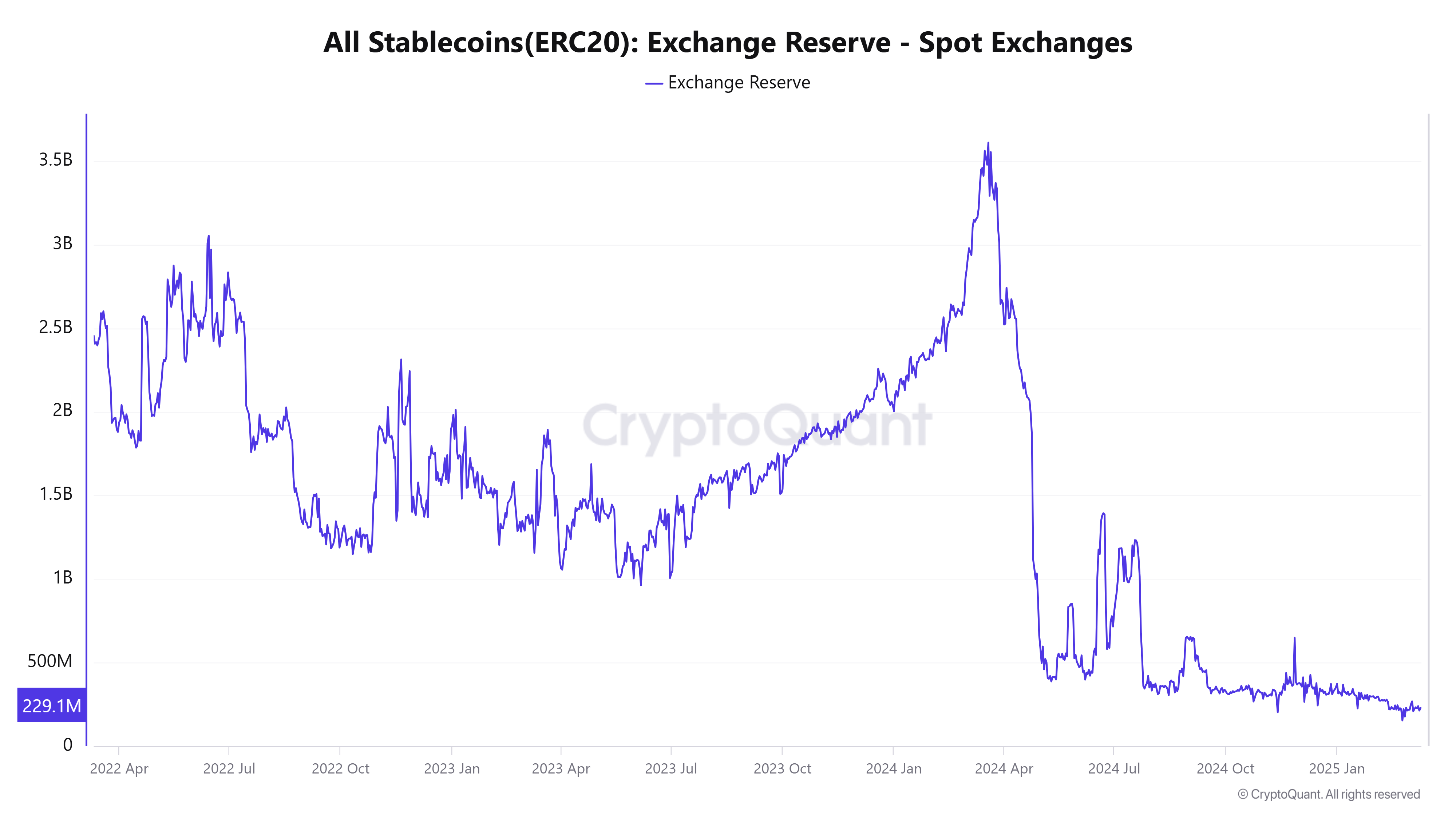

However, a closer look at spot exchanges tells a different story. Instead of rising, stablecoin reserves on these platforms have actually declined significantly.

CryptoQuant data shows that out of the $44 billion in ERC-20 stablecoins on centralized exchanges (CEXs), a staggering $43.8 billion is held on derivatives exchanges. Meanwhile, spot exchanges hold just over $220 million in stablecoins.

Historical trends indicate that from July 2023 to March 2024, a surge in spot exchange stablecoin reserves coincided with the market capitalization rising from $1 trillion to $2.7 trillion. Today, spot exchange reserves have dropped to a three-year low.

Most stablecoins on derivatives exchanges do not contribute to sustainable price increases. Instead, they reflect short-term leveraged trading with high risk. BeInCrypto recently reported that 334,404 traders were liquidated in the past 24 hours, totaling $947.7 million. Long positions suffered the most.

Additionally, the altcoin market capitalization (TOTAL2) dropped by 20% in March, falling from $1.2 trillion to below $1 trillion.

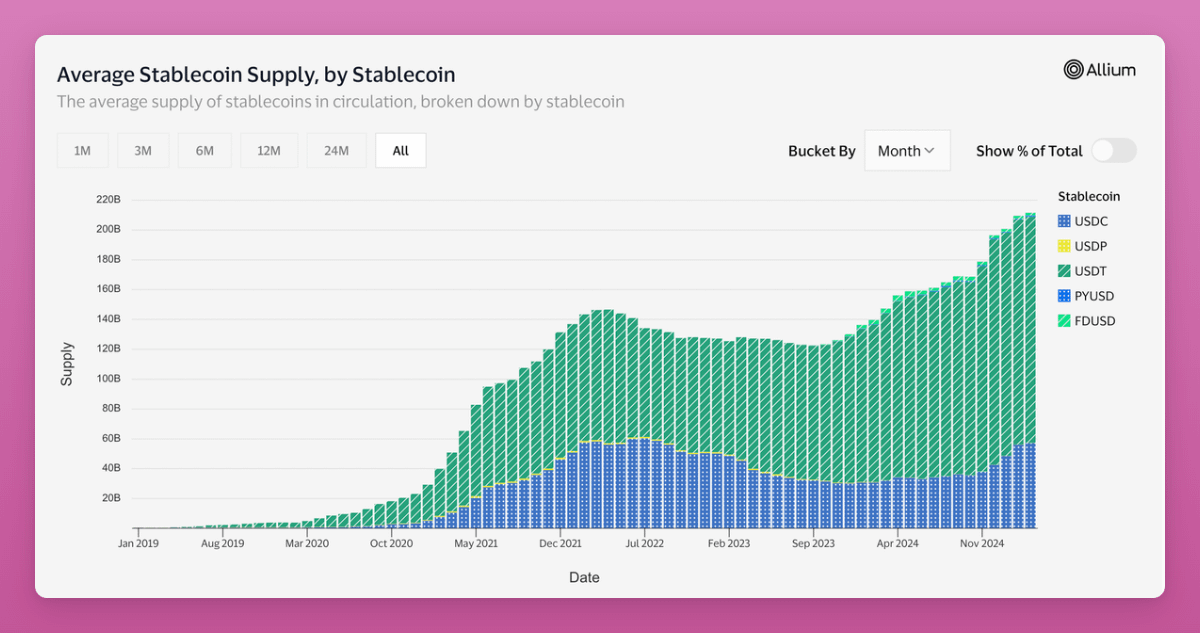

Stablecoin Market Cap Hits New High Amid Rising Adoption

According to Ignas, co-founder of Pink Brains, stablecoin market capitalization has surged 44% over the past two years, surpassing $200 billion.

Historically, a growing stablecoin supply signaled the start of an Altcoin Season. However, Ignas believes the narrative in 2025 is different.

“Until recently, an increase in stablecoin supply led to a pump in crypto prices, as stablecoins were mostly used for short-term holding between trades. Now, stablecoins are growing beyond speculation,” he noted.

He pointed to real-world use cases that extend beyond crypto trading. For example, SpaceX processes Starlink sales in Argentina and Nigeria using stablecoins. ScaleAI pays overseas employees with stablecoins.

Meanwhile, major TradFi institutions are preparing for stablecoin growth. Bank of America is open to launching its own stablecoin if regulations permit. PayPal plans to expand PYUSD in 2025. Stripe recently acquired Bridge, a stablecoin platform, for $1.1 billion. Revolut is considering issuing a stablecoin. Visa is integrating stablecoins into global payments and operations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.