Market

SEC Drops Uniswap Investigation After Coinbase and Robinhood

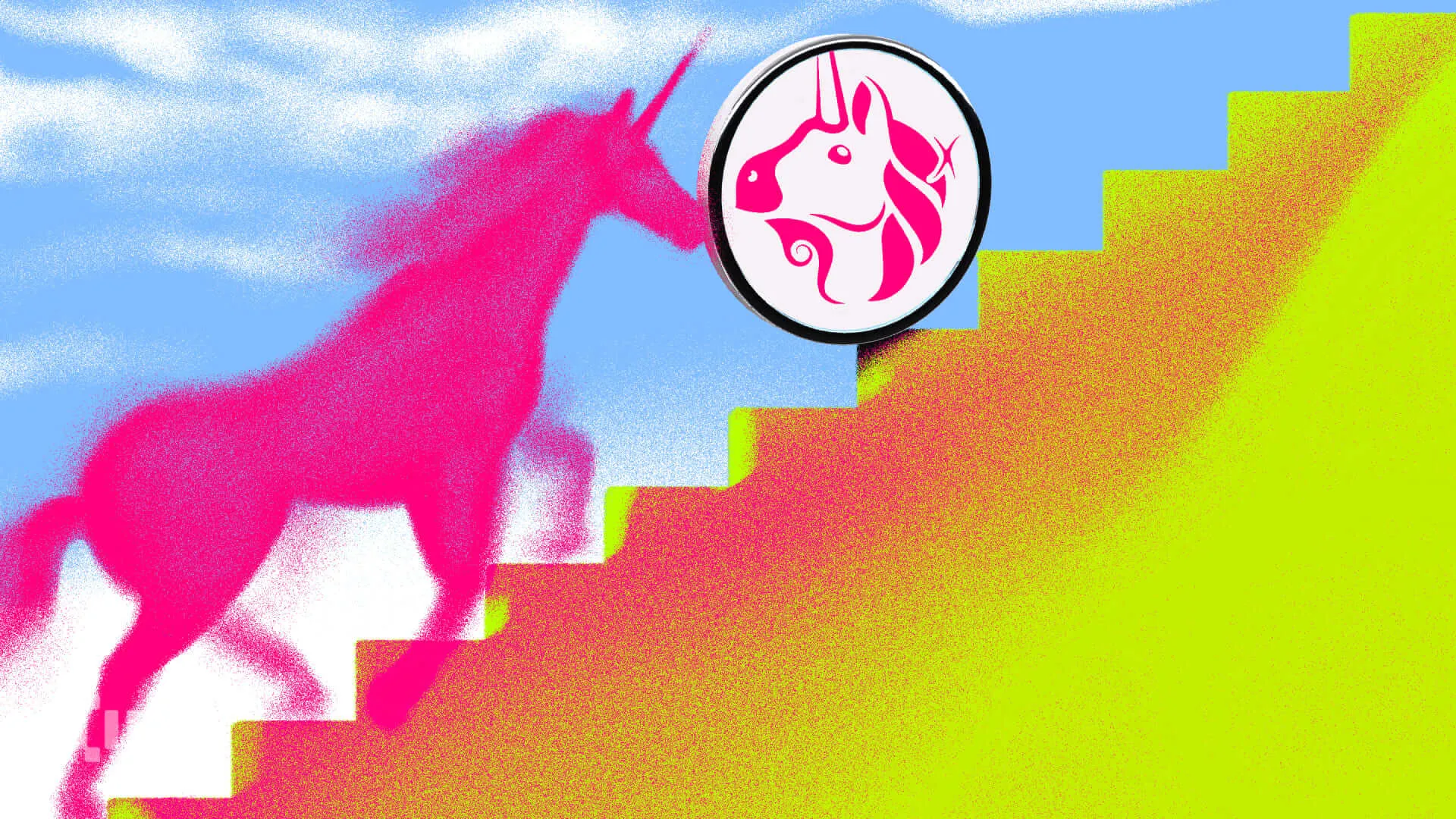

The SEC dropped its investigation into Uniswap Labs, causing the UNI token to briefly jump while bearish conditions still dominate the market. Despite the volatility, it has been a positive month for the decentralized exchange, as it launched the v4 upgrade and Unichain mainnet this month.

Uniswap’s CEO Hayden Adams claimed that TradFi regulations are not applicable to the crypto space and that new ones are required. Now that another enforcement case has been dropped, pressure is building to create these friendlier regulations.

SEC Vs Uniswap Ends Without Any Enforcement

When the SEC sent a Wells Notice to Uniswap last year, it kicked off a year-long investigation. The Commission claimed it was an operated unregistered broker, exchange, and clearing agency and issued an unregistered security.

In response, the industry rallied behind it. This probe, which was considered integral to the future of DeFi, has now been dropped by the SEC.

“This is a huge win, not just for Uniswap Labs but for DeFi as a whole. I’m grateful that the new SEC leadership is taking a more constructive approach, and I look forward to working with Congress and regulators to help create rules that actually make sense for DeFi. The best days for DeFi are ahead,” claimed Uniswap CEO Hayden Adams.

The quiet end to the Uniswap case is part of a new trend at the SEC. Since President Trump’s term began last month, the Commission has been dropping crypto enforcement suits left and right. In the last few days, it dropped a major suit against Coinbase, while ending investigations into Opensea and Robinhood.

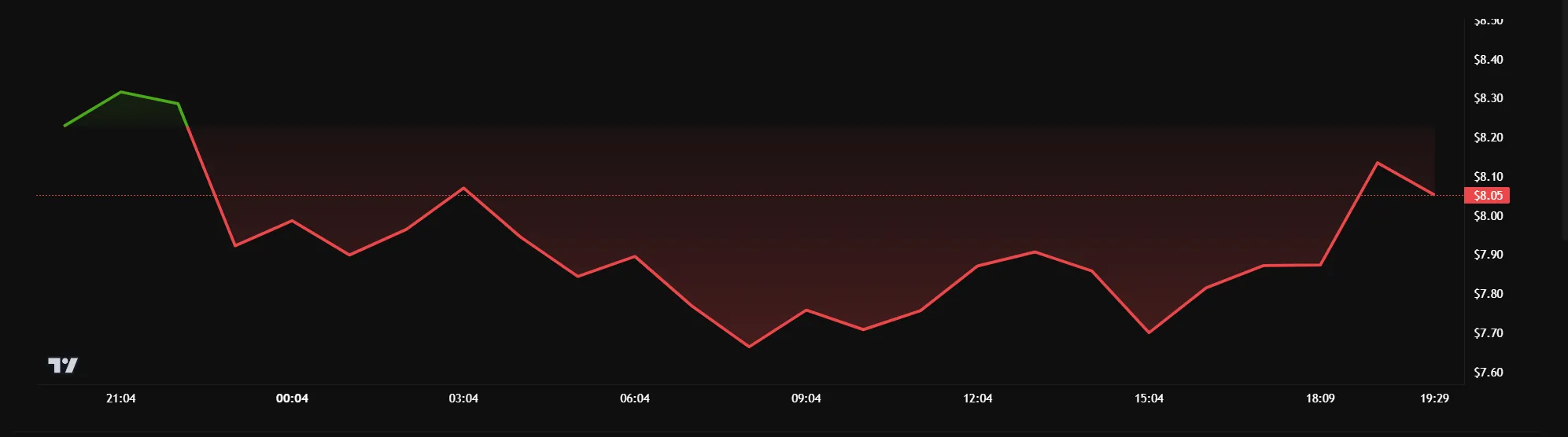

Now that the SEC has dropped its case, Uniswap’s UNI token can breathe a little easier. Over the past month, its price has suffered a 30% drop. Even the long-awaited v4 update and the Unichain launch did not have any notable impact.

Despite the stale price movements, UNI jumped briefly after the SEC’s announcement, indicating some positive outlook. Also, the token’s daily trading volume surged over 140% today, according to CoinMarketCap data.

A New Future for Crypto Enforcement

It will be interesting to see how this development fits into a broader mosaic of federal crypto policy.

In his statement, Adams claimed that “decentralized technology and self-custody are inherently different” from TradFi and that they should be held to different regulations. This is a common refrain, and the SEC is working to receive constructive industry feedback.

To sum it up, The SEC is dropping a lot of enforcement cases made under Gary Gensler’s interpretation of the law, and Uniswap is part of that trend.

However, as the Commission changes its focus, it also puts pressure on developing this constructive new regulatory environment. Crypto has a real chance to chart its own future, but it must comply with the new rules it helps create.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.