Market

Ripple Maintains Positive Outlook for XRPL Despite Volume Drop

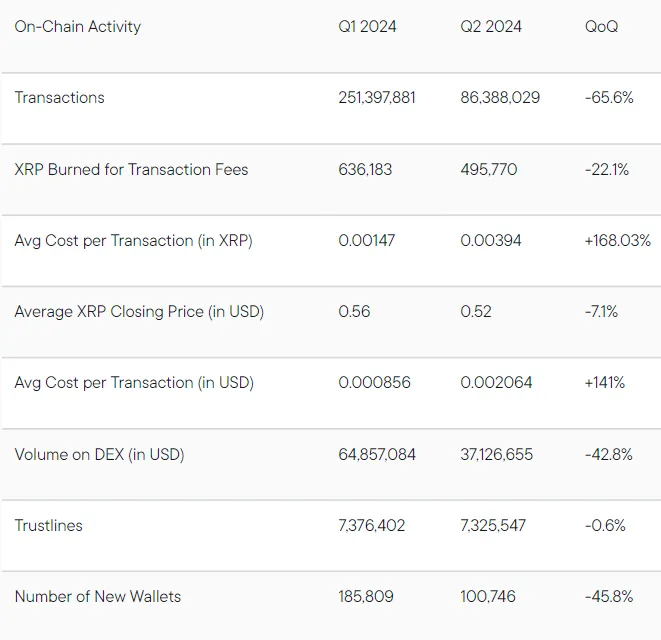

Ripple-backed XRP Ledger (XRPL) saw a notable drop in transaction volume in Q2 2024, according to the latest XRP Markets Report. This decline is part of a wider trend affecting major blockchain protocols, with XRPL experiencing a similar downturn.

In Q2 2024, XRPL logged 86.39 million transactions, a 65.6% decrease from the previous quarter. Despite this drop, average transaction fees on the network surged by 168% to 0.00394 XRP.

Ripple Remains Bullish on XRPL Despite Falling Volume

XRP’s trading volume, along with Bitcoin and Ethereum, fell by 20% during the second quarter. Nonetheless, spot trading volumes for XRP remained high throughout most of the quarter. Binance continued to dominate the trading volume, with other exchanges like Bybit and Upbit showing varied contributions.

Trading of XRP against fiat currencies decreased to 10%, with most trading occurring against the USDT stablecoin. Ripple views this shift positively, particularly with the upcoming launch of its USD Stablecoin later this year.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

Meanwhile, Ripple remains optimistic about XRPL’s future. The company expects increased network activity due to upcoming updates. Key developments include the integration of Archax, a regulated exchange and custodian, and OpenEden, which could bring significant tokenized real-world assets to XRPL.

Ripple also highlighted several innovations on the horizon. These include the XRPL Ethereum Virtual Machine (EVM) sidechain, Axelar interoperability, and the new Oracle and Multi-Purpose Token (MPT) standard. These advancements are expected to drive XRPL’s growth in the upcoming quarters.

“[The] progress with the XRPL EVM sidechain and Axelar for interoperability, and Archax’s expected influx of tokenized real-world assets, [alongside] the preparation for future Oracle and Multi-Purpose Token (MPT) standard, excites me about Q3 and Q4.” Monica Long, Ripple President, commented.

On a separate note, Ripple awaits a court decision on its longstanding case against the US Securities and Exchange Commission (SEC). The firm stated that the court would rule on the remedies related to institutional XRP sales and it remains hopeful for a fair judicial outcome.

Read more: Everything You Need To Know About Ripple vs SEC

Further, Ripple noted the significance of the upcoming November elections, calling them “the most consequential in crypto’s history to date” and crucial for the future of crypto regulation in the US. The company highlighted its $25 million donation to Fairshake, a federal super PAC supporting pro-crypto candidates, bringing its total contributions to $50 million.

“This is an industry-wide, bipartisan effort to ensure there is a strong future with regulatory clarity for crypto in the US. The SEC’s repeated attempts to smother the crypto industry through enforcement actions has benefitted other key global markets that have embraced responsible innovation and economic growth,” Ripple added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.