Market

PEPE Price Faces Potential 47% Drop if Key Support Levels Fail

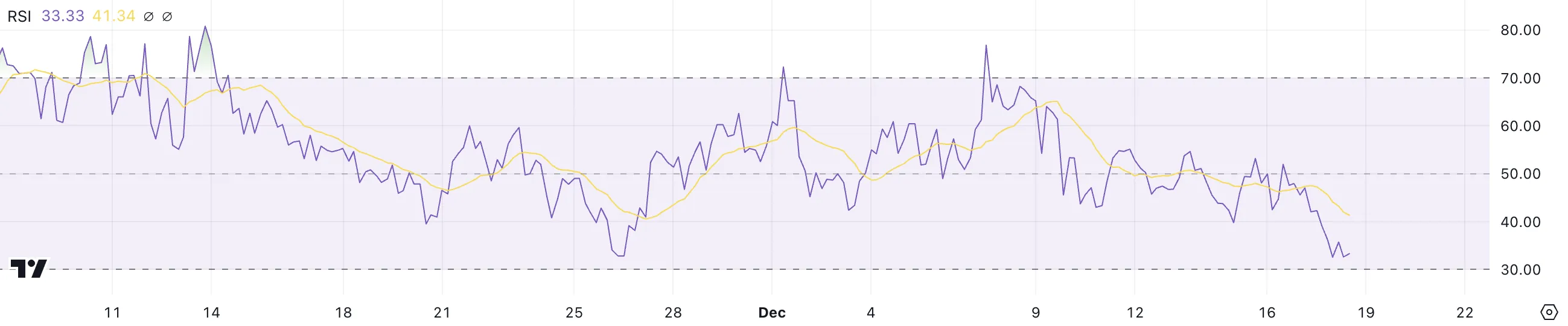

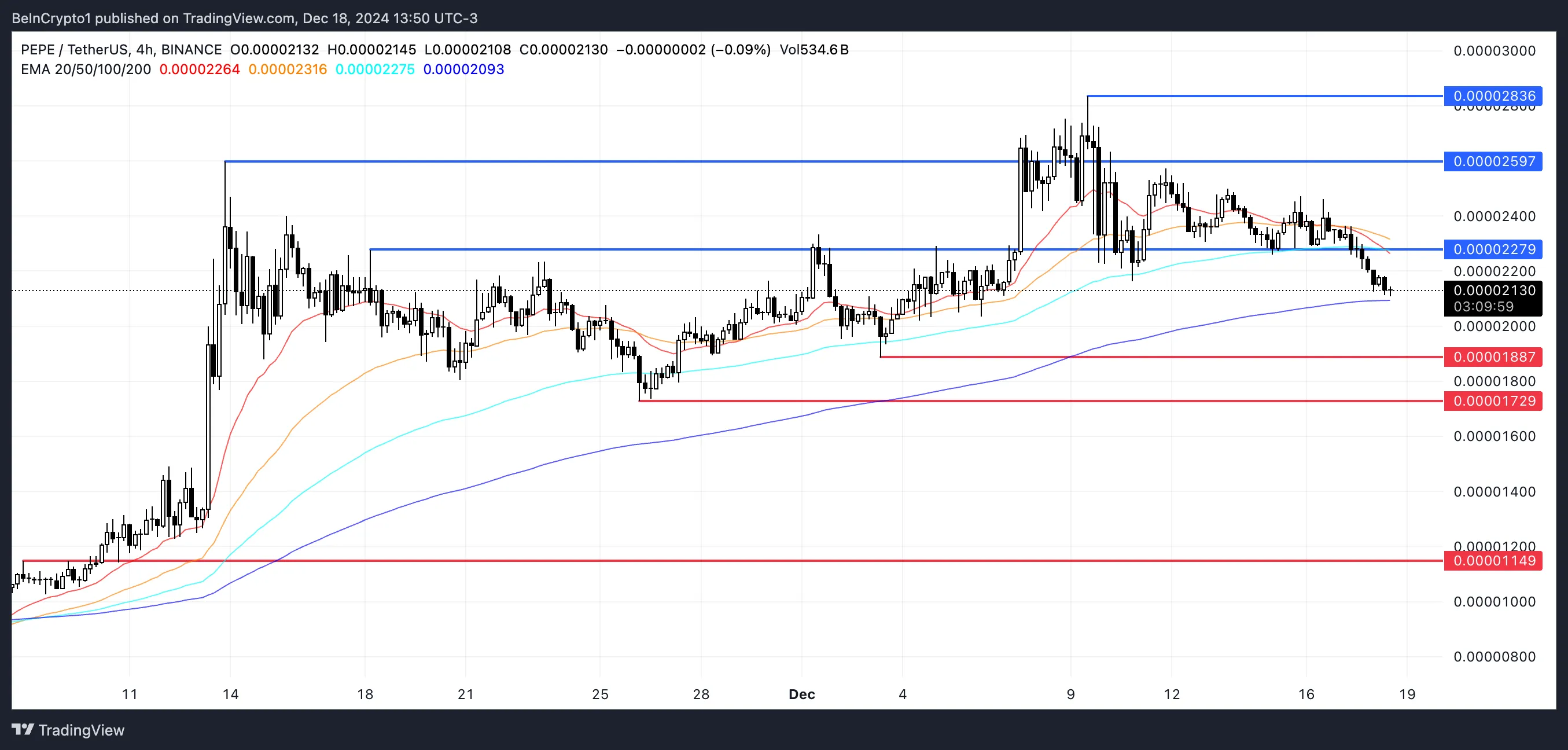

PEPE’s price has dropped nearly 8% in the past 24 hours, days after reaching its all-time high on December 9. Momentum indicators, including the RSI at 33.3, show that PEPE is nearing oversold territory but has not yet hit the critical threshold of 30, leaving room for further correction.

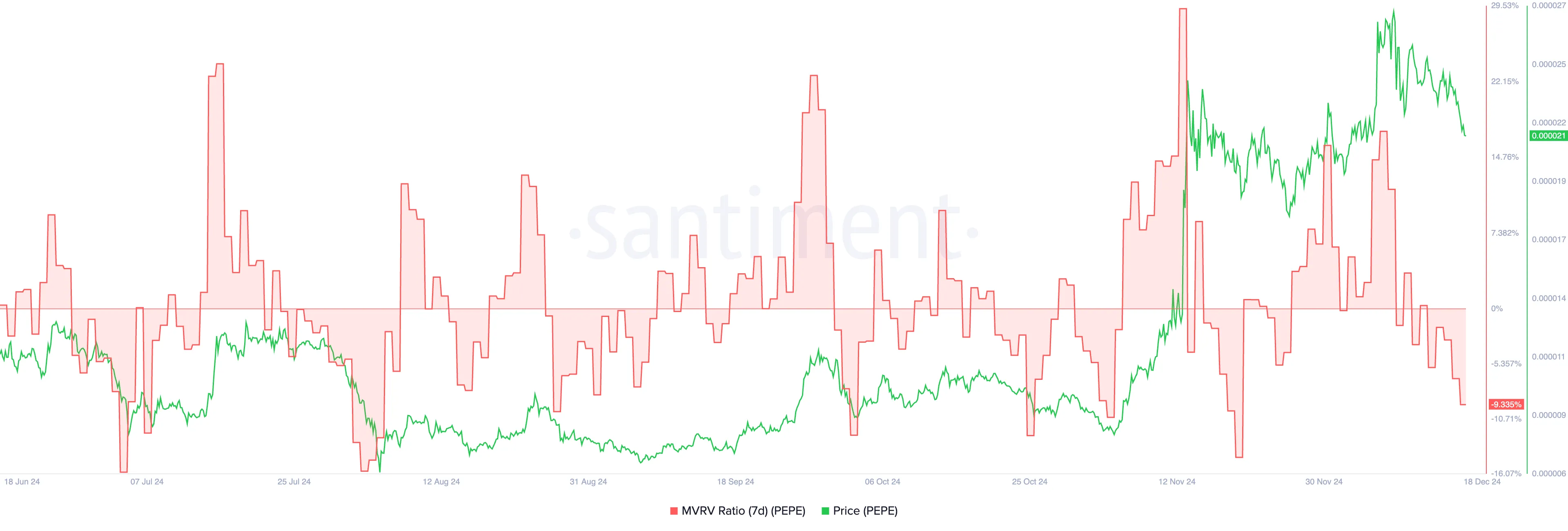

Additionally, the 7D MVRV Ratio at -9.3% points to significant short-term holder losses, with historical data indicating a potential downside toward -12% to -15% before a rebound. Whether PEPE holds its key support at $0.0000188 or breaks lower will likely define its next major price movement.

PEPE RSI Isn’t In The Oversold Zone Yet

PEPE RSI is currently at 33.3, reflecting a sharp decline since December 16. This indicates that the meme coin is approaching oversold territory, as its RSI nears the critical threshold of 30.

The heavy drop in RSI, combined with the ongoing 8% correction in the last 24 hours, suggests increased selling pressure and bearish sentiment in the short term.

The RSI (Relative Strength Index) measures the speed and magnitude of price changes to evaluate whether an asset is overbought or oversold. RSI values above 70 indicate overbought conditions, often signaling a potential pullback, while values below 30 suggest oversold conditions, which could precede a rebound.

With PEPE RSI at 33.3 and nearing oversold levels, the price may continue to face downward pressure, but a potential bounce could occur if buyers step in at these lower levels.

MVRV Ratio Shows The Correction Could Continue

PEPE 7D MVRV Ratio is currently at -9.3%, a sharp decline from 17% on December 8 when its price hit a new all-time high. This negative MVRV indicates that, on average, short-term holders are now at an unrealized loss. The recent drop reflects increased selling pressure, suggesting that the current correction could persist in the short term.

The 7D MVRV Ratio measures the average profit or loss of tokens moved in the last seven days relative to their current market value. Historical data shows that PEPE’s 7D MVRV often reaches levels around -12% to -15% before price recoveries occur.

If this trend continues, the current -9.3% suggests that further downside is possible before PEPE finds a bottom and begins to rebound.

PEPE Price Prediction: A Potential 47% Correction Soon?

The support at $0.0000188 is a critical level for PEPE price, as a breakdown below it could lead to further declines. If this support fails, PEPE may test $0.000017, with the potential to drop as low as $0.000011, representing a 47% correction from current levels.

This bearish outlook is reinforced by its EMA lines, which have formed a death cross as short-term EMAs cross below long-term EMAs, signaling continued downside momentum.

On the other hand, if PEPE price can regain positive momentum, it could challenge the resistance at $0.0000227.

A breakout above this level could open the door to further gains, with targets at $0.0000259 and potentially $0.000028 if the uptrend strengthens.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.