Market

Onyxcoin (XCN) Sinks 35% in February as Bears Take Full Control

Onyxcoin (XCN) is down 19% in the last seven days and over 35% in the past 30 days, reflecting strong bearish momentum. Its market cap reached $1.4 billion on January 26 but has since dropped to $572 million.

Despite a brief recovery, its RSI has now fallen to 41.8, signaling weakened buying interest. With the ADX at 25.2 confirming a strong downtrend, XCN faces critical support at $0.014, while a potential reversal could target resistance at $0.0229 and beyond if bullish momentum returns.

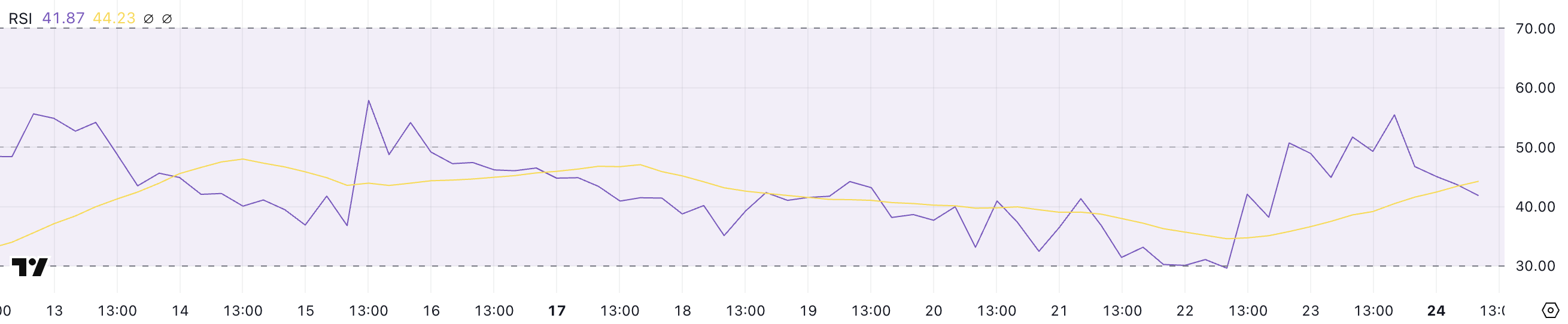

Onyxcoin RSI Is Down After Reaching 55

XCN’s RSI is currently at 41.8, after rising from 29.6 two days ago to 55.4 yesterday, indicating increased volatility in market momentum. RSI, or Relative Strength Index, is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100.

An RSI above 70 suggests an asset is overbought, indicating potential selling pressure. Meanwhile, an RSI below 30 suggests it is oversold, potentially signaling buying opportunities. An RSI between 30 and 70 is generally considered neutral, reflecting normal market fluctuations.

XCN’s RSI dropping from 55.4 to 41.8 after a sharp rise from 29.6 indicates a shift from bullish to bearish sentiment. This decline suggests that buying momentum has weakened, increasing selling pressure. If the RSI continues to fall toward 30, the altcoin could face further downward movement.

However, if the RSI stabilizes above 40, it could indicate consolidation before the next price move.

XCN ADX Shows the Downtrend Is Still Strong

XCN’s ADX is currently at 25.2, rising from 13.9 three days ago and peaking at 27 a few hours ago, indicating a strengthening trend. The Average Directional Index (ADX) measures the strength of a trend without indicating its direction, ranging from 0 to 100.

An ADX below 20 suggests a weak or non-existent trend, while a value above 25 indicates a strong trend. A rising ADX confirms increasing trend strength, regardless of whether the price is moving up or down.

With XCN currently in a downtrend, an ADX of 25.2 indicates that selling pressure is still strong, potentially leading to further price declines. If the ADX keeps above 25, it would confirm the downtrend’s momentum.

Conversely, if the ADX starts to decline, it could indicate weakening bearish pressure and the possibility of consolidation. The current ADX level signals caution, as the downtrend shows no signs of reversal yet.

Can Onyxcoin Recover The Good Momentum From The End of January?

If the downtrend continues, XCN could test the support at $0.014, a critical level that could determine its next move.

A break below this support would indicate increased selling pressure, potentially pushing Onyxcoin price below $0.010 for the first time since mid-January.

Conversely, if the trend reverses, XCN could test the resistance at $0.0229. Breaking above this level could trigger buying interest, pushing the price towards $0.0339 and potentially $0.040.

If XCN can regain the strong uptrend it experienced at the end of January, when it was one of the most trending altcoins in the market, it could reach levels around $0.049.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.