Market

Nvidia Reaches $3 Trillion Market Cap, Triggers AI Tokens Sell-Off

Nvidia Inc. has reached the $3 trillion market capitalization threshold, effectively outperforming Apple.

Meanwhile, AI tokens are dropping in price alongside a 10% surge in trading volume, typical of a ‘buy the rumor, sell the news’ situation.

Nvidia Outperforms Apple With $3 Trillion Market Cap

Chip-making giant Nvidia has attained a market capitalization of 3 trillion, and data shows that it was one of the most heavily traded stocks during the last trading session, only second to GameStop’s GME. It comes after the chip manufacturer’s 10:1 split, which would allow company employees and retail investors to purchase NVDA stock easily and at more affordable rates.

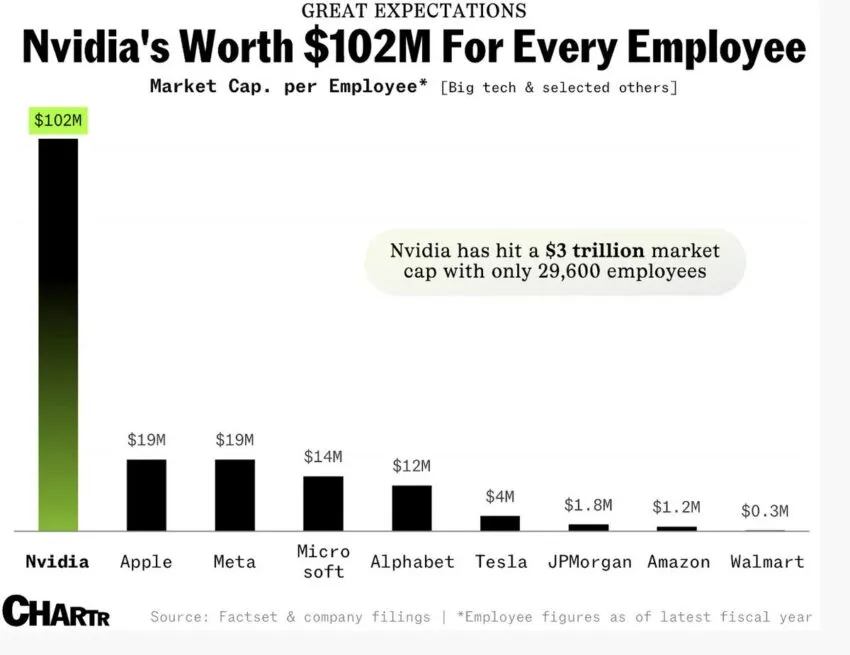

“NVIDIA breaks $3 TRILLION market cap and is now worth $102m for every employee,” highlighted crypto watch tool Radar in a post.

Data shows that NVDA stock is now worth five times more than Apple Inc. (AAPL) stock. Immediately after the split, NVDA surged to $120 per share before dropping to its current price of $102.

Read More: AI Stocks: Best Artificial Intelligence Companies To Know in 2024

Only recently, Nvidia Corp beat the Russell 2000 Index by a $10 billion range, recording up to $45.94 billion in volume on June 3. This comes despite the US Department of Commerce’s recent move to impose new restrictions on exporting AI processors to several Middle Eastern countries. These measures aim to address security concerns, particularly the risk of high-performance chips being resold to China.

“With regards to the most cutting edge technologies, we conduct extensive due diligence through an interagency process, thoroughly reviewing license applications from applicants who intend to ship these advanced technologies around the world,” the Commerce Department’s announcement states.

NVDA stock suffered in late May due to this resolve, as chipmakers AMD and Nvidia have struggled to obtain approvals for exporting AI accelerators amid a slowdown in licensing. Before this news, there was general speculation that crypto tokens related to AI and Big Data would rally, especially if NVDA outperformed AAPL. This expectation arose from the positive correlation between AI tokens and past events involving the GPU giant and its stock price.

AI Tokens Record Soaring Trading Volume

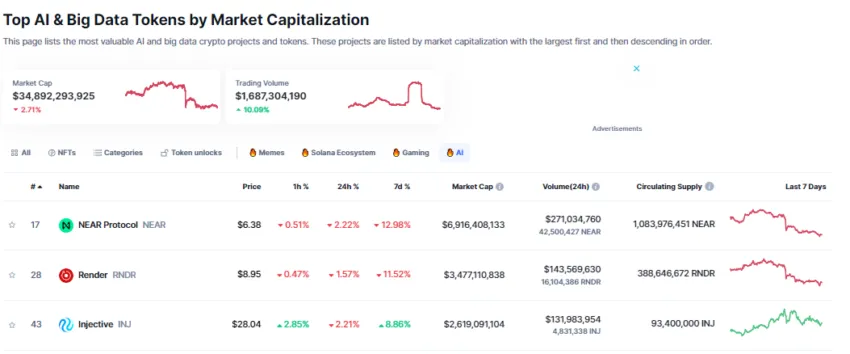

The anticipation for Nvidia Corp’s 10:1 split stirred interest in AI-related cryptocurrencies as market watchers speculated on potential impacts. Among them, the Render (RNDR) price soared 5% on Sunday, from a low of $8.921 to a high of $9.262. Likewise, Near Protocol (NEAR) climbed 3%, while the Injective (INJ) price exploded 10% to an intra-day high of $29.31.

The surge was a typical ‘buy the rumor’ situation, and in a typical ‘sell the event’ reaction, these tokens dropped. AI crypto coins’ trading volume is up 10% to show massive profit booking. With this, AI cryptos’ market capitalization has fallen by nearly 3% to $34.8 billion.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

The adage “buy the rumor, sell the news” is a contrarian trading strategy based on predictions of expected market reactions to rumors, events, or news announcements. Investors look to capitalize on price movements by acting before the masses widely disseminate and process the information (rumor). The strategy works such that when rumors surface concerning a particular event that could positively impact the asset’s price, enlightened traders may buy the asset based on the speculation (rumor).

A sell-off occurs when the news breaks, provided the market has already priced for the anticipated event. This allows the enlightened folk (early investors) to realize profits.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.