Market

Latam Crypto News: Brazil Approves Solana ETF

BeInCrypto comprehensive Latam Crypto Roundup brings Latin America’s most important news and trends. With reporters in Brazil, Mexico, Argentina, and more, we cover the latest updates and insights from the region’s crypto scene.

This week’s roundup includes stories on Solana ETF approval in Brazil, Bolivia’s interest in metal-backed stablecoins, and more.

Brazil Approves World’s First Spot Solana-Based ETF

The Brazilian Securities and Exchange Commission (CVM) has given the green light for the launch of the world’s first spot Solana-based exchange-traded fund (ETF). This product is currently in its pre-operational phase, with final approval pending from Brazil’s main stock exchange, B3.

The spot Solana ETF, managed by QR Asset and operated by Vortx, will track the CME CF Solana Dollar Reference Rate. Theodoro Fleury, Chief Investment Officer of QR Asset, expressed enthusiasm about the new ETF.

“This ETF reaffirms our commitment to offering quality and diversification to Brazilian investors. We are proud to be global pioneers in this segment, consolidating Brazil’s position as a leading market for regulated investments in crypto assets,” Fleury said.

Read more: Solana ETF Explained: What It Is and How It Works

The ETF launch will integrate Solana into mainstream financial systems and mark the first Solana-based product in Brazil. Over the past few years, the Latam country has shown a strong interest in pioneering financial products, with B3 playing a major role.

The exchange has listed several crypto ETFs, including those for Bitcoin and Ethereum, between 2021 and 2022. Most recently, in March 2024, B3 began offering BlackRock’s iShares Bitcoin Trust (IBIT).

Peru Launches New Anti-Money Laundering Regulation for Crypto Companies

Starting August 1, Peru’s cryptocurrency market enters a new regulatory era. The Superintendency of Banking, Insurance, and AFPs (SBS) has introduced the country’s first official framework aimed at preventing money laundering and terrorist financing within the sector.

This regulation requires all cryptocurrency businesses, including digital wallet providers and investment platforms, to follow strict anti-money laundering (AML) measures. The SBS will oversee these entities to ensure they implement a “risk-based approach” to deter illicit activities.

A key aspect of the new rules involves verifying the identity of transaction beneficiaries. This step aims to prevent corrupt funds and other illicit gains from infiltrating the financial system. The regulation covers all transactions, even those under $1,000, with potential for increased scrutiny in the future.

Read more: Crypto Regulation: What Are the Benefits and Drawbacks?

Non-compliance with these regulations could result in severe penalties. Companies that fail to meet the new standards may face hefty fines, the loss of their operating licenses, or the removal of their websites and apps.

This measure aligns with Recommendation 15 of the Financial Action Task Force (FATF), which urges countries to enforce legal frameworks for the supervision of virtual asset service providers (VASPs). Peru’s move follows similar actions in other Latam countries, such as Argentina, where stricter crypto regulations were implemented despite initial resistance.

Paraguay Dismisses Exodus of Miners Despite Higher Electricity Rates

Paraguay’s National Electricity Administration (ANDE) has dismissed concerns over an exodus of cryptocurrency mining companies following a hike in electricity rates. The increase, which raised tariffs by up to 16% for large-scale cryptocurrency miners, sparked fears of companies fleeing to neighboring countries like Brazil.

The Paraguayan Chamber of Mining of Digital Assets (Capamad) had previously warned that many cryptocurrency miners were considering relocating to Brazil due to the rising costs. Capamad suggested that Paraguay could lose its appeal as a favorable location for Bitcoin mining.

However, Félix Sosa, president of ANDE, refuted these claims, asserting that no mining companies had left Paraguay. Sosa highlighted a recent contract with a large mining operation, which secured the supply of 6 megawatts (MW) of electricity, ensuring the continued operation of 72 mining companies in the country.

“A technical evaluation is made to verify where to install, where ANDE has power availability for the installation of this type of load,” Felix Sosa explained to ABC.

Read more: Is Crypto Mining Profitable in 2024?

Sosa also revealed that these 72 companies currently have 391 MW of contracted electricity, with a total potential of 821 MW. He shared that ANDE expects to generate $100 million in revenue from these contracts. Additionally, 400 MW of new contracts with mining companies are pending approval.

In contrast, Jimmy Kim, director of Capamad, noted that the expansion plans of many cryptocurrency mining companies now favor Brazil over Paraguay. He pointed to a contract signed by Penguin Group for 400 MW in Brazil, with another 400 MW in the pipeline.

Despite these tensions, ANDE has maintained its stance, arguing that the increased tariffs will help reduce losses from illegal mining activities, which amount to over $185,000 annually. The tariff increase, outlined in Resolution 49238 issued on June 26, targets large-scale cryptocurrency miners specifically.

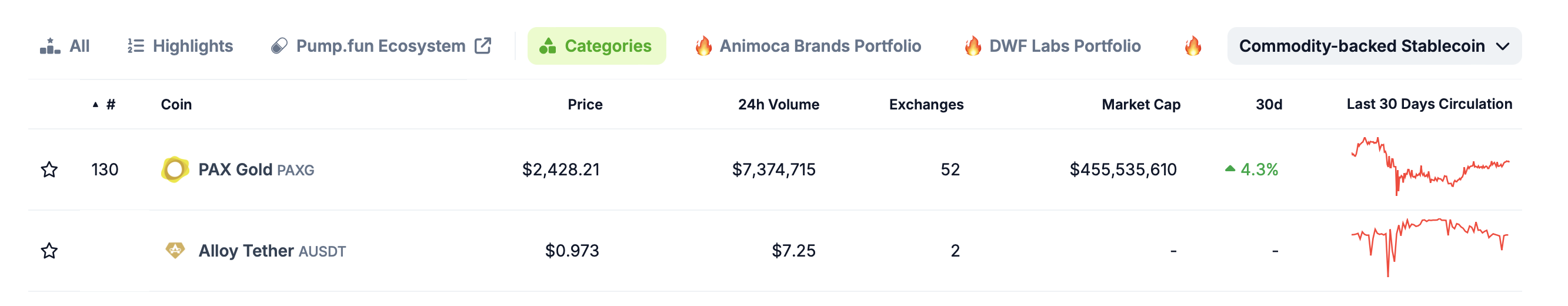

Bolivian President Luis Arce is advocating for the adoption of cryptocurrencies backed by metals, such as lithium and gold, as part of a broader strategy to strengthen Bolivia’s financial system. This move aims to integrate digital assets with the country’s abundant mineral resources while reducing reliance on the US dollar.

President Arce highlighted that this initiative would promote the use of metal-backed cryptocurrencies like Tether’s Alloy stablecoin (aUSDT). He noted that the measure is designed to streamline the flow of foreign currency into Bolivia and strengthen the payment system for international transactions.

“The greater dissemination of cryptoassets backed by gold, lithium, and other technological metals like Alloy (aUSDT) will boost the inflow of foreign currency into the country and deepen the payment system for international purchases,” Arce stated.

Read more: A Guide to the Best Stablecoins in 2024

This push follows a recent proposal by Congresswoman Mariela Baldivieso, who introduced a bill in the Bolivian Legislative Assembly to regulate Bitcoin. Baldivieso argued that cryptocurrencies could enable Bolivia to conduct transactions and receive international payments without depending on traditional fiat currencies.

In June, Bolivia lifted its ban on cryptocurrencies, allowing the use of “virtual assets” through Electronic Payment Instruments (EPI). The announcement by Edwin Rojas, president of the Central Bank of Bolivia, marked a shift in the country’s financial policies.

Uruguay Sees Rising Interest in Real Estate Deals Using Bitcoin

Uruguay is witnessing a rising trend in real estate transactions conducted with Bitcoin, signaling a shift in how properties are bought and sold. Recently, a property was purchased for $500,000 in Bitcoin, facilitated by Banque Heritage as an intermediary.

This event is showcasing Bitcoin’s potential as a medium of exchange in real estate. Cryptocurrencies, known for challenging traditional financial systems, offer an alternative to conventional currencies by enabling quick, borderless transfers without the need for banks or other intermediaries.

Local analysts highlight several advantages of using Bitcoin for real estate transactions, including faster processes and reduced costs. By cutting out financial intermediaries, transaction fees decrease, and the global market becomes more accessible, free from the complexities of currency conversions.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

Uruguay has quickly embraced the use of cryptocurrencies in real estate. As of October 1, 2022, a new law allows buying and selling property with digital currencies. This change made what was once considered a swap into a fully legal sale, recognizing cryptocurrencies as valid payment.

The General Tax Directorate, which previously didn’t accept cryptocurrencies for real estate transactions, has now welcomed this new approach. This positions Uruguay as a leader in bringing digital assets into the real estate market. On July 17, 2023, this was clearly demonstrated when a property was sold using Bitcoin, with Banque Heritage and Cryptotrust managing the transaction.

Binance VP for Latam to Speak at RIW 2024 on BeInCrypto Stage

As Rio Innovation Week 2024 approaches, Guilherme Nazar, Vice President for Latin America at Binance, has been confirmed as a speaker on the BeInCrypto stage. Nazar will address the current state of the industry, future prospects, and the path to reaching the next billion users.

Nazar will also discuss the importance of customer focus, education, and security in advancing crypto adoption, particularly in Latam. He noted that Brazil is heavily investing in Web3 solutions, positioning it as a global leader in this area.

“Latin America is a market with great prospects for the digital asset ecosystem, home to three of the top 20 countries in adoption, and there are endless opportunities to develop the local industry, meet users’ needs and educate society. We are determined to work hand in hand with policymakers to define regulations that allow innovation to advance and protect users’ funds,” he said on taking over management of the region.

Read more: A Calendar of the Top Blockchain and Cryptocurrency Events in 2024

Alena Afanaseva, CEO of BeInCrypto, and Fabrício Tota, Director of New Business at Mercado Bitcoin, will join Nazar on stage. Afanaseva has turned BeInCrypto into a global crypto news hub with eight million monthly visitors. Tota, meanwhile, is a key figure in Brazil’s crypto industry.

The BeInCrypto stage at Rio Innovation Week will feature names like Agrotoken, B3, and Comissão de Valores Mobiliários (CVM). Other participants include Itaú Unibanco, Bradesco, BTG Pactual, Banco do Brasil, and Microsoft. TecBan, ABCripto, Bitso, Trexx, MIBR, Plataforma Impact, and the Ethereum Brasil community will also be present.

As the Latam crypto scene grows, these stories highlight the region’s increasing influence in the global market. Stay tuned for more updates and insights in next week’s roundup.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.