Market

How Stellar’s (XLM) Close Ties with XRP Boosted Its Price

Stellar (XLM) price has increased by 9.15%, making it one of the top five altcoin gainers in the last 24 hours.

Market participants are likely unsure why the token, which has been out of the spotlight for a while, is now rising. This analysis unravels the details and how it is linked to a major development.

Stellar’s Decade-Old Development Brings It a Much-Needed Result

For those unfamiliar, XLM is the native token of Stellar, a blockchain that facilitates trades for the unbanked. However, this project was founded by Jed McCaleb, who is also one of the co-founders of Ripple (XRP).

Since McCaleb’s decision to create Stellar about 10 years ago, XLM and XRP have almost always shared a strong correlation. Besides this, both Ripple and Stellar focus on cross-border transactions with only a slight difference in technology employed.

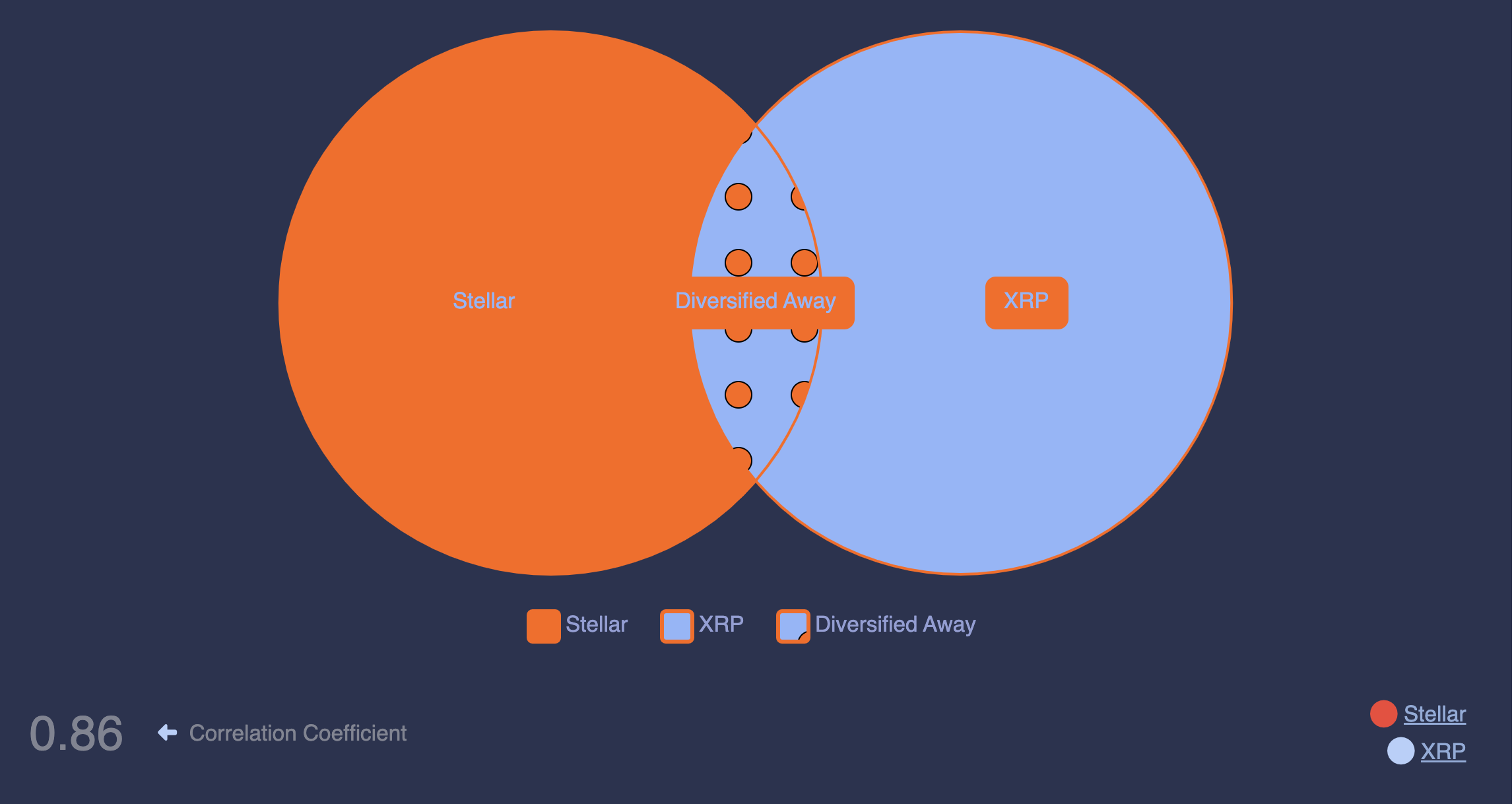

Therefore, the sudden spike in XLM’s price is linked to the recent settlement of the long-standing Ripple-SEC lawsuit, which saw XRP’s price climb by more than 20%. As of this writing, the correlation coefficient between the tokens is 0.86.

The correlation coefficient ranges from -1 to +1. Values close to -1 indicate a divergence, suggesting that prices rarely move in the same direction. However, a reading close to +1 suggests strong directional movement.

Read more: What is Stellar & How Does it Work: Deep Dive Into XLM

To buttress this point, an investment in XLM on a 30-day horizon would have brought in a slightly lower return than one in XRP.

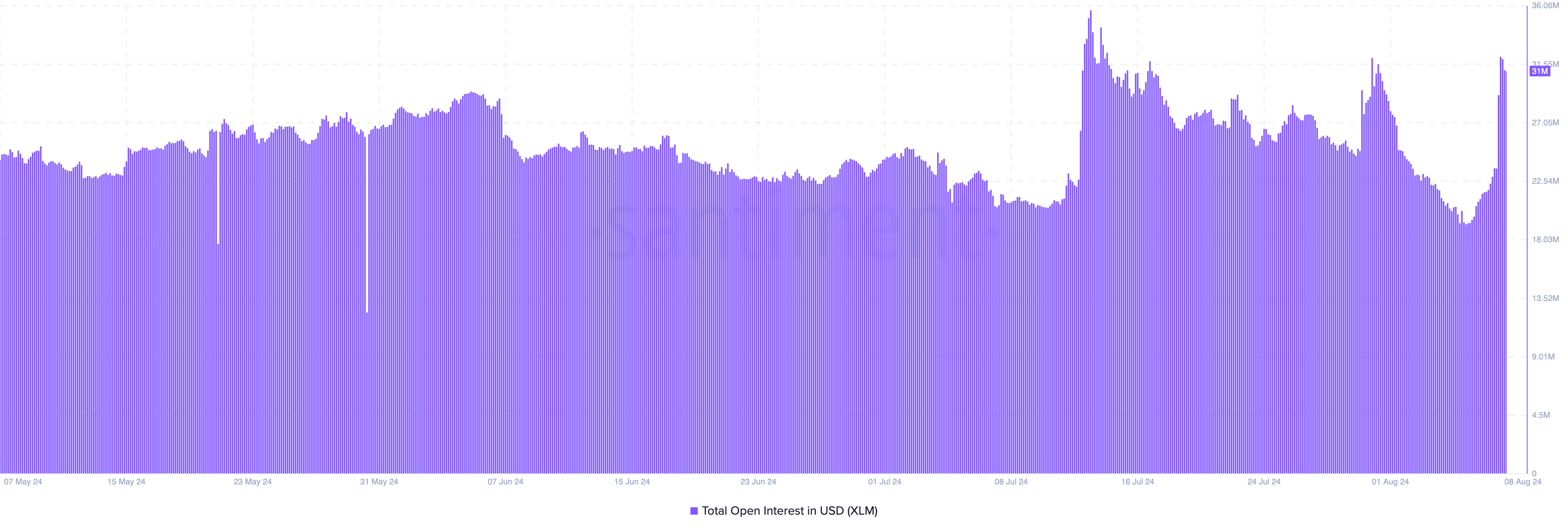

Furthermore, the development has triggered a surge in XLM’s Open Interest (OI). Open Interest is the total value of outstanding derivative contracts that are yet to be settled. An increase in this value typically indicates increased liquidity allocated to contracts.

If it surges, it can help a cryptocurrency’s price sustain its trend. However, a decrease in OI translates to a drop in net positioning, which could weaken a price trend.

As seen above, Stellar’s Open Interest had increased to 31 million, suggesting an influx of money into XLM-related contracts. If the value continues to increase, then XLM’s uptrend may become stronger.

XLM Price Prediction: Next Target Lies at $0.11

According to the 4-hour chart, XLM has formed a series of lower highs (LH). In the same vein, the ascending channel seen below shows it hitting higher highs (HH) as well.

The formation of the LH and HH suggests that the bulls have overcome selling pressure, and the uptrend is likely to continue.

Another confirmation of this bias is the descending trendline, which XLM’s price has surpassed. If this market structure remains the same, the token’s value could soon be higher than $0.10.

Additionally, the Awesome Oscillator (AO) is positive. The AO compares short and long-term price movements to determine momentum. When the reading is negative, the momentum is bearish, and the price could decline.

Read more: Stellar (XLM) Price Prediction 2024/2025/2030

At the same time, the token risks being overbought. Should this happen, the upswing may become weak, and the price may drop to $0.96.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.