Market

How Solana Price Could Shatter 3-Month Downtrend

Solana (SOL) has surged past $150, marking the first time since October 1 that it has reached this level, signaling a potential turnaround after a challenging start to the month.

Renewed market interest and positive technical indicators suggest that a bullish breakout could be imminent. But how high can SOL go?

Solana to Escape the Downtrend

Solana’s price trend over the past few weeks has been nothing short of volatile. After starting October strong at $160, market optimism suggested the altcoin was ready for further gains. However, just four days later, that bullish sentiment evaporated, and SOL tumbled to $136.90 as investor greed quickly gave way to fear.

Now, with the token recovering to $152.08, it appears Solana may have shaken off the worst of its losses. This latest uptick raises hopes of breaking free from the descending trendline that has kept SOL range-bound since late July.

Notably, the altcoin has twice failed to break key resistance levels at $185 in late July and again at $160 in late September. As it stands, this third attempt finally signals a true breakout from the three-month falling trendlines, with other indicators supporting the move.

Read more: How to Buy Solana (SOL) and Everything You Need To Know

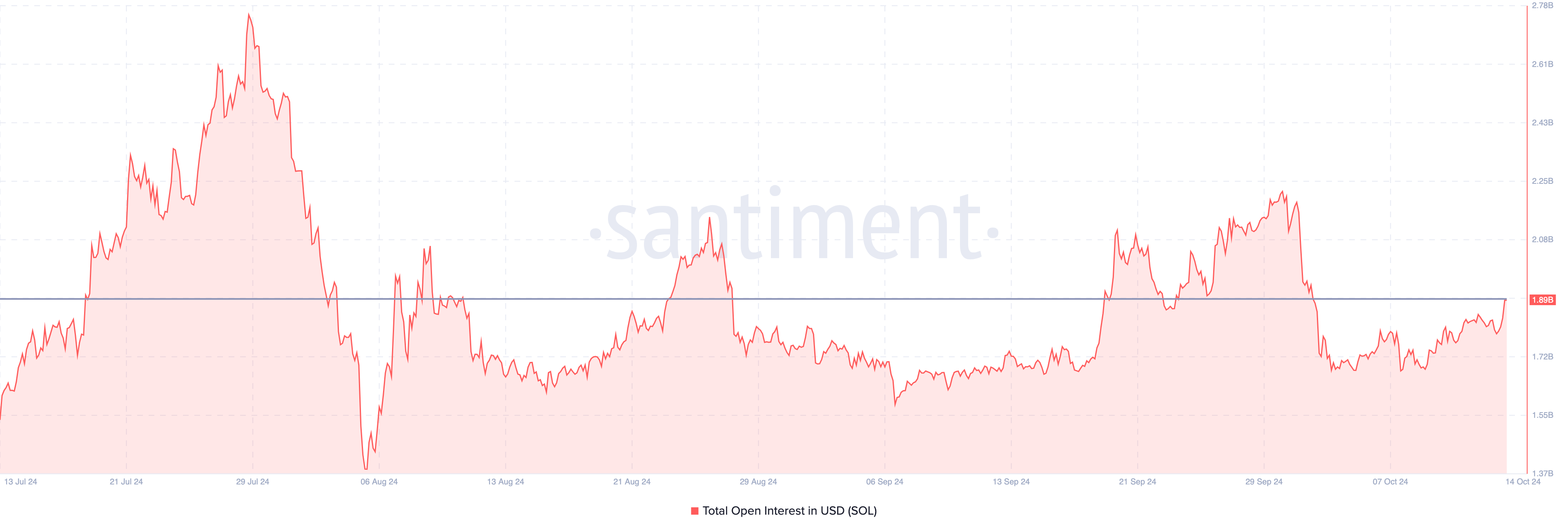

In line with Solana’s price rebound, the Open Interest (OI) in the derivative market is also tracking an upward trajectory, mirroring the altcoin’s recent movements. OI, a key indicator of speculative activity, last peaked at $1.89 billion on October 1, coinciding with SOL’s initial rally.

As of now, it has returned to that level, suggesting heightened market participation and growing confidence in a sustained bullish trend. Typically, increasing Open Interest points to more contracts being opened, signaling greater buying pressure. Conversely, falling OI amidst a price surge often hints at a potential reversal.

However, with both SOL’s price and OI rising, the current upswing could have more momentum, positioning the altcoin for continued gains in the near term.

SOL Price Prediction: Uptrend Could Surpass $200

On the daily chart, SOL’s price is looking to breach the $159.42 resistance. This breakout could be possible due to the rising reading of the Relative Strength Index (RSI).

The RSI measures momentum, and when it rises above the 50.00 signal line, the price movement is bullish. Conversely, if the RSI rating falls, the trend is bearish. Since it is the latter for SOL, the altcoin is likely to successfully push past the resistance threshold.

Besides that, the Supertrend indicator, which helps to spot uptrends or downtrends, has flashed a buy signal. Usually, if the red segment of the Supertrend is above the cryptocurrency’s price, it is a sell sign. But currently, the green area is below Solana, suggesting that the uptrend might continue.

Read more: 13 Best Solana (SOL) Wallets to Consider in October 2024

Should this remain the same, Solana’s price could climb by 32% and hit $201.55. On the contrary, failure to climb past $159.42 or $178.64 could render the prediction null and void. In that scenario, SOL could tumble to $128.36.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.