Market

How Polygon (MATIC) Bulls Hesitated to Give the Price a Hand

Unlike many altcoins, Polygon (MATIC) struggles to keep up with its recently-found uptrend. MATIC tested $0.55 in the early periods of July 16.

Later, the cryptocurrency’s value fell. Trading at $0.52 at press time, the price has affected the position of Polygon holders.

Polygon Uptrend Stumbles, Holders Back in Losses After Brief Relief

Last week, MATIC dropped to $0.48 following a long period that saw the price plunge from its highs in March.

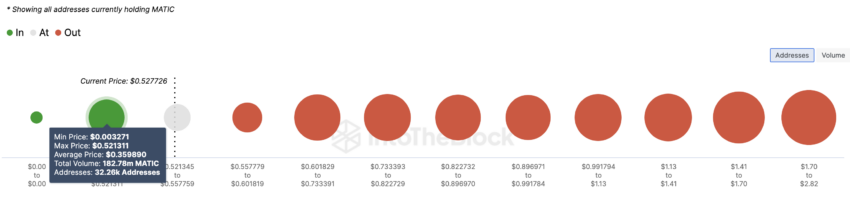

The consequence of this underwhelming price action is indicated by the Global In/Out of Money (GIOM). The GIOM classifies addresses based on those profiting from the current price action, those losing money, and those at the breakeven point.

Addresses in profits mean they purchased the token at a lower value than the current price. However, the addresses losing money accumulated at a higher price. Taking it back to July 9, there was no holder on the Polygon network in profits.

Read More: How To Buy Polygon (MATIC) and Everything You Need To Know

However, the brief price increase ensures only those who bought the token between $0.0032 and $0.52, representing 5% of the total MATIC holders, are now making money at the current price.

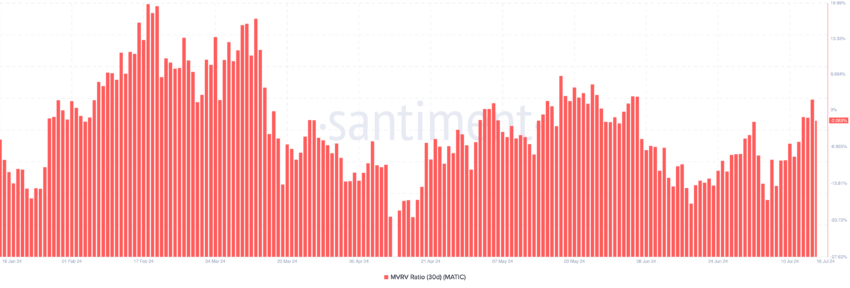

Another metric that indicates this position is the Market Value to Realized Value (MVRV) ratio. This ratio is an on-chain indicator that offers insights into investor behavior. Generally, high values indicate a large degree of unrealized profits.

It also increases the chances of investors’ willingness to distribute their holdings. However, a low ratio suggests poor demand dynamics. The more the ratio decreases, the lesser the motive to sell.

Polygon’s price increase on July 15 improved profitability, as the 30-day MVRV ratio rose to 1.87%. However, the retracement has forced the ratio back to 2.05% at press time.

This short-lived hike is evidence that MATIC holders are willing to sell at any chance to break even. If this continues, the cryptocurrency’s value may drop to $0.50.

MATIC Price Prediction: Risk of Falling Below $0.50

According to the daily chart, MATIC tested the key support of $0.47 on July 5, and this was instrumental to the extended formation to $0.54 seven days later.

However, the token finds it challenging to reach $0.57 due to a lack of substantial liquidity, as indicated by the Money Flow Index (MFI). The MFI reveals the flow of money in and out of a cryptocurrency.

If it increases, it means there is enough capital deployed to push prices higher. However, a decrease in the MFI indicates otherwise.

From the chart below, the indicator has been unable to cross over the neutral line, indicating that bulls have lowered their commitment to driving the Polygon native token higher.

Read More: Polygon (MATIC) Price Prediction 2024/2025/2030

If this remains the case, MATIC’s price may slip below $0.50, possibly declining to $0.47 again in the process.

Given the token’s market structure, the next move could be range-bound between $0.47 and $0.50. However, a close above $0.53 may invalidate this prediction.

Should liquidity into the token increase, MATIC could rebound, possibly leading to a breakout toward $0.64.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.